Report: Facebook’s display ad domination to grow as US digital ad spend hits $83B in 2017

Google to see total ad revenues jump nearly 15% in the US. Snapchat and Amazon to gain US mobile ad share.

The US digital ad market will grow 15.9 percent in 2017 to top $83 billion, with growth dominated by Google and Facebook, eMarketer estimated on Tuesday. Facebook’s US growth will exceed 32 percent in 2017, higher than eMarketer previously predicted.

Google is expected to see ad revenues increase 14.8 percent in the US this year, largely due to its overwhelming position in search and growing dominance in mobile search. Google’s search ad revenue share will increase by 16.1 percent to account for 77.8 percent of the US search market this year, up from 75.8 percent market share.

Display to remain Facebook’s domain

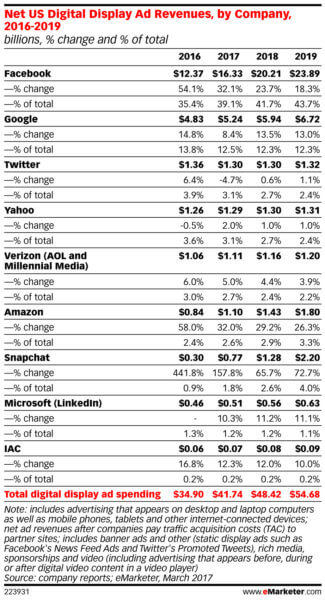

Facebook will take US ad share from Google, Twitter and Yahoo in 2017, eMarketer predicts. Facebook’s US display revenues are expected to increase by 32.1 percent in 2017 to capture 39.1 percent of the US display market, up from 35.4 percent in 2016. That share is expected to continue growing to 43.7 percent by 2019.

The social network’s ability to keep more users sucked in for more time with video is helping to drive growth. Instagram is also becoming a mobile ad force in its own right and will account for 20 percent of Facebook’s US mobile revenue in 2017, up from 15 percent in 2016.

Twitter’s prospects have dimmed significantly. EMarketer lowered its estimates and expects US ad revenue to fall by 4.7 percent this year to $1.3 billion. Twitter’s market share will dip from 1.9 percent in 2016 to 1.6 percent in 2017. Its display share will fall from 3.9 percent to 3.1 percent year over year. Twitter is still growing somewhat in other regions, and overall worldwide revenue will tick up 1.6 percent in 2017.

Mobile: Snapchat & Amazon to see share growth

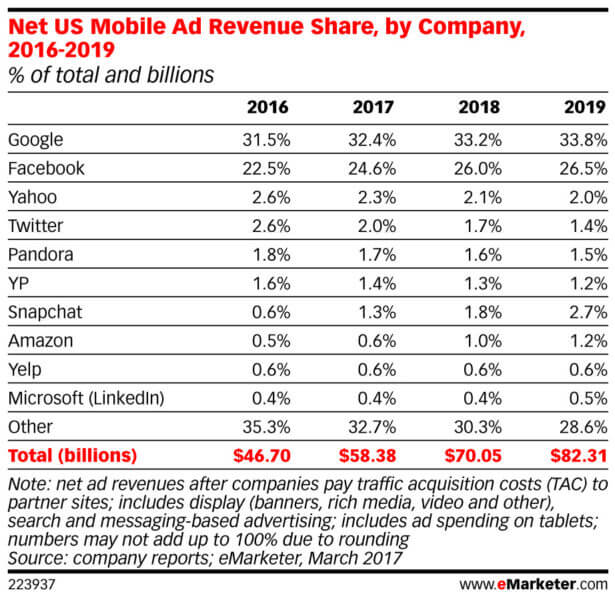

Google and Facebook are expected to keep chipping away share from others in the mobile ad market in the coming years. With Google’s dominance in search, the company will maintain a hold on nearly one-third of mobile in the US, with 32.4 percent in 2017. That share is expected to grow to 33.8 percent in 2019.

Facebook will account for 24.6 percent of the mobile ad market in 2017 and see its US share increase to 26.5 percent in 2019.

Snapchat and Amazon are both expected to see their mobile ad share rise in the next few years. Snapchat, which saw parent company Snap IPO last week, will see mobile ad revenue share increase from 1.3 percent this year to 2.7 percent in 2019. Its ad revenues are expected to grow 157.8 percent to hit $770 million in the US this year.

Amazon’s mobile ad revenue share will grow from .6 percent in 2017 to 1.2 percent in 2019.

Twitter’s mobile ad share, its key revenue source, in the US will fall by 4.1 percent in 2017 to $1.15 billion and its ad share will decline from 2.6 percent in 2016 to 2 percent this year.

Yahoo is expected to see mobile ad revenues rise this year, but its market share is expected to fall from 2.6 percent last year to 2 percent in 2017.

Marketing Land – Internet Marketing News, Strategies & Tips

(92)