Survey Says: Yes, U.S. Consumers Will Buy Cars From Apple And Google

Automakers may have a good reason to fear competition from tech companies.

Though some have scoffed at the idea that tech companies like Apple and Google could cause any real concern, a new survey suggests that the existential threat of tech entrants into the auto market should be taken seriously.

TECHnalysis Research recently surveyed 1,000 U.S. consumers who both own a car and are planning to purchase a new one within the next two years. They were asked a wide range of questions regarding car brands, features, technologies, and much more. One of the questions specifically focused on the potential interest that consumers would have in purchasing a car sold by Apple, Google, or another major tech company.

To be clear, the question was a hypothetical one because none of these companies have formally committed to manufacturing and selling a car. Plus, it’s very possible they never will manufacture one under their own brand. But if they do, consumers may buy in.

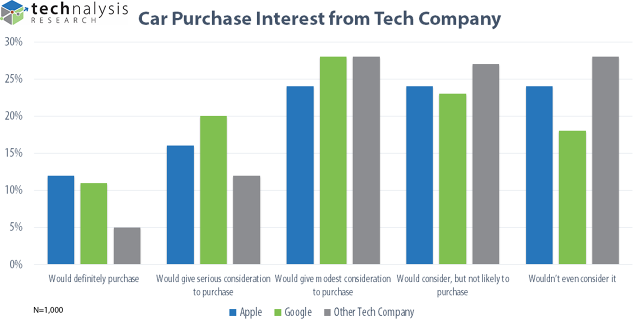

In fact, half of the respondents in our survey said they would give at least moderate consideration to purchasing a car from a tech company. In the case of Apple- and Google-branded cars, about one third would give serious consideration to a purchase, and just over 10% said they would definitely purchase a car from one of those companies.

Of course, without real cars, real prices, and real capabilities to consider, that intent is somewhat hypothetical and general, but the surprisingly high level of potential intent should give traditional carmakers pause.

Another fascinating insight from the survey responses is the preference between companies. Despite all the speculation and press about the possibility of an Apple car, more consumers said they were interested in a potential Google car than were interested in an Apple one.

In sum, 59% said they were at least moderately interested in a Google car versus 52% for an Apple car, and 33% said they were at least seriously interested in a Google car versus 28% for an Apple car.

Even when looking at the data by age and gender categories, the Google preference is higher in every group except 18- to 24-year-old and 55- to 64-year-old females.

The chart below illustrates the top-level responses to the question about potential tech brand car purchases.

It’s difficult to discern exactly why consumers might prefer a Google car over an Apple one, but the fact that Google has a real autonomous car now being tested out on the roadways is probably a factor. Meanwhile, a fully functioning prototype of an Apple car may well not exist yet, and if it does, it’s certainly far from public view.

The preference for a Google car may also have something to do with price expectations. People might simply expect an Apple car to cost more than a Google car. On average, our survey respondents said they were expecting to spend $31,173 on their next car purchase. That’s about half of survey respondents’ average household income, and close to the average U.S. auto purchase price.

Apple did, however, slightly edge out Google in the percentage of those who said they would definitely plan to purchase a car from a particular tech vendor—12% said they would do that for an Apple car vs. 11% for a Google car. This likely reflects the Apple fanboy and fangirl base—people who are extremely loyal to the company and would purchase nearly anything with an Apple logo on it.

Another point that becomes clear when analyzing the data is that interest in potential tech-branded cars is fairly divisive, particularly a potential Apple car. Almost a quarter of respondents (24%) said they had absolutely no interest in an Apple-branded car. Meanwhile, 18% said they had no interest in a Google-branded car.

Not surprisingly, people who own iPhones are more interested in an Apple-branded car (69% expressed at least moderate consideration), while people who own Android-based phones have a lower interest than the average at 45%.

But in a fascinating twist, iPhone owners have more interest in potentially owning a Google-branded car than even Android device users. Sixty-three percent of iPhone owners said they’d give at least moderate consideration to buying a Google car, versus only 60% of Android device users.

This may be due in part to the higher average income for iOS device users, who in this survey reported an average income of $71,899 versus an average income of $57,728 for Android device users. Having a higher income may make one more apt to consider what’s perceived to be more expensive semi-automated or fully automated cars. It could also be that iPhone owners are generally more inclined toward tech-centric products.

The bottom line is that consumer interest in purchasing (or at least seriously considering) cars from tech companies is very real. If Apple, Google, and other tech companies do enter the market with branded cars, the pent-up demand could end up having a sizable impact on the auto industry as we currently know it.

Bob O’Donnell is the president and chief analyst of TECHnalysis Research, a market research firm that provides strategic consulting and market research services to the technology industry and professional financial community. You can follow him on Twitter @bobodtech.

Fast Company , Read Full Story

(13)