Could Hawaii Be The First State To Offer A Basic Income?

With trials already underway in Kenya, Finland, and Oakland, and several others planned elsewhere, basic income is starting to get a thorough testing. The idea of direct cash transfers to meet basic human needs has been getting a lot of attention in the media, from Silicon Valley leaders, and among academics and think tanks. It can’t be long before a city or state in the United States experiments with basic income for itself (Oakland’s pilot is run by Y Combinator, a startup incubator).

Several are apparently discussing the possibility behind closed doors, but Hawaii has come the closest. In May, its legislature passed continuing resolution HCR 89, setting up a commission to study the concept. It has a remit to examine how automation, and innovation in general, will affect Hawaii’s future job market and to analyze how other states and cities around the world are facing up to the challenge of delivering economic security. “For the first time, a state has declared that everyone deserves basic financial security,” says Chris Lee, the state representative (a Democrat) who sponsored the measure. “In the wealthiest nation on the planet, we have the resources to ensure that no-one gets left behind.”

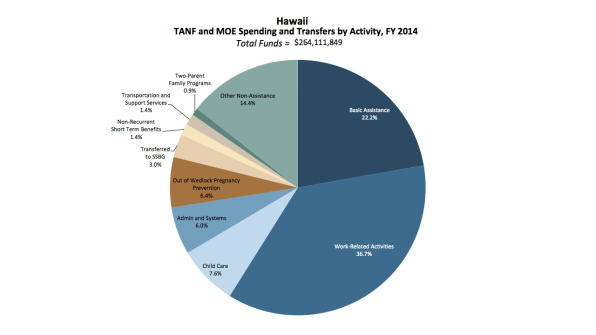

A lot of people might question that last statement. But as he looks at Hawaii’s economic future, Lee is greatly concerned. Several of the state’s manufacturing industries, including pineapples and sugar, are in trouble, he says. Many residents are reliant on service jobs (like tourism) that often don’t pay well and lack security. Automation–like computerized cashier desks–is taking retail jobs. The state has a high homeless rate, and a very high cost of living (utility bills are 35% higher in Honolulu than in Austin, Texas, for example). And welfare, traditionally a safety net, looks less and less able to take up the slack. Hawaii’s welfare benefits (TANF) are now effectively below 1996 levels, according to the Center for Budget And Policy Priorities.

Moreover, says Lee, Hawaii is more isolated than other states. Sitting in the Pacific, it’s less able to feed off its neighbors, taking in new industries or benefiting from economic spillover effects. It lacks big anchor industries like tech or gambling. “We definitely feel more exposed and a greater sense of urgency to look at new ideas,” he tells Fast Company. (Alaska, another non-contiguous state, has had a sort of basic income since the early-1980s, paying out as much as $2,000 annually to residents from its oil revenues.)

Lee wants Hawaii to consider paying a basic income guarantee because he believes work is no longer able to provide for everyone and because there may be ways to improve the potency and efficiency of today’s public assistance budget. He’s not sure how Hawaii might pay for a basic income–which perhaps is the most important question of all. But he says it could mean everything from expanding the state’s recently passed Earned Income Tax Credit to a regular monthly payment, perhaps amounting to $1,500.

Paying out a basic income to cover people’s needs, including food, housing, and childcare, may be less costly than traditional benefits, he argues. “We know it’s going to be significantly more expensive to taxpayers and businesses if we do nothing if wages have stagnated and unemployment increases, than to create a basic income mechanism. It’s not only a new safety net, but it could also encourage entrepreneurship and give people the capacity to start new businesses and make investments in themselves that they wouldn’t ordinarily do,” he says. Lee says he would consider cutting existing assistance programs to pay for a basic income in Hawaii.

Lee wants to learn from basic income trials elsewhere, so Hawaii doesn’t need to embark on its own significant experiment. But he admits the lessons from, say, the Kenyan trial–involving dozens of poor villages in rural areas–may not be too instructive for a U.S. context. Several trials in Canada and the U.S. in the 60s and 70s, and more recent ones in the developing world, however, have served to knock back one myth about basic income, he believes. Cash transfers don’t stop people from working. Most people keep showing up for jobs.

Since HCR 89 passed, Lee has heard from interested legislators in California, Minnesota, Japan, Taiwan, Switzerland, and elsewhere, showing how interest in basic income is growing in many places. Hawaii’s resolution was supported by both unions and the Chamber of Commerce in the state, demonstrating how basic income can break down some normal ideological boundaries. Lee hopes Republicans–who number only five representatives in Hawaii out of 51 members–will support the idea in time.

“I expect it to be a topic of discussion on both sides of the aisle [as we head into the next election in 2020],” he says. “After the housing bubble, the recession, and the 2016 election, we cannot ignore a mechanism that ensures opportunity for all in the face of a dying American Dream.”

Talking to one the state representatives who’s pushed the state government to study the policy.

With trials already underway in Kenya, Finland, and Oakland, and several others planned elsewhere, basic income is starting to get a thorough testing. The idea of direct cash transfers to meet basic human needs has been getting a lot of attention in the media, from Silicon Valley leaders, and among academics and think tanks. It can’t be long before a city or state in the United States experiments with basic income for itself (Oakland’s pilot is run by Y Combinator, a startup incubator).

Fast Company , Read Full Story

(11)