6 Fintech Players Changing the Face of Global Payments

— December 17, 2016

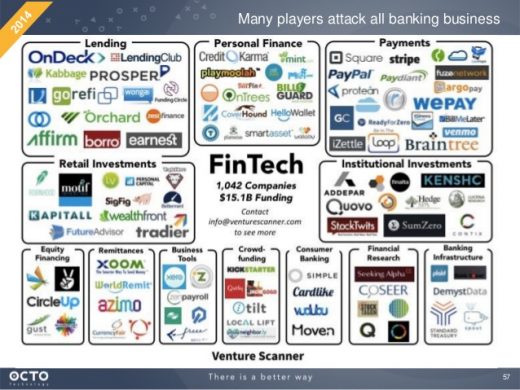

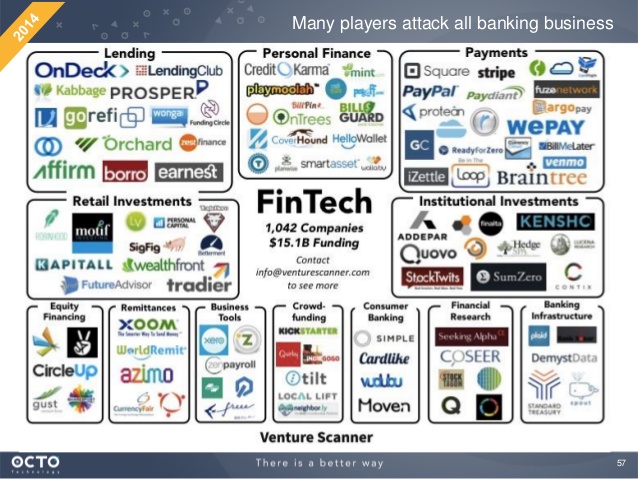

The onset of the digital revolution has facilitated diversification, fragmentation and personalisation of spaces as diverse as media, travel and communications. Through the emergence and popularization of fintech platforms, this process is reshaping the payments space. The emergence of fintech disruptors in the payments space is enabling users to take payments to the next level in terms of speed, convenience, efficiency and multichannel accessibility. To add to this, the number and type of fintech players is growing and bringing with them new tools and solutions which are overhauling the payments world as we know it.

As a result, this is no longer a case of faster payment methods but a complete overturning of the idea of ‘value’ and how we transfer it between different entities. In this post, we’ll talk about 6 fintech players to watch out for in four main categories. First, we’ll look at retail-focused fintechs. Second, we’ll examine an employer payroll focused start up. Third, we’ll focus on an online micropayments player. Finally, we’ll look at the fintechs firms expertly taking on the field of international transfers.

The retailer-focused fintech

Consumer-focused payments fintech has already changed the game. Within the last five years, we have seen Apple Pay and contactless cards break into and revolutionise payment markets. With contactless now an established technology, retailer focused fintech companies are looking to expand use of this functionality to every corner of commerce.

One example is iZettle. A leading mobile payments company, iZettle offers small businesses portable point-of-sale solutions as well as free sales overview tools. This allows any individual or merchant to take card payments anywhere, anytime. This solution is based on a free app for iPhone, iPad for Android and two different card readers. iZettle takes minutes to set up and has no start-up costs or monthly fees, making taking contactless payments fully accessible to even the smallest or most occasional retailer.

Another player in this space is Klarna, a Swedish e-commerce company that supplies payment services for online storefronts. The Klarna system eliminates the risks for buyers and sellers by taking over stores’ payment claims and by managing customer payments. In this sense, Klarna acts as a middle agent: users can even pay with just their email address; in this situation, Klarna pays the retailer whilst billing the customer, who then pays at a later date. As a result, their business model differs substantially from that of other online payment companies who collect payments from customers immediately. However, this system has proved attractive to both users and companies with about 40% of all Swedish e-commerce sales going through Klarna. In addition, Klarna operates locally in over 18 countries and as of 2016, is valued at over €2 billion.

The employer-focused fintech

Consumer to business payment fintech is increasingly well established. But some fintech firms are looking to facilitate business to employee payment services.

Doreming, for instance, focuses on financial inclusion for workers, an emerging theme for fintech firms, with the World Bank estimating that 2.5 billion adults worldwide are excluded from traditional banking services. Furthermore, research from Doreming has found that millions are forced into taking loans at high rates from unofficial sources (such as loan sharks). In order to address this, Doreming have created a payroll system that gives workers access to their daily incomes through a linked virtual account. This system lowers the risk of default because payments are made pro rata, rather than a monthly or weekly salary. For employers, their system automatically updates the payroll processing to calculate the accrued salary of workers with taxes, insurance costs and other statutory expenses deducted.

The fintechs operating in the field of international transfers

Payment fintech is not only facilitating consumer to business and business to employee payments, it is also making payments across borders easier than ever. Two disruptors leading this charge are Adyen and Azimo.

Adyen is a multichannel payment company outsourcing financial transfer services to international merchants giving them a single solution to accept payments anywhere in the world. Adyen delivers frictionless payments online, via mobile and in-store, and is also the only provider of a modern end-to-end infrastructure connecting directly to Visa, MasterCard and 250 other payment methods. Among Adyen’s customers are Facebook, Dropbox, SoundCloud, Spotify, Uber, Airbnb and Netflix.

Azimo is also an international money transfer service harbouring a large digital network that allows customers to send money to over 190 countries, from any internet-connected device. A unique selling point of Azimo is that the company is the first international money transfer service to integrate with Facebook Messenger, connecting senders and receivers through their Facebook friend list. This enables users of the service to exchange details immediately through the Azimo App, and make an easy transfer.

Micropayments fintech

Microfinance fintechs are riding a wave of popularity with their social media partners and increasingly facilitating the online sharing community. For example, Flattr, a fintech founded in 2010, enables users to ‘flattr’ creators for their digital content by clicking the Flattr-button next to their content. Each month, you add money to your account and at the end of the month your monthly budget is divided between all the things you flattered and sent to the creators. Flattr aims to ensure that journalists, artists, bloggers and other creators get the money they need, so they can continue to create great things.

The fintech market is an exciting and increasingly integral part of many contemporary markets. Within the payment sector, new and progressive fintech firms are claiming more and more market share, and delivering services that are quicker, more efficient and convenient across a broad range of channels. By connecting across social media platforms, enabling payments at a more local level, and operating new technologies such as cryptocurrencies, fintechs have are drastically defining the financial services space.

Business & Finance Articles on Business 2 Community

(200)