At Digit, All That Spare Change Is Adding Up—To $500 Million In Deposits

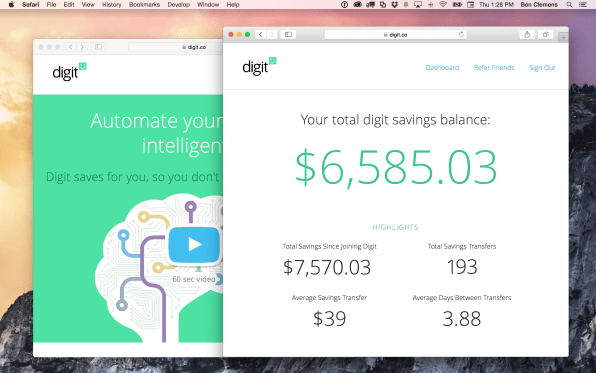

This month Digit passed a major milestone: The money-saving app’s users have collectively saved half a billion dollars, all from setting aside a bit of extra cash here or there, as determined by the company’s algorithms.

“It’s a shit-ton of money, but it’s still a small amount relative to the households in the U.S. and the amount they could be saving,” says founder and CEO Ethan Bloch. (It’s also small relative to major banks, the largest of which have deposit bases larger than $1 trillion.)

In its first year of operations, Digit helped users generate $75 million in savings. Since then, growth has accelerated and the startup saved users over $400 million.

Most of those dollars have gone toward emergency funds, with 61% of Digit users citing that goal as their primary purpose. (Half of Americans lack the savings to cover a $400 emergency expense.) Other Digit users are looking to travel or pay off debts.

Digit competes with startups like Acorns and Qapital. Qapital, while similar to Digit, is mobile-only and gives users greater control, thanks to a range of custom savings triggers. In contrast, Acorns directs users’ spare change into an investment portfolio. Acorns has also teamed up with brands to offer cash-back rewards that flow directly into users’ portfolios.

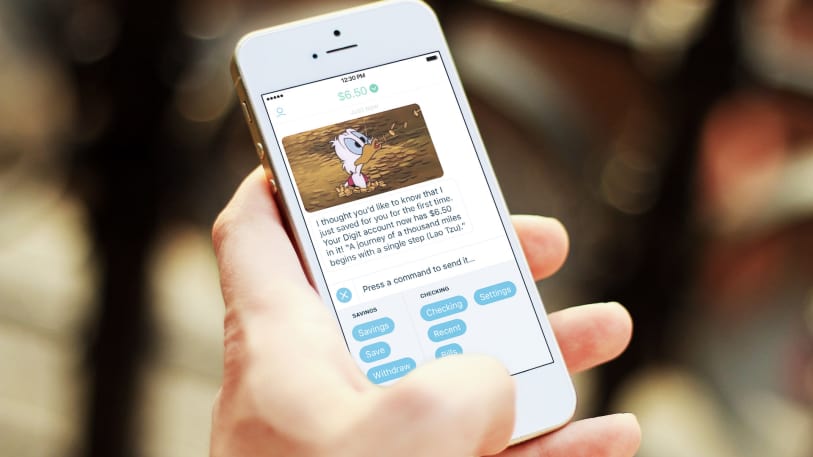

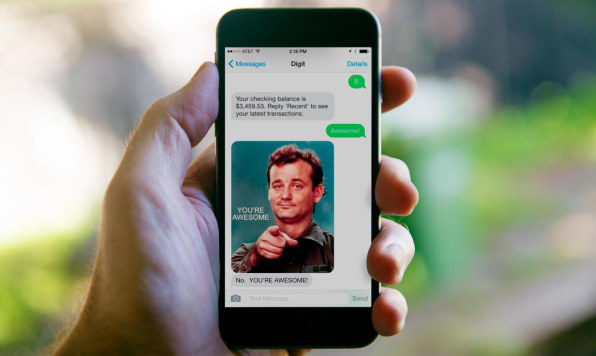

Digit, for its part, is betting on automation and simplicity. “Our goal is to make achieving and maintaining financial health effortless,” Bloch says of the product his team has built. After a user signs up, Digit works in the background to transfer funds from checking to savings, while managing the risk of overdraft. The dollars sit in a Digit savings account. “You’re being kept in the loop and can adjust things if you want, but it’s happening. You’re off living your life, and Digit is managing your money.”

Unlike a traditional savings account, Digit does not pay interest (it is not a bank). Instead, the company pays what it calls a “savings bonus” every three months, worth 5 cents for every $100 of the user’s average balance over that time frame.

Going forward, Bloch envisions becoming a central hub for users’ financial lives. “Every human should have their own badass sidekick AI in their pocket helping them navigate the complex financial world they’re in,” he says. “I think that works well when you have one thing managing your relationships, and on your side.”

(62)