Inside Pandora’s Plan To Reinvent Itself—And Beat Back Apple And Spotify

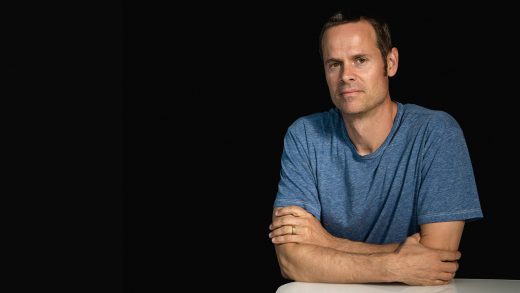

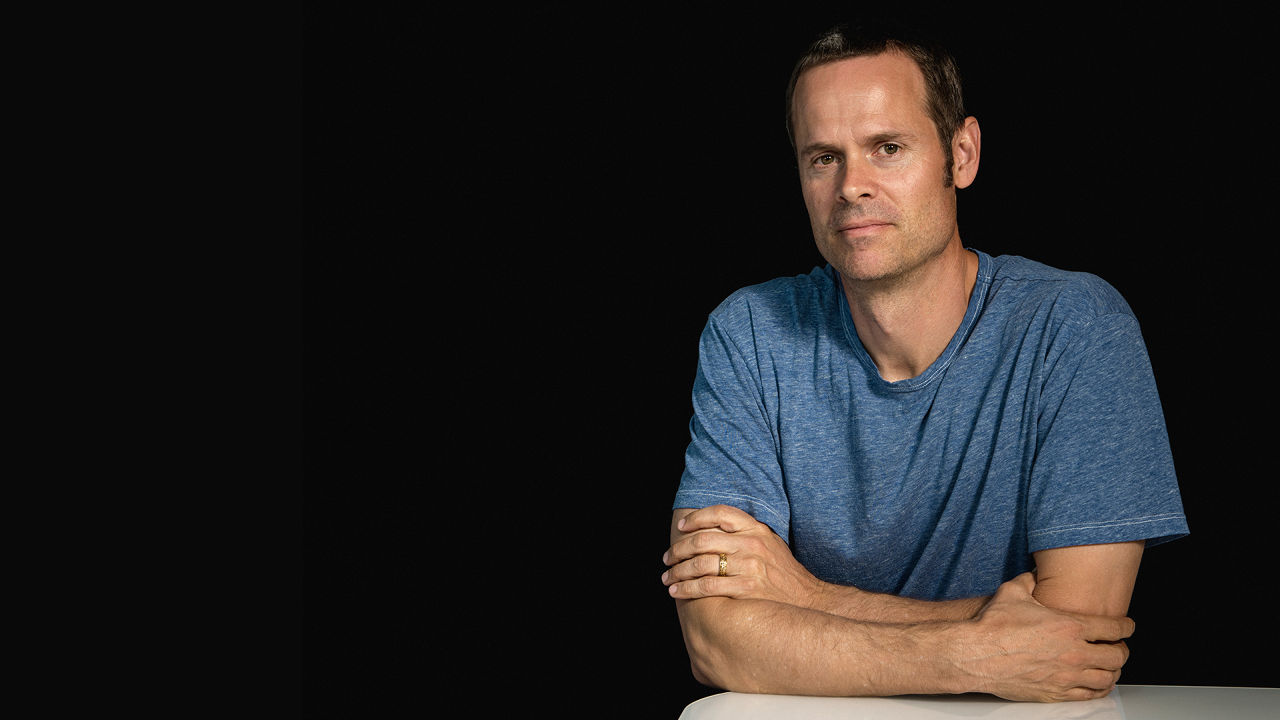

For somebody who just got off of a red-eye flight across the country at six this morning, Tim Westergren seems strangely energized. Perhaps it’s adrenaline. But it would be hard to blame him if there was a shred of terror in there, too. Two days earlier, Westergren had suddenly found himself with a new job: chief executive of Pandora, the Internet radio company he cofounded 16 years ago.

Plenty has changed since the early days—the company has travelled a rocky road. After inventing personalized Internet radio as we know it, Pandora amassed more than 80 million users, went public on the U.S. stock market, quarreled with the music industry, made up with the music industry, acquired a few music startups—and integrated its radio service into 1,700 types of devices along the way.

But there are some notable things Pandora has not done. It hasn’t become a hugely profitable company—most financial quarters, it reports a loss—and its core product has not changed all that dramatically, even as on-demand streaming has taken hold and competition has heated up. In the coming months, Pandora is getting ready to make some major changes to its product and business model—and it’s praying that it all pays off. That’s why Westergren flew to New York from California this morning. The task ahead of him is hugely challenging—not to mention urgent.

“It’s crystal clear to me what I should be doing,” says Westergren, who replaces Brian McAndrews, who suddenly left the company in late March after two and a half years as CEO. “Both why I should be doing this as a job in the first place and what the most important things to tackle are.”

During his first week on the job, Westergren’s focus was on “rallying the troops” internally and meeting with two of Pandora’s most important constituencies—record labels and investors. Before this New York jaunt, he was in Los Angeles meeting with music label execs and artists. Before that, he hosted an all-hands meeting at the company’s headquarters in Oakland, unveiling a new org chart with his name at the top and refined roles for other members of the top brass.

“I can’t remember the last time I slept a decent night’s sleep,” Westergren says between bites of a sushi lunch that seems like it barely snuck into his packed afternoon. “But I’ve never been more fired up than I am now.”

That’s good, because Westergren has his work cut out for him. In 2015, the company failed to grow its audience beyond the 81 million listeners it had at the beginning of the year. And while it pulled in $1.16 billion in revenue last year, it was still $170 million short of profitability, thanks to its stubbornly huge, federally defined music licensing costs. Those fees, which don’t apply to terrestrial radio or on-demand music services like Spotify, eat up roughly half of Pandora’s revenue, making it hard to consistently turn a profit. The company may even be looking to sell itself off, according to a recent report in the New York Times. Even with Westergren now at the helm, that option may remain on the table—the company hasn’t officially commented on that. But right now, he seems sincerely hell-bent on breathing new life into this thing he helped build so many years ago.

“There’s something about having been here from the very beginning,” says Westergren. “I know how everything is stitched together. I know how things work. Why we do things. Where our weaknesses and strengths are.”

Even before its unexpected CEO swap, Pandora was busy charting a new course. Late last year, it acquired the remains of struggling Spotify competitor Rdio, concert ticket seller Ticketfly, and Next Big Sound, a startup that tracks music online and offers detailed analytics to artists and labels. The acquisitions signaled a two-pronged strategy: Turn Pandora into a more comprehensive, Spotify-esque place for listening to music, while also making it a more valuable (and hopefully lucrative) resource for musicians. The time line on launching these new initiatives, Westergren assures me, has not changed, although like any executive operating in the ever-fluctuating digital music space, he’s hesitant to give exact dates.

“We want to be a one-stop shop for artists and for listeners,” Westergren says. “And all that activity will turn into a set of businesses.” And crucially, those businesses won’t all be eaten at by the same fixed (and very costly) royalty payments that Pandora’s radio product endures. That isn’t to suggest that profits will explode once the switch is flipped, but if all goes according to plan, Pandora is hoping its road ahead could be a bit less bumpy.

It’s tempting to view Westergren’s promotion like a Jack Dorsey moment: A publicly traded technology company struggling to grow its user base turns to its charismatic cofounder to help steer the ship through increasingly crowded and competitive waters. But perhaps if anybody can pull this off, it’s Westergren. He brings to the table what he sees as being two distinct advantages: past experience as a working musician—he believes it gives him a unique vantage point from which to court the music industry and artists—and a face that’s very familiar inside the company. He may only have had this new job title for a few weeks, but Westergren has long been a hands-on cofounder and cheerleader for Pandora, serving as the public face of the company in the press, holding public town halls with listeners, and sitting in on sales calls with ad reps, among much else. Who better to lead the organization through trying times than somebody who naturally brims with enthusiasm for his own creation?

Why Pandora Needs To Look More like Spotify

If life is challenging for Pandora, it may have less to do with the missteps the company has made over the years and more with forces that have sprung up all around it. Make no mistake about it: Pandora’s original concept—personalized online radio based on the tastes of its listeners and powered by an algorithm trained by living, breathing music experts—was a bona fide innovation when it premiered in 2005. It changed the way millions of people listen to music, spawned countless copycats, and cut into terrestrial radio’s share of airtime by nearly 10%.

But in 2016, personalized radio alone just doesn’t cut it. As a business, it’s incredibly expensive to operate, and it’s difficult to scale beyond the U.S., Australia, and New Zealand, thanks to the unique music licensing rules that govern Internet radio broadcasters.

Meanwhile, listeners’ expectations have changed since Pandora’s heydey. The rise of on-demand services like Spotify, SoundCloud, and Apple Music have given people more control over their listening experience, allowing them to find and play whatever tracks they want, when they want. Through playlists and various flavors of human-meets-machine algorithmic intelligence, these services offer music curation and personalization, as well, and a radio feature of some kind is usually bolted onto their on-demand music experience.

It’s no wonder Pandora’s growth has stalled.

Last year, digital music made more money than physical albums for the first time, fueled by an explosion in streaming. In December, even the famously new-format-shy Beatles released their entire catalog on all the major streaming services. And just this month, Kanye West’s Life of Pablo became the first album to hit No. 1 on the Billboard charts without selling any physical copies.

Pandora is still exceptionally adept at delivering the artist- and song-based radio stations it pioneered. But for many, refining their station with the thumbs-up button alone isn’t enough. When you hear something you like on Pandora, you likely head off to YouTube, SoundCloud, Apple Music, or Spotify to save your newly discovered jam. “We don’t want you to do that,” says Westergren.

That’s why Pandora has been working on new options for its users. In early 2014, Pandora’s chief financial officer Mike Herring met up with Sara Clemens, a former Microsoft executive who led business development and international expansion for the Xbox. Over lunch, the pair discussed Pandora’s unique set of challenges and opportunities as a business.

“Both of us were very aligned about this chance to create a scaled music marketplace,” says Clemens, who would soon join Pandora as its chief strategy officer. “A place where fans and artists could connect at an unprecedented scale. What are the services you’d need to build to create the most delightful experience for both of those groups?”

By mid-2014, Clemens and other members of Pandora’s leadership met with the teams at Ticketfly, Next Big Sound, and Rdio and began mapping out a new, more ambitious future for the company.

The company’s previous experiments helping artists plot tours and sell tickets suggested that Pandora could play a new, unique role in the live music side of the industry. In mid-2015, Pandora teamed up with the Rolling Stones to help promote an upcoming tour—and managed to presell 55,000 tickets in 24 hours. The partnership, which came about from an existing advertising relationship with the band’s tour promotion company, demonstrated how Pandora’s reach and technology could be used to sell tickets directly to fans. Surely, that process could be made even smoother if Pandora owned the ticket-selling platform itself.

Meanwhile, earlier discussions with Next Big Sound about including Pandora as one of the analytics company’s many data partners had evolved into a conversation, instead, about Pandora buying Next Big Sound to enhance its own suite of self-service, data-powered tools for artists.

For its part, Rdio was struggling to keep up with Spotify and Apple Music, reportedly losing $2 million per month and barreling toward bankruptcy. With many in the music industry loudly railing against free, ad-supported music and Pandora looking for new sources of revenue, Rdio’s assets—chiefly, its technology stack, product team, engineers, and business affairs group—seemed well worth the $75 million Pandora would drop to scoop them up. That might seem counterintuitive, given that on-demand streaming isn’t a wildly profitable business either. But unlike with radio, on-demand music lets Pandora directly negotiate licensing deals with the labels—and experiment with subscription business models.

Later this year, Pandora will launch its own on-demand music subscription service, once the licensing deals and logistical and design details are all ironed out. It’s easy to envision a Spotify clone layered on top of the existing Pandora app. But there’s more to it than that, insists Chris Phillips, Pandora’s chief product officer and the man overseeing the process of integrating these new pieces—an on-demand library, ticket-selling features, and a fresh arsenal of data—into the Pandora puzzle.

“We’re tackling it differently,” says Phillips, arguing that most music streaming services start with a huge on-demand library and then tack on personalized radio and curated playlists as an afterthought. “We’re starting from this very simplistic personalized radio, and we’ll be adding in the right level of control in the right places.”

Pandora knows, for instance, if you’re into Carly Rae Jepsen. Maybe the Carly Rae station is your guilty pleasure at work. Or perhaps you’ve repeatedly hit the thumbs-up button on her songs when you hear them on Pandora stations. Armed with this intel, Pandora can confidently dangle her latest album in front of you, hoping to lure you toward the on-demand service subscribe button. The trick will be elegantly layering these pitches into the experience without annoying listeners.

“You can think of any number of ways in which we would auto-complete your virtual music collection,” says Westergren, suggesting that teasing listeners with a Spotify-style list of albums might help show casual, “lean back” radio listeners the value of paying up.

Tricks like this may help Pandora reach its stated goal of converting 10% of its Internet radio listeners (that’s 8.1 million people) to paying on-demand subscribers. And for existing Pandora listeners who haven’t yet invested in another $10-per-month music service, why not? It’s the people already hooked on Spotify or Apple Music who will be harder to convince. Indeed, catching up to Spotify and Apple’s combined 40 million paying subscribers will undoubtedly be an uphill battle for Pandora, which is admittedly jumping into the on-demand subscription game very late. Just look at Tidal, which struggled to amass 3 million subscribers even after coaxing fans with exclusives from top-tier artists like Rihanna and Kanye West.

To its credit, Pandora is trying to build more than just another Spotify copycat. For one thing, Clemens tells me, the company is not going to stick strictly with the all-you-can-stream-for-10-bucks model that dominates music subscription services today.

“One of the things that the industry has done to its detriment over the years is create this $120 price cap irrespective of how much people love music,” says Clemens, referring to the yearly price tag affixed to all-you-can-stream services like Spotify. “If I look at the gaming industry for example, people are willing to spend thousands if they’re a superfan.”

Pandora already has 3.9 million subscribers for its Pandora One tier, which eliminates advertisements from its online radio streams. The company won’t comment on how Pandora One will be affected by the new on-demand offerings. But whatever the pricing details may be, Clemens and Westergren clearly envision multiple price tiers that cater to fans of varying levels of intensity.

“What does it look like if they rent access to the new album for a period?” wonders Clemens. “Or for the price in the market, would you like to be able to buy it and listen to it unlimited? Or you’re a superfan and there’s a presale going on for the gig that’s going to be in your town. Would you like to know ahead of time? What’s the premium you’re willing to pay for that?”

The impending launch of its on-demand service might also help Pandora position itself to expand into other countries, depending on the details of the deals that are now being negotiated with record labels. The compulsory licensing scheme used by Pandora radio in the U.S. doesn’t easily translate overseas, but direct deals with labels as part of the new on-demand initiative may well help unclog one of the company’s biggest bottlenecks toward growth. The company won’t commit to any time lines on when it might launch overseas, but doing so is clearly a pressing priority for Westergren. Spotify already operates in more than 60 countries, while Apple Music is available in 113.

At this point, even an aggressive international expansion won’t solve Pandora’s challenges overnight. But when pressed on the question of competition in the on-demand space, Westergren goes right back to his magic number: 81 million active listeners.

“That’s our strategic advantage,” he insists. “We can take an existing audience and put the product in front of them in a really compelling way. And that’s our pitch to the music industry, too. You want to convert the masses? We’re the ones who can do it, in the U.S. at least.”

Frustrated by the popularity of free on-demand music options from Spotify and YouTube (whose ad revenue doesn’t yield nearly as much cash for labels and artists as paid subscriptions do), the music industry will happily embrace any partner that can push listeners toward a payment button. The question is whether Pandora can cobble together enough unique perks to make it worth users’ while.

Can Pandora Become Ticketmaster For The Little Guy?

For many artists, touring makes them more money than selling recorded music. In the streaming era, this sobering reality only becomes more real, especially for the middle class of musicians without major label marketing muscle. Indeed, the economics of streaming music—be it ad supported or subscription—does not usually favor these artists financially. While the business math of the new ecosystem shakes out, many argue, musicians simply need to scrape dollars together elsewhere, however they can—from merchandise, from synch licensing deals for TV and movies, and from playing live.

If hitting the road is indeed a bigger piece of the sustainability pie for musicians, Pandora is busy positioning itself to play an important role. Its Ticketfly acquisition hits a sweet spot for the company. It’s a new source of revenue (a cut of ticket sales) unfixed to steep, legally defined royalty costs. It’s also a way for Pandora to aid artists in a direct, potentially hugely beneficial way. And for listeners faced with a range of streaming service options, it could be a big perk.

Ticketfly will allow Pandora to do something that its competitors don’t: sell concert tickets directly to fans within its music app. Using its existing data-powered personalization, Pandora wants to intelligently target concert ticket sales, including presales and special VIP passes, to the people who are most likely to buy them. Those offers can come in the form of in-stream advertising (smartly placed after a song by the artist who is touring) or as push notifications aimed at superfans the moment a show is announced. If the design of the recently launched Ticketfly mobile app is any indication, the ticket-buying experience itself will be nearly effortless.

“One of the reasons we actually bought Ticketfly versus just partnering is that we want to tighten up the actual full process,” explains Phillips. “From discovering the ticket to actually purchasing it and making it really easy.”

Anyone who has ever tried to buy a concert ticket on their phone will appreciate what Phillips and his team are trying to do here. If Pandora is really able to make the ticket buying experience as painless as possible, it would not only be a good thing for users, but could be a potential boon for artists and venues. Ticketfly serves small- to medium-sized venues, which often take a gamble on booking smaller acts, whether they be local bands or somebody touring from out of town. Pandora’s personalization technology can help sell tickets that otherwise may not have been sold, including to people who may not even realize they want to see that band play live, but are nonetheless dropping a hint every time they tap the thumbs-up button.

For shows that might not be coming to your town (or might not be at a Ticketfly venue), Pandora is plotting a second phase to its live music strategy: live-streaming. Pandora has already run pilot live streams with acts such as G-Eazy, Fall Out Boy, Jack White, and Mumford and Sons, which Philips says were “wildly successful.” Pandora’s product team is plotting a greater emphasis on live-streamed shows, which could be targeted to fans based on their tastes. It wouldn’t be the first time a company offered fans the option to tune into concerts live, but the combination of Pandora’s size and listener-targeting capabilities could make it another compelling add-on for music fans.

If the company is successful in attracting an audience to these live events, both virtual and in the flesh, they could generate not only a new source of income for Pandora (the company is mum on which features fall on which side of its upcoming paywalls), but also something that is just as valuable: more data.

It’s All About The Data

The company’s Internet radio service was built atop Pandora’s Music Genome data set, which was created by dozens of musicologists who sat down with their headphones on and manually tagged songs with descriptive terms based on style, instrumentation, and various musical nuances. By wrapping thousands of songs in detailed metadata, the Music Genome Project allowed Pandora to create an algorithm that could link songs together by their stylistic and sonic attributes and then, crucially, start learning about its listeners’ musical preferences.

Every time a listener hit the thumbs-up or thumbs-down button on a song, they taught the system something new about their tastes. That intelligence was used to personalize stations for individual listeners and helped train Pandora’s system about the relationships between artists, songs, and listeners across its platform. What Amazon and Netflix did for horror films and hand soap—the classic “people who like that also like this” recommendation engine—Pandora trained its system to do for songs.

As Pandora grew, so too did its data science and personalization muscle. For millions of listeners, this formula made a lot more sense than the one-to-many model of terrestrial radio, which had historically jammed a narrow selection of popular music down the throats of the masses. Over time, Pandora’s underlying methodology was amended with new moving parts: machine listening to help scale the work of the musicologists and, at the same time, a new tier of flesh-and-blood curators to add another layer of human touch to the experience.

Now Pandora is sitting on a massive (and potentially lucrative) mountain of data about its listeners, and 9 billion user-created stations and 65 billion taps of the thumb buttons have taught Pandora’s artificial brain quite a lot. On average, a Pandora user listens to more than 20 hours of music per month.

As powerful as all that data is, it’s limited by the same thing inhibiting Pandora’s user experience: Its ability to learn hits a wall as soon as users switch over to Spotify, SoundCloud, or Apple Music to save songs for on-demand listening later or to explore entire albums and playlists at will. This is a big competitive vulnerability for Pandora, especially as Spotify releases its own innovative, data-powered music curation features like Fresh Finds and Discover Weekly. The science that powers these features (as well as Spotify’s own customized radio stations) comes from the Echo Nest, the music intelligence company Spotify acquired in 2014. The Echo Nest, which takes a slightly different, more machine-oriented stab at curation and discovery, is not quite as good as Pandora when it comes to personalized radio. But it’s quickly catching up. In the meantime, Spotify features like Discover Weekly are proving to be a big hit among listeners, giving them one less reason to open up the Pandora app. Meanwhile, Apple Music’s hand-built playlists and decidedly old school Beats One radio station have wowed listeners and generated a hip sort of buzz that must make an aging Internet radio pioneer feel jealous.

By shifting toward on-demand subscriptions, Pandora is hoping to add a new, much deeper layer of data and understanding to its artificial brain. By creating artist-based stations and thumbing songs, listeners can teach Pandora a lot—but behaviors like saving albums and listening to them on repeat or adding individual songs to playlists are vastly more informative (as Spotify and Apple already know). Right now, if you’re obsessed with the new Rihanna album, Pandora has no idea. These are the types of blind spots the service needs to fill in, especially if it wants to target superfans with special perks.

Data is just as crucial when it comes to selling concert tickets. Not only will Pandora know what music you like to listen to, it will also learn which artists motivate you to spend your disposable income on tickets, get off your couch, and go see a show in person. That level of commitment says so much more than the tap of a thumbs-up button does. And that sort of intelligence will be hard for other music services to replicate without a ticket-selling service of their own.

With these acquisitions, Pandora is attempting to bolt on fresh sources of revenue, but they shouldn’t be seen as a shift away from radio. In fact, all these new data pipelines could funnel back into the service’s core algorithm, making the brain behind Pandora’s ad-supported radio service even smarter and, the company hopes, more lucrative.

Winning The Hearts And Minds Of Musicians

Tim Westergren is fond of recalling his days as a touring musician. It’s not just that he’s nostalgic about lugging gear between venues with Yellowwood Junction, the acoustic rock outfit in which he played keyboard in the mid-1990s. Rather, he believes that his experience as an artist gives Pandora a unique perspective, especially now that he’s the company’s CEO. He might not have quite the music industry cred of Apple Music’s Jimmy Iovine or Tidal’s Jay-Z, but he can at least speak the language of the people who make music, who are sometimes deeply skeptical of anyone with the word “executive” in their title.

“Being CEO is like managing my band,” says Westergren. “It’s got all the same things. The chances of success are almost zero. It’s a creative endeavor with lots of artistic differences. You’re poor as shit. You’ve got financial stress. It’s the same thing.”

This narrative smacks of hip corporate spin, but it’s hard to dismiss when you look at Pandora’s recent strategy, which helps serve artists with new tools and opportunities. That was true when Westergren was merely a cofounder—and the company’s focus on the needs of artists is bound to get even sharper now.

In late 2014, Pandora launched its Artist Marketing Platform (AMP), partially under the guidance of then-cofounder Westergren. Through AMP’s dashboard, artists and managers can get a Google Analytics-style breakdown of the locations where their music is being played, how many new Pandora stations are being created from their songs, and how many listens and thumbs each song gets. Last month, the company launched AMPcast, which lets artists record their own self-promotional audio messages on their phone and target the audio (and an accompanying display ad) directly to fans. In one beta campaign, a small string quartet used AMPcast to advertise their new boxed set of CDs with a link to purchase—and made $3,000 in 20 minutes.

In another campaign, EDM artist Steve Aoki used AMPcast to help promote an album that was premiering exclusively on Pandora. That ad saw a nearly 18% click-through rate, handily putting most banner campaigns and social ads to shame.

“I think it was our most successful album launch we’ve ever done,” says Matt Colon, cofounder of Deckstar Management, which manages Aoki and several other big name artists. Colon says his company plans on utilizing Pandora more as the service’s artist-focused tools mature. Until recently, he says, they had no idea what kind of reach Pandora had into the fan bases of artists like Aoki.

“I’m as guilty as everyone else of underestimating them,” says Colon. “But when I saw the numbers, I was blown away. There’s a lot of functionality that we didn’t know existed.”

Indeed, artists are often surprised to see how much their music gets heard on Pandora. At a recent dinner with music executives in L.A., Westergren bumped into pop music heartthrob Nick Jonas and, quite naturally, proceeded to show him Pandora’s new promotional tools. Querying the data, Westergren found that Jonas’s music had been heard by 31 million listeners on Pandora, 1.7 million of whom made radio stations based on his music, much to Jonas’s surprise.

“Eighty percent of these top artists have far more people on Pandora who have created a radio station using their name than they have Twitter followers,” claims Westergren. “This is where their audience is.”

When Pandora launched AMP, Alex White saw it as an excuse to try his luck one more time. For years, the founder of Next Big Sound was dying to get Pandora’s listener data into his startup’s music analytics dashboard, which helps artists and labels visualize and understand their online presence and popularity. But unlike SoundCloud, Spotify, and YouTube, Pandora was shy about sharing its data with third parties like Next Big Sound. “Pandora was always our biggest blind spot in terms of consumption and they never shared their data with anybody,” says White. With AMP, that was clearly starting to change.

Sure enough, Pandora was open to the idea of licensing its data to Next Big Sound and allowing the startup to flesh out its visualization-heavy artist dashboards with details on the service’s millions of monthly song plays.

As Pandora’s AMP team worked with White’s small army of data wizards on the details, the two product’s similarities—and Next Big Sound’s value to the music industry—quickly became obvious to Pandora’s top brass. Before long, the conversation morphed from a data licensing negotiation into acquisition talks.

Since the acquisition, some partners like SoundCloud and Spotify have pulled their data from Next Big Sound for obvious competitive reasons. But NBS still scrapes music-related info from Facebook, Twitter, Wikipedia, Instagram, Vine, YouTube, and—of course—Pandora. Its data also powers social music charts for Billboard, a relationship that remains unchanged by the acquisition.

By snatching up Next Big Sound, Pandora extends its already massive data operation outside the walls of its own service and arms its product team and playlisting engine with a whole new set of insights about how music is shared and discussed online. Don’t be surprised if you start to see Pandora turn this intelligence into new music discovery features aimed at reclaiming the territory now being threatened by Spotify and Apple.

More than anything, Next Big Sound makes Pandora a more useful platform for musicians and labels, for whom detailed, multifaceted data can unlock new, useful insights that can help artists make decisions, such as where they should book their next tour. In an era when the economic viability of being a musician seems so uncertain, anything that removes friction, frees up creative energy, or sells empty seats can go a long way.

Will It Work?

From a business perspective, Pandora’s new strategies are anything but a silver bullet. If executed well, they could help close the gap on its balance sheet and open up new, more flexible financial possibilities. But once the switch is flipped on these new products and integrations, the hard work will have only just begun. Both Westergren and Clemens seem to understand that. Simply marketing its new services will be a major feat, even with its already captive audience. To help, the company is currently searching for a new chief marketing officer to replace Simon Fleming-Wood, who stepped down shortly after Westergren took over as CEO.

“When we built this product, I was 26 and I said to myself, ‘What do I need?’’ says Westergren, recalling the days when he thought his career would unfold in concert halls rather than corporate offices. For a small-time band like his in the mid-1990s, getting radio airplay was unthinkable. As a touring band without the backing of a major label, plotting shows, promoting them, and selling tickets was an uphill battle. For thousands of bands today, it still is.

“That’s the frame that we bring to this. This is something that your average musician can use. And if it’s not, then it’s a waste of fucking time. It’s another product built by some software engineer or a music fanatic who doesn’t know what it’s like to be an artist.”

If Pandora is serious about becoming a full-service marketplace for fans and artists alike, then we likely haven’t seen the last of its big moves. For example, another potential opportunity is e-commerce. When asked whether Pandora plans to move toward selling artist merchandise directly to fans like Bandcamp or Band Page, Westergren and Clemens hint that this is something they’re open to exploring in the future. Indeed, it’s easy to speculate how a startup like Bandcamp, which serves many of the same middle-class artists as Ticketfly, might make for a logical acquisition down the road, considering its huge trove of buzzworthy, under-the-radar music, its e-commerce marketplace, and its beloved status among the sort of artists that Pandora seeks to serve—though the company did not discuss with me whether such an aquisition is a real possibility.

Certainly, the company has plenty of work ahead of itself as is. To truly thrive—and avoid having to sell itself off—Pandora needs to do exactly what it appears to be trying to do: branch out. Its future isn’t a sure bet, but it’s hard to imagine that Pandora is finished rewiring itself just yet.

App photo: Ivy Close Images/Alamy

Fast Company , Read Full Story

(30)