all the cash in the world, In A Single Chart

1,000,000 dollars isn’t cool. 1.2 quadrillion bucks is cool. (In different phrases, you might want to get into derivatives.)

January eleven, 2016

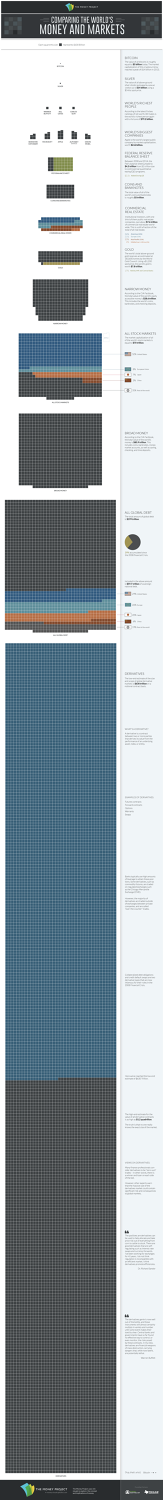

for most of us, $5 billion would possibly already appear to be a fairly large—and summary—sum of money. but that number, which happens to be roughly the value of all of the Bitcoins on the earth lately, is a tiny fraction of alternative markets.

A up to date chart from the cash project makes an attempt to visualise all the cash on this planet, from Bitcoin to the mind-bogglingly huge derivatives market, and compares them by means of dimension. every small sq. on the chart represents $a hundred billion.

“i feel the most interesting side of this visualization is the exponential distinction in measurement between these completely different markets,” says Jeff Desjardins, president of visible Capitalist, which produces the money project. “It actually helps to position things into perspective.”

“the dimensions of the whole Bitcoin market ($5 billion) is a blip on the radar in comparison with the gold market, which is worth 1560 occasions as so much—at $7.8 trillion,” he says. “yet, the gold market is insignificant when in comparison with whole global debt, which is the same as $199 trillion.”

The chart is designed to help make summary figures a bit of more concrete.

“We wished to create better context for folks to take into account the sum of money that exists not like other markets they could also be extra conversant in,” he says. “The numbers that we care for when we are talking about large quantities of cash always sound identical—thousands and thousands, billions, trillions—however actually these numbers are orders of magnitude in difference. This juxtaposition isn’t in reality obvious unless we’re in a position to visualise this information in an intuitive manner. Then the information speaks for itself.”

the most important surprise, for somebody not within the financial world, could be the dimensions of the derivatives market. on the low end, it can be estimated at $630 trillion. at the high end, $1.2 quadrillion. (Put another way, that is greater than 1,000 million million, or $1,200,000,000,000,000.)

Derivatives fly below the radar, Desjardins says, because they’ve most effective been around since the Seventies, and so they’re principally traded by means of folks at hedge money or investment banks, no longer particular person traders. they are also exhausting to take note—they take different forms, but basically, they all the time get their worth from something else, like an possibility to purchase inventory or a futures contract for a commodity like corn.

They could be little known, however they played a key role in the last monetary hindrance. And it’s somewhat horrifying to see that on the chart, derivatives dwarf everything else.

[quilt photograph: handiest heritage by the use of Shutterstock]

fast company , read Full Story

(17)