The Class Of 2016 Has Better Economic Prospects Than Last Year’s Grads

Members of the class of 2016 are about to take their first steps on career paths. While no one can predict how they will do once they become part of the workforce, the Economic Policy Institute analyzed employment, enrollment, and wage trends to determine their economic prospects.

A paper, titled “Class of 2016,” found that this cohort has better job prospects than members of last year’s graduating class. Thanks to the steady economic recovery, these young people are expected to do better than any other class since 2009.

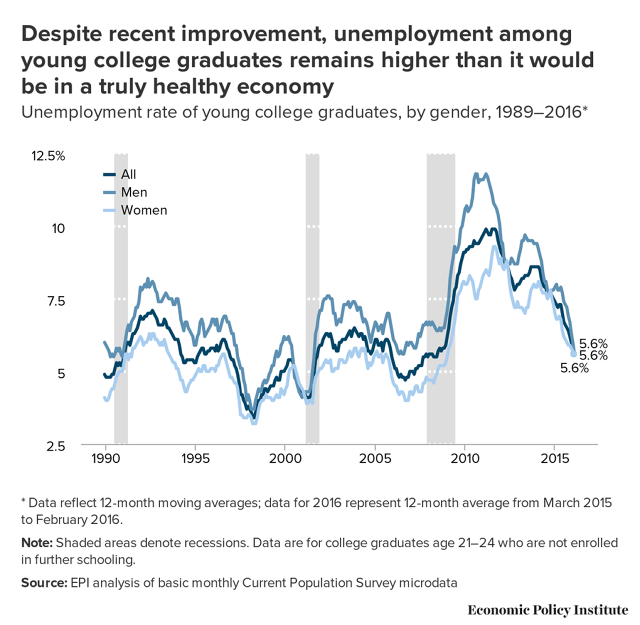

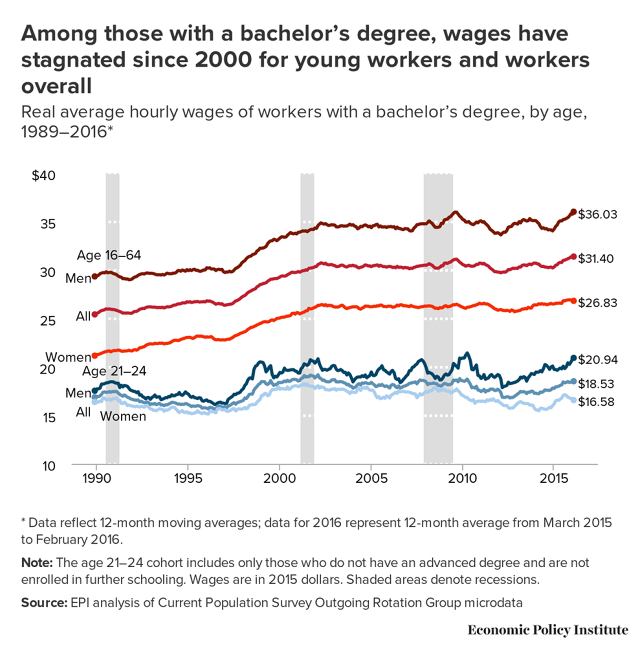

On a less positive note, they will still have challenges. Wages for both high school and college grads haven’t reached pre-recession levels, as they’ve either stagnated or declined for nearly each group since 2000. And while both unemployment and underemployment (aka working in a job that doesn’t require a degree) rates improved, they too haven’t fallen past what they were before 2007.

As the EPI researchers noted, the recession isn’t totally to blame. They write:

It is high because young workers always experience disproportionate increases in unemployment during periods of labor market weakness—and the Great Recession and its aftermath is the longest, most severe period of economic weakness in more than seven decades.

Neither is the so-called “skills gap” that others have cited as a hiring challenge when searching for qualified candidates. Instead, the researchers point to “weak demand for goods and services, which makes it unnecessary for employers to significantly ramp up hiring.”

Here’s how it breaks down:

- College graduates: unemployment in 2016 is 5.6% versus 5.5% in 2007. Underemployment in 2016 is 12.6% versus 9.6% in 2007.

- High school graduates: unemployment in 2016 is 17.9% versus 15.9% in 2007. Underemployment in 2016 is 33.7% versus 26.8% in 2007.

Where The Graduates Are

The paper focuses on graduates, but the researchers observed that not all young people in the workforce have a diploma or degree. Three-quarters of those aged between 17-24 have graduated from high school, and only 9.3% have earned a bachelor’s degree.

Among the slightly older set between the ages of 24-29, there are more who’ve finished high school. College grads are still a minority as 30.8% have some college experience and only 34.2% have completed college or received an advanced degree. Women overall are more educated than men. At each level of higher education (some college, bachelor’s, advanced), women earned more degrees than men.

That doesn’t mean they are being compensated more for their education. The report found that the average wages of young female graduates are less than for male graduates. Female high school grads are currently paid 92¢ for every dollar paid to men, while female college graduates earn 79¢ for every dollar paid to men.

High unemployment levels for high school graduates reflect recent findings from Careerbuilder that assert a third of employers are raising education requirements for new hires, and as many as 37% are hiring college grads for positions that used to go to those with a high school diploma.

The Continuing Struggle Of The Underemployed

For this reason, as well as the presence of a still-struggling economic recovery, those who have made a hefty investment on higher education aren’t necessarily assured of getting a job after graduation. The EPI report shows that this cohort of graduates “will join a sizable backlog of unemployed college graduates from the last seven graduating classes (the classes of 2009–2015) in a difficult job market.” One in eight are underemployed.

EPI’s researchers say that the share of underemployed graduates increased since 2007, and the jobs they are getting are of “lower quality” now. Fifteen years ago, even though half of college grads were in jobs that didn’t require a degree, they could be found in career paths that paid well, such as dental hygienist or electrician. What’s more, their employers provided health benefits and pensions. Now they are more likely to take low-wage jobs, such as bartender, food server, or cashier, without the attendant benefits or compensation for overtime.

Those who took on student loans to pay for tuition didn’t know their economic prospects would be so challenging. Although loans usually have a grace period, those who can’t pay because they don’t have a job or are in one with low wages are in danger of wrecking their credit by defaulting on payments. And because of their newly minted workforce status, the federal and state assistance programs that create a safety net for unemployed and underemployed workers are not available.

(20)