Online Sales Skyrocketed This Holiday—Will Amazon’s Profit Follow?

It’s been a heck of a holiday quarter for Amazon, what with online sales at record levels and the e-commerce giant entrenching itself further into the supply chain with ventures like Prime Air—not to mention more aggressive bets on original movies and TV content. When Amazon reports fourth-quarter earnings tomorrow afternoon, there will almost be too many moving parts to keep track of, but we’ll have our eye on a few key things. Specifically, are customers actually grafting on to its new services? And are some of these bets finally paying off?

Last quarter, the company’s revenue hit $32.71 billion, which was a modest jump from its expected revenue of $32.69 billion. All the same, it missed EPS, which was at 52 cents instead of the expected 78 cents. This caused shares to fall following the earnings report.

Tomorrow, analysts expect the company to hit $44.66 billion in quarterly revenue, thanks largely to the holiday rush. That would be an impressive 24.9% increase over the year before. This projection is bolstered by reports that online sales in both November and December saw healthy boosts compared to the prior year.

All the same, Amazon could still miss on EPS again. Analysts are expecting earnings of $1.41 per share, but Amazon’s heavy investing in new products and infrastructure could make margins slimmer than expected. This has been an issue for Amazon throughout its two-decade history as a public company.

Here are a few things we’ll specifically be looking out for:

- AWS: Amazon’s web hosting services has been one of its fastest-growing units. AWS revenue exceeded expectations in the last quarter with $3.23 billion in revenue. The company has continued to invest in it, and we’ll be interested to see if the growth continues.

- Digital Content: Amazon has continued to invest in new digital programming, both for the United States as well as in dozens of countries. Last December, the company announced that Prime Video would be available in 200 countries and territories, trying to put the service in step with Netflix. We’ll be looking out to see if this helped boost Prime sales as well as if the company has any further plans to build out its video programming.

- International Success: Amazon is popular stateside, but it’s not content with that. The company has been pushing to be an international superpower, and as a result, its international sales are increasing, with revenue jumping 28% year-over-year in the last quarter. We’ll be looking to see if these sales are going up even more, and if they’re representing a larger chunk of the overall sales compared to North America.

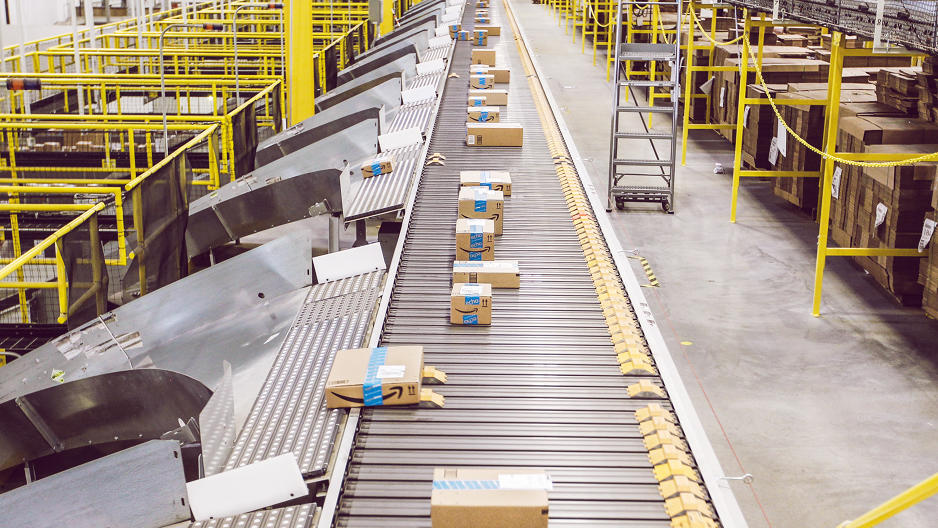

- New Products/Services: We’re always interested in how Amazon’s new programs are doing—specifically products like Echo, which has been getting lots of fanfare lately. Moreover, as Amazon continues to double down and invest in its own infrastructure, rumors persist that it will look into investing in its own logistics program. Just (February 17, 2017) the company announced that it would create 2,000 new jobs at a “new cargo air hub” to help meet demands for Prime members. We’ll be looking for more clues about those kinds of new services.

- The Holidays: This last quarter will reveal just how gangbusters the holiday season was for Amazon. With retail brick-and-mortar companies like Macy’s scaling back, we’re expecting sales for the e-commerce giant to be big. But how big? We’ll soon find out.

There’s much more to look out for as well. The big question for Amazon is whether its heavy investments will bear fruit or continue to be a drain on profit. As soon we the earnings go live, we’ll let you know.

Fast Company , Read Full Story

(4)