Is Silicon Valley Taking Menswear More Seriously?

As men increasingly rival women in the amount of money they spend on clothes, the tech scene is accommodating the man who wants to dress like Kanye, Bieber, or even President Barack Obama—but on a millennial’s budget.

Menswear sales grew 13% from 2010 to 2015, versus 9% in womenswear for the same period in the U.S., according to Euromonitor International. By 2020, worldwide annual menswear sales are predicted to reach $457 billion and womenswear, $698 billion.

It would seem that men are more fashion-conscious than ever before, but when it comes to the tech side of the market, menswear has traditionally lagged behind womenswear. For years, women have enjoyed a wide range of apps, e-commerce sites, and wearable tech lines. Now dudes are catching up.

A recent success story is Combatant Gentlemen, an online retailer targeting young professionals on a budget. These millennials want to dress like Entourage‘s Ari Gold but find themselves in a bind: They can’t afford Hugo Boss and feel out of place hitting up Men’s Wearhouse. Combatant Gentlemen solves this dilemma by selling custom-made 100% Italian wool suits starting at just $160.

The startup is a hybrid of fashion and apparel essentials (like shirts and ties), almost like a “Uniqlo for suits” but with stronger roots in the higher end of the business. The design-to-delivery brand uses a Netflix-like algorithm to recommend curated looks based on customers’ preferences and previous shopping behavior. Launched in 2012, Combatant Gentlemen grew from $4 million to $10 million in revenue between 2013 and 2014. The company controls prices by producing clothing in-house, with it its own factories and cotton plantations in Italy. They even have their own sheep.

Cofounder and CEO Vishaal Melwani recalls that pitching his startup in 2012 in Silicon Valley was a “very difficult” experience. He’s since witnessed a surge in industry interest. “It’s been exciting to see other menswear startups come about, whether it be accessories or luggage,” he says. “The space is really wide open.”

Menlo Ventures’ Pravin Vazirani, an investor in companies like The Black Tux, Warby Parker, and Poshmark, has also seen a significant increase in menswear startups. In fact, one company in his portfolio—Stance, a luxury menswear sock e-retailer—is projected to make $100 million in revenue this year.

“The way men shop makes it more conducive to online. Men are a little bit more utilitarian, they focus on convenience and price as some of the main criteria,” Vazirani says, noting that this differs from women’s typically more social and interactive shopping habits. “It makes more sense for men’s fashion to move online, but it’s still underinvested in terms of startup activity—which is exactly why we think it’s interesting.”

The market has been wildly receptive to several online retailers, and the wealth is spreading. Online menswear sales grew 17.4% between 2010 and 2015, outpacing all other categories, IbisWorld reports. The market research firm predicts online menswear will grow more, with an annual average of 14.2% between 2015 and 2020.

There’s Bonobos, the menswear e-retail startup that subverted the shop-in-store experience. It’s now added brick-and-mortar stores to its model, allowing shoppers to browse merchandise in person and have purchases shipped to them free of charge. You don’t leave with anything in your bag.

Mr Porter, meanwhile, has become a booming business that translated the luxury shopping experience for men onto mobile. Mr Porter has become so synonymous with men’s fashion that it even made its way into an A$AP Rocky rap song. Their premiere service offers same-day delivery, and just last month, the company announced a shoppable Apple TV app.

“The ability to create a dynamic digital shopping experience broadens the appeal of shopping to reach over to men,” says Kirsten Green, founder of Forerunner Ventures, whose portfolio includes Bonobos. Men prefer the simplicity of shopping online, particularly on their phones. They value functional, Green says, yet at the same time are now more in tune with fashion due to our image-driven culture. Men, like women, are bombarded with fashion on Instagram, Tumblr, and their Facebook accounts.

Some insiders think there’s still plenty of room to grow in elevating menswear to the same digital status as womenswear. “There really hasn’t been a killer app yet,” says Jian DeLeon, senior menswear editor of trend forecasting firm WGSN. He doesn’t foresee major innovation in menswear clothing per se—or how they wear clothing—but rather changes in logistics: how the industry distributes products, controls price points, and improves quality. Companies such as Warby Parker and Everlane reimagined the process of obtaining high-quality style, but The Next Big Thing for men has yet to be created.

And because of that, DeLeon dismisses the idea that the industry has experienced any true earthquakes of innovation in recent years. “[The term] ‘disruption’ is often abused in the fashion space because oftentimes they’re not really disrupting anything—they’re just entering the market, especially in menswear,” said DeLeon.

Dudes Gone Designer

Celebrity fashion is playing a bigger part in menswear—just think of the styles on display during the locker room walk in NBA games.

As DeLeon sees it, men want to emulate celebrities who dress according to their own style, or at least look like they do. They don’t want to know about stylists and all the work that goes into designing a consistent and unique personal aesthetic.

“Men’s BS detector is at an all-time high. It’s not about ‘getting the look’ of a certain celebrity,” says DeLeon. “That Kanye and John Mayer know their fashion—that’s what guys identify with. They might not like John Mayer’s music, but no other celebrity has a Rolex collection and is super nerdy about it. I think that’s his appeal. They respect that realness in how he dresses.”

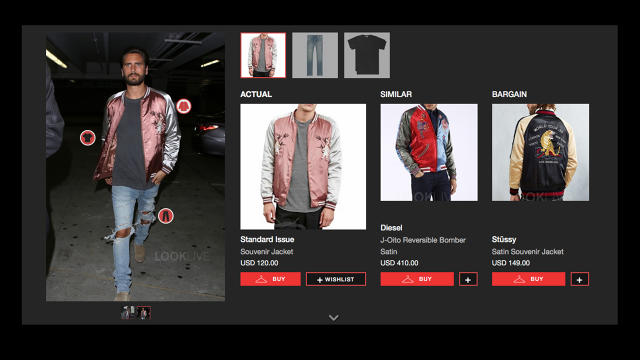

That’s exactly the philosophy behind Looklive, a Y Combinator-backed startup that harnesses the power of sartorial stars. The site and its app use both image search technology and a human editorial team to mine the best of men’s fashion, then match it to corresponding brands and similar looks for sale.

Looklive accurately identifies products worn by the world’s most influential men in fashion. Top influencers include Scott Disick, The Weeknd, and even Jack Dorsey.

Founders Cedric Rogers, Paul Judge, and Greg Selkoe noticed a hole in the market when it came to translating celebrity men’s fashion into e-commerce, whereas womenswear has sites like Polyvore and Project September. They were cognizant of what happens when a celebrity wears a piece of clothing, and how household names drive consumer purchases.

“Men are especially influenced by athletes as well as entertainers, so we wanted to leverage that,” says Rogers, who pointed to LeBron James and David Beckham, who both possess a near saintly status with fans.

Cofounder Greg Selkoe previously ran Karmaloop, a streetwear e-commerce site that saw a billion-dollar revenue, with 80% from male customers. “There is this need now to provide more fashion guidance, more apps, more websites…things that hit this [male] demographic” he says.

Looklive specifically targets men 18-35, an audience that is looking for a different type of shopping experience than what’s offered by traditional box retailers. “They really want to have a genuine experience with the brands that they’re identifying with, as well social influencers,” Rogers says, noting that their company provides all of that in a quick, simple format. For example, their newest app update features Siri integration, so when you ask, “What did Drake wear to the VMAs?” you get an answer. (It was Tom Ford.)

“Authenticity has a real value still,” says DeLeon. He believes that designer fashion “feels real” next to the hordes of fast-fashion knock-offs and purely practical apparel options. Style-conscious men, he says, want “something that cultivates a sense of desire in an age where clothing is leaning more towards problem-solving and filling gaps in a man’s wardrobe.” Brands like Uniqlo, for instance, are better known for selling pragmatic, on-trend garments than showstopping fashion pieces—despite the company’s many successful partnerings with well-known designers. Uniqlo fleece might not necessarily inspire you, but it will probably keep you warm.

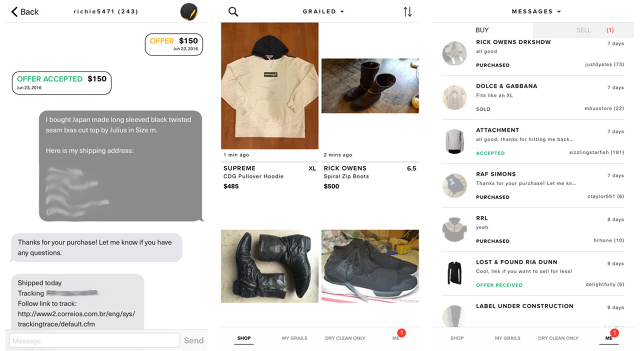

Men’s interest in investing in designer fashion explains the rise of “re-commerce” companies like Grailed, which offers a curated retail experience featuring secondhand high-end clothing from such brands as Raf Simons, Rick Owens, and Saint Laurent.

Three years ago, Grailed cofounder Arun Gupta started frequenting menswear forums on Reddit, where he witnessed an increasing interest in men’s luxury fashion. He interacted daily with men who saw few options to buy labels they admired. “There was a clear void,” he says. “Now it’s heating up and men are seeing more and more services being provided to them.”

Describing the genesis of the trend, Grailed’s brand director, Lawrence Schlossman, says, “It started with the forums then migrated to the blogosphere with independent, non-industry voices. Then from blogging it went to independent shops, pop-ups. You see this ripple effect.”

Grailed is more than just a resale site. It also promises customers a sense of discovery as it introduces them to new, noteworthy designers. The company targets both fashion enthusiasts and the more casual consumer. According to Gupta, this is what separates Grailed from competitors like Poshmark or TheRealReal or even eBay. The number of visitors to the site quadrupled in the last year, and items posted grew from 10,000 in 2015 to 350,000 in 2016.

“We have a brand,” Gupta says. “While eBay doesn’t really have a brand or a voice.”

It wasn’t easy getting Silicon Valley on board. Raising money for a fashion startup is hard enough. Pitch a company that caters to men—who are widely (and incorrectly) presumed to be indifferent to fashion—and it becomes even more challenging. As Gupta recalls, VCs were “generally dismissive” because they wanted the next Amazon, not something targeting a niche audience.

Gupta points to the market trends to refute the idea that men aren’t as into fashion as women. If the menswear market is a third the size of the womenswear market, there should be more startups in that space, right? “The market is massive: There’s 10 women’s [resale] sites, and we’re the only men’s site,” he says. “It makes you wonder why there aren’t more.”

Innovation In The Market

WGSN’s DeLeon acknowledges that a few innovative startups have come on the scene in recent years. This includes Gustin, which crowdsources every single item in their menswear catalog, like a Kickstarter campaign for a complete clothing line, ranging from sneakers to jackets. There’s also Google’s Project Jacquard, the touch-sensitive fabric technology that now has a partnership with Levi’s.

And accelerators are starting to pay more attention to these fashion-forward startups. Manufacture NY is an incubator for independent designers working on bold initiatives such as wearable tech. Dropel Fabrics, for example, is a menswear line of water and stain-resistant clothing (for the fashionable, yet clumsy, man).

No matter the level of innovation genius, Manufacture NY CEO Bob Bland says it’s important for new brands to recognize how menswear differs from womenswear. Men, for example, might not be as mindful of seasonal trends as women.

“It is imperative for menswear brands to not follow the traditional wholesale calendar, seasonal approach… They must offer their customers enduring, timeless styles and rely on direct sales to survive in the luxury space,” Bland says via email. “I see men’s wearable tech as a big growth opportunity, especially in the performance category and niche areas like custom (bespoke) sizing, mass customization, and IoT [connected devices].”

On the West Coast, Grid110 is an economic and community development organization working to activate the fashion startup ecosystem in downtown L.A. Close to one-third of their applicants are focused on menswear. One of their recent startups is Lumenus, a smart-clothing brand that produces outdoor apparel with industrial wearable light, such as jackets with embedded LEDs that interface with Google Maps.

Lumenus started with menswear because they see men becoming more receptive to boundary-pushing designs. “In the tech product market, early adopters are almost always male,” said Jeremy Wall, founder of Lumenus, in an email. “For this reason, Lumenus will target men with the launch of our first line of technology-enhanced cycling apparel—also because athletic wear for men is a bit more ‘forgiving’ in terms of product design.”

Grid110 is only in its second fundraising cycle, but the founders are confident it will see more menswear startups attempt to take on the fashion industry. “As social media surges, we’re seeing more and more direct-to-consumer brands pop up,” says Megan Sette, cofounder and a member of the board of directors at Grid110. “And as shopping technology evolves, one can only imagine that there could be an uptick in the development of new men’s product lines, considering how easy it’s becoming to access the consumer and for them to shop from home or on demand.”

These innovations are exciting in terms of pushing the industry forward, but will they resonate with customers who value function as well as fashion?

“There will always be the early adopters who wear envelope-pushing styles and labels,” DeLeon says. “Guys just want to look presentable and look like themselves, just better-dressed versions.”

Well, now there’s an app for that.

Fast Company , Read Full Story

(27)