A Short History Of The Most Important Economic Theory In Tech

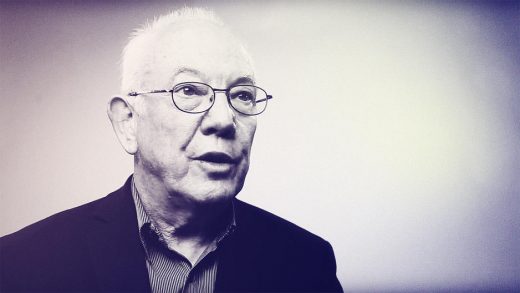

This summer marked the 20th anniversary of one of the Harvard Business Review’s most influential articles ever, “Increasing Returns and the New World of Business,” by theoretical economist W. Brian Arthur, who was and remains a fellow at the Santa Fe Institute. The summer of 1996 was a propitious moment for such an article to arrive. Netscape had gone public the previous summer, launching Internet 1.0, whose startups heartily embraced the idea. Even now, the theory of increasing returns is as important as ever: It’s at the heart of the success of companies such as Google, Facebook, Uber, Amazon, and Airbnb.

Back then, much more had been written about decreasing returns than increasing ones. In Arthur’s words, “The old way of thinking about the economy was, ‘Well, we have a pretty good product, and if we look after our costs and we manage to execute pretty well, we’ll get our 15% of the market.’ That’s true, maybe, for beer brewers and gas stations and barber shops.” Arthur, however, recognized that as we moved further and further away from a purely industrial economy, a different mechanism became paramount. It’s worth quoting the entire second paragraph of his essay:

Increasing returns are the tendency for that which is ahead to get further ahead, for that which loses advantage to lose further advantage. They are mechanisms of positive feedback that operate—within markets, businesses, and industries—to reinforce that which gains success or aggravate that which suffers loss. Increasing returns generate not equilibrium but instability: If a product or a company or a technology—one of many competing in a market—gets ahead by chance or clever strategy, increasing returns can magnify this advantage, and the product or company or technology can go on to lock in the market. More than causing products to become standards, increasing returns cause businesses to work differently, and they stand many of our notions of how business operates on their head.

These concepts sound familiar to us now, at a distance of two decades. At the time, however, they were not widely understood outside of Silicon Valley. “People in Silicon Valley,” says Arthur, “knew a lot about this phenomenon intuitively. But nobody had really written about it clearly.”

Back then, the primary example of increasing returns at work in the high-tech industry was Microsoft’s successful effort to turn Windows into the standard operating system for well over 90% of the world’s personal computers. With considerable help from Intel CEO Andy Grove, Gates used increasing returns to wrest control of the entire PC architecture from its inventor, IBM.

With its history of dominating the mainframe computing market, IBM believed that hardware mattered more than software. Gates, however, understood that this was not true for personal computers, so he held onto the right to license Microsoft’s operating system to other manufacturers. The result: The more people used Windows (and DOS, its predecessor), the more Windows benefitted users, manufacturers, and even other software vendors. Users gained from compatibility with other users. PC manufacturers did not have to create unique software for each of their new hardware offerings. PC makers could simply follow the road map created by Microsoft and Intel. And while other software vendors envied and decried Microsoft’s power—power that was ultimately challenged in a 2001 U.S. antitrust law case—they too benefitted from being able to write software for a single, dominant operating system.

In the mid- to late 1990s, one tech company after another sought to replicate the way Microsoft had triggered and taken advantage of increasing returns. Online service AOL sent out hundreds of millions of disks to build a huge user base. Sun Microsystems, Amazon, Yahoo, Google, and others used increasing returns to their advantage. Software has high costs up front but minimal ones later (developing software requires much time and money; printing and mailing diskettes with code was inexpensive, and delivering code over the internet is even cheaper). This made it a business with great potential for increasing returns.

A shallow understanding of the way these companies had exploited increasing returns led to a form of abuse. “The only thing I would change about that article is the way the whole thing was viewed,” says Arthur, a Belfast-born, Berkeley-trained economist. “In 1999, 2000, and 2001, we had a tech bubble. People were talking about network effects and waving that article around a lot. Startups were going in front of venture capitalists and saying, ‘All we need to do is fan the flames a bit and everything will take off. It’s winner-take-all, so we’re going to get a huge amount of the market.’

“But if they’d understood the idea a bit better, they’d have realized that out of the 20 startups rushing into one field, 18 or 19 were likely to fail. The chances of being that winner-take-all would have been 1 in 20, which isn’t a very good bet for a startup.” Webvan, eToys.com, and Pets.com are just three of the many examples of companies that fizzled out after promising increasing-returns-fueled dominance.

“The terms ‘Network effects and increasing returns’ are used often, many times without clearly understanding them,” says Bill Gurley, a respected venture capitalist at Benchmark. “But just because some people overuse a meme doesn’t mean that it’s not important or powerful. This one is.”

The concept proved more robust than the frenzy it had inspired. In the last decade, one company after another has succeeded by fomenting increasing returns and then doing everything it could to make the most of them. Airbnb, Facebook, Amazon, Instagram, Snapchat, and Uber have all done this brilliantly. Each has rapidly gained customers with continually updated products that become more valuable with more users. These companies then use that foundational strength to offer new, linked services to their customers, further strengthening their relationship. Google is perhaps the best example of all, by tying an advertising element to its ability to attract eyeballs.

The power of increasing returns is not infinite, however. The experience of Airbnb and Uber illustrates some of the limits. Both companies have exploited markets with increasing returns. The more apartments go up on Airbnb, the more customers the service attracts. The more customers it attracts, the more owners want to list their homes. The more drivers who sign up with Uber, the faster Uber can get to a customer. The faster Uber gets to a customer, the more customers want to sign up. The more customers sign up, the more attractive Uber becomes to drivers. But that cycle doesn’t go on forever. “It kind of plateaus out,” says Arthur. “Once you get a certain density of drivers, if you double the density it’s not going to make that much difference when I call for an Uber.” The same could be said of Airbnb, which says it has over 2 million listings; 4 million wouldn’t make the service twice as good.

Furthermore, both Uber and Airbnb have run up against another limiting factor: regulators. Uber lost billions of dollars trying to win in the Chinese market, often butting heads with regulators who seemed to favor homegrown Didi Chuxing. And like Airbnb, it has battled repeatedly with local and state officials seeking to protect businesses threatened by its arrival and enforce existing standards and rules, for instance around safety and worker compensation. But getting regulation right is difficult.

“If you don’t allow companies the potential prize of locking in a market,” says Arthur, “you might stymie innovation.” On the other hand, deregulation can backfire—precisely because of increasing returns.

“I remember reading in the early 1980s that the Reagan Administration had decided to deregulate the airline industry in the U.S.,” says Arthur. “Competition was supposed to work miracles. But under the hub-and-spoke system, the more you can expand your hub-and-spoke network, the more you can lock out other airlines. I thought, ‘This doesn’t make any sense to me.’ But the idea that you’d get good competition from deregulation did make sense to people who thought in terms of constant returns. Well, amazingly enough, my initial thought turned out to be true, and we now have three or four major airlines that have a kind of quasi-monopoly on certain parts of the country and certain routes. Prices went down, comfort went down, airlines and airports got jammed. Maybe it was all worth it, I don’t know.”

Taking advantage of increasing returns is much, much harder than people commonly believe. When I ask him what kind of CEO is best equipped to take advantage of the increasing returns that might exist in his or her industry, he tells me, “You need an awareness of the ecology you are in. If you think of different firms and products as being different species, then you have to be very aware of how that entire network of different companies operates, even if they are quite peripheral to you.” He cites Steve Jobs as someone who had a feel for this, a clear vision of the tech industry’s ecology and dynamics. “Whether he ever read my articles on the stuff, I have no idea,” he adds, “but I think he did understand this stuff.”

Arthur, now 70, maintains a wry and modest sensibility. “I think the ideas hold up,” says Arthur. “It’s not a fad, I’d say.”

As we are wrapping up the interview, he tells me an anecdote about the creation of that Harvard Business Review article. “I don’t know if you know the writer Cormac McCarthy,” he begins, “but I was very good friends with him at the time. I mailed the draft down to Cormac, who was in El Paso or somewhere like that. When I didn’t hear from him, I called him up and said, ‘Did you like my increasing returns article? It’s for the Harvard Business Review.’ There was kind of a silence on the line. And then he said, ‘Would you be interested in some editing help on that?’ Next time he’s in Santa Fe we spent four days on that piece. He took apart every single sentence, deleted every comma he could find. I said, ‘You can add that piece to your Collected Works, it will be somewhere in between Blood Meridian and All the Pretty Horses.’

“Let’s say the piece was better for all the hours Cormac and I spent poring over every sentence. The word got back to my editor at Harvard Business Review. She called me up, in a slight panic, and says, ‘I heard your article’s getting completely rewritten.’ And I said, ‘Yeah!’ She says, ‘By Cormac McCarthy? What did he do to it?’ And I said, ‘Oh, well, you know, pretty much what you’d expect. It now starts out with two guys on horseback in Texas, and they go off and discover increasing returns.’ And for a couple of seconds she was aghast.”

Fast Company , Read Full Story

(46)