How CEOs’ Paychecks Can Impact Their Employees

They say that ignorance is bliss, but when it comes to their CEOs’ compensation, people aren’t as angry about their boss’s paycheck as you might expect.

According to a recent study by PayScale, an online salary, benefits, and compensation information company, and Equilar, an executive compensation and corporate governance data solutions provider, 79% of those who know their CEO’s compensation believe that it’s appropriate, though the level of approval changes drastically depending on employee compensation and seniority.

“Those at higher levels within the organization tend to be more aware of their CEO’s compensation in the first place, and they also tend to have higher approval ratings,” says Lydia Frank, the senior editorial director for PayScale. “It turns out that fewer people than we thought disapprove of their top executive’s pay, but there is a percentage that cares enough to consider seeking work elsewhere,” she observes.

Of that 21% who disapprove of their CEO’s compensation, 57% of respondents said it negatively affects their view of the company, but only 26% intend on finding employment elsewhere.

The study was conducted by comparing Equilar’s data on U.S.-based companies with more than $1 billion in revenue that filed a proxy statement disclosing CEO compensation—in accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act. It also included employee compensation data from 80,000 workers across 167 companies between May of 2015 and May of 2016.

More than 22,000 employees were surveyed about their opinion on their CEO’s compensation, which includes base salary as well as bonuses, stock options, and other forms of compensation, such as benefits and perks.

Do They Mind The Gap?

The study found that higher-level employees tend to be more aware and more approving of their CEO’s compensation, while those on the lower end of the corporate ladder are more likely to be unaware or disapproving.

“We see today that the demographic of people aware of their CEO’s compensation tends to be those employees with more responsibility within the organization—executives, directors, etc. They also tend to be older and have higher incomes themselves,” says Frank. “For workers that make less than $25,000 annually, though, only 72% approve.”

Where CEOs Make More Than 400 Times What Employees Earn

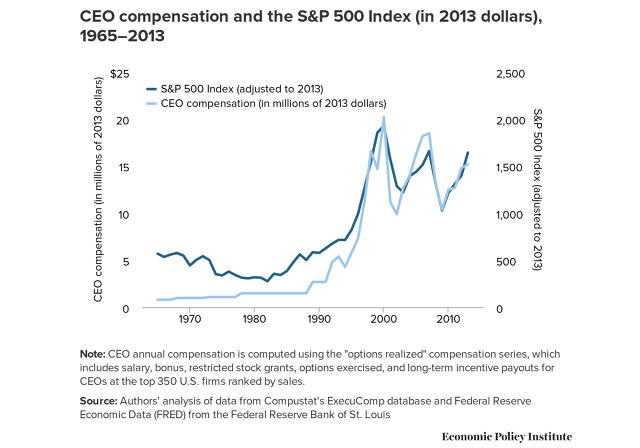

The study also looked at employee-to-CEO compensation ratios, and found that the average ratio of CEO compensation across the study was approximately 70 to 1. According to the Economic Policy Institute’s analysis of similar wage data though the CEO-to-worker compensation ratio still falls below those earlier in the 2000s, it is far higher than it was in the 1960s through the 1990s.

However, Larry J. Merlo, CEO of CVS Health Corp., had the highest salary compared to his average employee. His total compensation package in 2015 totaled more than $12 million, while his average employee earned only $27,900, a ratio of 434 to 1. “Because CVS employs many retail positions that likely pay at or around minimum wage, the median worker pay is relatively low compared to other companies in this report,” explains Frank.

The results of this study differ from a similar study conducted by Glassdoor last year, which placed Merlo in third behind the CEOs of Discovery Communications and Chipotle. The Glassdoor study, however, did not account for non-cash compensation for employees, such as perks, benefits bonuses, and other forms of compensation.

“The total compensation for CVS’s CEO Larry Merlo was about $10 million higher than in 2015,” adds Frank. “If we calculated the ratio for CVS in the way that this Glassdoor study did it a year ago, the ratio would have been 819 to 1.”

At the other end of the spectrum, ServiceNow, Inc.’s CEO Frank Slootman earned $642,000 in 2015, while his average employee took home $106,000, for the study’s lowest ratio of 6 to 1.

The Benefits Of Salary Transparency

Private companies have historically remained tight-lipped on their CEO’s compensation, but Dodd-Frank will require more companies to disclose their CEO pay ratios when it goes into full effect on January 1.

“Employees are likely more accepting of high CEO pay when they understand the logic behind it,” says Frank. “If the logic is perceived as sound, then there’s not necessarily an issue,” she asserts. “If it’s perceived as flawed, well, I suspect that’s part of the reason the SEC put this rule into place to begin with.”

When the rule goes into effect, Frank believes employees, particularly younger employees, will demand more transparency and justification for their CEO’s compensation. She believes that the new SEC requirements will also pressure shareholders to justify CEO compensation to their employees, or risk jeopardizing employee satisfaction.

“Employee sentiment may begin to shift as the millennial generation, who demand transparency and a sense of fairness in so many aspects of their lives, begins to move into higher job levels at their organization and has more ability to influence company philosophy and communication around things like executive compensation,” she says. “There’s a window of opportunity that’s closing for companies to think about how the new required disclosure of CEO pay ratio might impact employee sentiment and retention at their organization.”

Fast Company , Read Full Story

(27)