Blue Apron Files To Go Public While Amazon And Walmart Prepare To Eat Its Lunch

Blue Apron has just filed to go public. The company has raised $193.8 million in venture capital and was valued at $2 billion in 2015.

In its S-1 filing, the company says it delivered more than 159 million meals to homes in 48 states–or roughly 25 million paid orders. That resulted in $795.4 million in revenue for 2016, up 133% from 2015. But it looks like losses grew from $30.8 million in 2014 to $54.9 million in 2016. In the first three months of 2017, the company had a net loss totaling $52.2 million—almost as much as all of last year. During the same period a year ago, the company earned a net income of $3 million. Given that profitable quarter, it seems last year may have been a better bet for going public. The company delayed a public offering last year, according to reports, to get its financials in order.

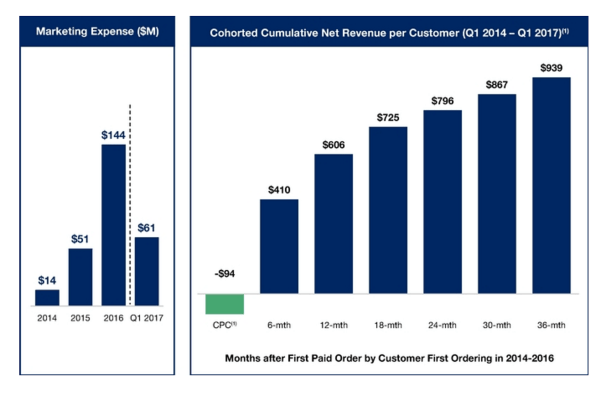

Though Blue Apron made nearly $800 million in 2016, it was plagued by consumer acquisition costs. In fact, Blue Apron spends approximately $94 per customer. Getting customers on board and keeping them is one of the toughest challenges in the meal kit space.

“A lot of meal kit startups were bolstered by VC funding, and felt comfortable spending a lot on customer acquisition early on, offering major price promotions, even in the face of reportedly high churn,” says Natan Reddy, tech industry analyst at CB Insights. “Meal kit startups can’t raise their prices too significantly, because they’re competing with traditional groceries as well as other meal kits, which limits margin potential. Therefore, their main way to grow is by adding customers, pushing them to focus heavily on costly customer acquisition.”

“The chart above also illustrates that, while we derive significant revenue from those customers that continue to make purchases from us, over time our customers on average order less frequently or sometimes cease ordering, as evidenced by the declining increases in cumulative net revenue per customer over the time intervals presented,” Blue Apron’s filing reads.

Research firm Morningstar notes in a recent report that meal kits only retain 8% to 18% of the people that initially sign up. (Editor’s note: Fast Company’s owner, Joe Manuseto, is executive chairman of Morningstar.)

In March, CNBC reported that Blue Apron had hired bankers from Citigroup, Goldman Sachs, and Morgan Stanley to lead its public offering later this year.

Meal kits are also facing off against the growing digital grocery space. Amazon and major retail players like Walmart, Whole Foods, and others are exploring meal kits.

Its biggest challenge: the high cost of customer acquisition in an increasingly competitive space.

Blue Apron has just filed to go public. The company has raised $ 193.8 million in venture capital and was valued at $ 2 billion in 2015.

Fast Company , Read Full Story

(28)