How We Created Intel’s Capital Diversity Fund

A VP at Intel Capital explains how they created their $125 million fund for companies run by women and minorities, and why we need it.

Shortly after he announced a $300 million initiative earlier this year to increase workforce diversity at Intel, I approached Intel CEO Brian Krzanich with an idea.

What if we applied the same intent and effort to our investment portfolios? What if we took stakes in high-growth companies run by women and underrepresented minorities, whose biggest hurdle wasn’t the quality of their ideas, but the funding to make them scale?

His reaction was short, succinct, and positive.

“We want to do this, and go big.”

That conversation put Intel Capital on a path to this week’s unveiling of our $125 million Diversity Fund—one that’s more than 10 times larger than anything similar in the finance industry, and which has already announced investments in the security software, healthcare, the Internet of Things, and do-it-yourself maker markets.

It’s a big step by any measure—and an amazing opportunity.

This fund enables Intel as a company, and Intel Capital as one of the largest sources of venture capital, to chart a new approach to diversity in an industry that desperately needs one; expand the market for Intel products and services; and help sustain the long-term strength of the U.S. economy.

In other words, it’s the right, smart, and wise thing to do.

Charting a Much-Needed, Numbers-Driven Course

In an industry obsessed with numbers—from chip speeds to operations per second—the representation of women and minorities in high tech is a failure by any measure.

While African-Americans and Hispanics collectively make up 28% of the U.S. workforce, they average only 5% of employees at some of Silicon Valley’s most iconic companies, including Apple, Facebook, and Google. (Intel’s 12% is better, but still lags behind the national average.)

Women, who are 45% of the U.S. labor force, have a steadily deteriorating presence as you move up the management chain at S&P 500 companies, according to Catalyst: from roughly 37% of middle managers, they fall to 25% of senior leaders to just 4.6% of CEOs.

It’s a similar problem at venture capital (VC) firms. In funds with $100 million or more under management, less than 1% of the investors are minorities. Women comprise only 5.6% of the decision-makers at VC houses. So it’s no surprise that companies headed by male executives received 98% of all VC investments.

While much has been made about the barriers at these venture firms, what’s not discussed is their collective failure to recognize good, marketable ideas from outside their traditional sources. Trish Costello, the CEO of Portfolia, a crowdsourcing site dedicated to funding women entrepreneurs, nailed the point in a recent Fast Company interview:

Oftentimes, we see a number of the big firms that have no women partners at all. So when a woman pitches, there’s just no organic knowledge about many of the markets that are really growing right now, where there are really great opportunities and a need for venture capital.

Yet women are a great investment, according to the data. Startups that have more women in senior positions will be more successful than those that do not. And private firms led by women achieve a 35% greater return on investment.

Those are the kinds of companies our new fund is already backing.

From Tracking Nutrients to DIY Gadget Building

The initial investments of the Diversity Fund run the gamut, from personal wellness to corporate security.

For example, think about everything you drink in a day. All those liquids have nutritional impact, from the water that hydrates your body to the caffeine that stimulates it. Mark One makes a 13-ounce (384 ml) cup that tracks and reports the composition of your beverages: the sugars, calories, alcohol, and more—even the water generated by melting ice.

Led by an executive team that includes three African-Americans and two women, the Mark One product, dubbed Vessyl, will use the Intel Curie module, a small, low-power microprocessor for the wearables market that fits everything from bags to rings to fitness trackers.

Then there’s cybersecurity. Many data thieves try to steal information, but the sophisticated ones go after entire communications channels, such as the connections that link you and an online retailer. They do it by stealing encryption keys and cracking into the digital certificates that are supposed to tell the world you are who you say you are.

With three women on its executive team, Venafi secures and protects keys and certificates so they can’t be used against you in a cyberattack. With Venafi’s key management solution, Intel can continue to bring market-leading security and data center technology to market.

Meanwhile, CareCloud is focused on modernizing medical practices by moving them to new software systems—financial, administrative, and clinical—designed specifically for the cloud.

This move is a big shift for healthcare practitioners. Until now, many have had to cobble together and maintain various desktop applications to get things done. With CareCloud systems, they get more time with patients, achieve greater productivity, and have a higher level of collections.

CareCloud—which has a Hispanic founder and three Hispanics in its leadership group—is collaborating with Intel in clinical analytics and genomics, two sectors that drive significant consumption of Intel chips.

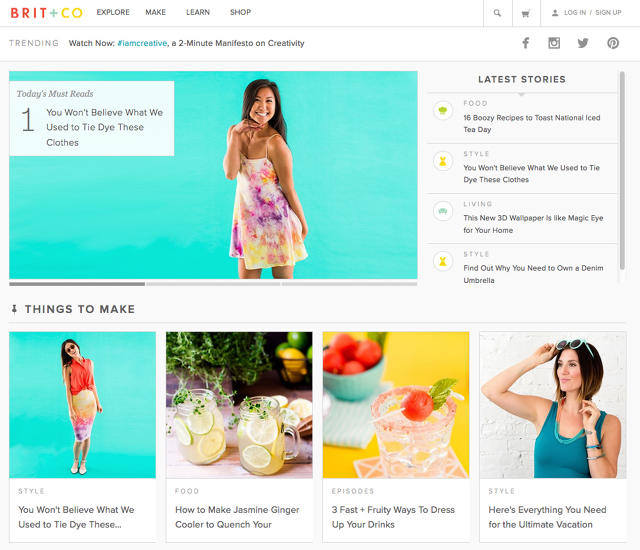

Then there’s Brit+Co, a company whose founder and CEO is a woman, and whose staff is 80% female.

Brit+Co falls into the maker movement, or the do-it-yourself category. Its online classes and all-in-one kits let you learn everything from 3-D printing to calligraphy. You can even build tech gadgets with Intel Galileo boards and participate in Internet of Things make-a-thons. The company is partnering with Intel on several cobranded marketing and advertising efforts focused on millennial women.

All these companies have high-growth potential. All have the ability to expand the footprint for Intel products. And the chances they would have received venture funding, technical support, and global visibility from traditional investment sources?

Slim to none.

Sustaining U.S. Economic Growth

Beyond being the right thing to do, or even the smart-minded business thing to do, the Intel Capital Diversity Fund can make a positive, long-term impact on the strength of the U.S. economy.

According to a study by McKinsey & Company, we will need more people in the workforce to sustain GDP in coming years.

Women, as noted, are already nearly half the labor force, and they graduate with college degrees at rates greater than men. Hispanics, who often lead the market in technology adoption, will account for most of the country’s future growth for the next 35 years, according to Nielsen. And the U.S. is expected to reach minority-majority status by 2043, less than two generations from now.

That means the economy of tomorrow is likely to be driven by women and underrepresented minorities.

So you can think of the Diversity Fund as the long-overdue right thing to do. Or you can think of it as Intel Capital getting in on the ground floor of one of the biggest demographically driven market opportunities in history. Or as our supporting a generation of entrepreneurs who’ll be responsible for the country’s well-being far into the future.

Any way you look at it, everybody wins.

Lisa Lambert is a vice president of Intel Capital. She is managing director of the Diversity Fund, leads the Software & Services Investment Group, and is a voting member of the investment committee. She also is the founder of UPWARD, a community of female executives and entrepreneurs.

[Woman using laptop while sitting at her desk: Ammentorp Photography via Shutterstock]

Fast Company , Read Full Story

(235)