This App Rewards You For Making Cheaper Business Travel Purchases

There is one thing that’s the same no matter the size of the organization. From small three-person businesses to multinational corporations, employees are required to stay within travel budgets, adhere to company travel policies, and to file expense reports. Most employees likely find the process tedious.

One company is looking to transform that experience with the millennial workforce in mind. The app TravelBank claims that it gives employees more choices in how they travel, while helping businesses save money in the process. That experience starts with an estimate on the cost of your trip. As soon as a business decides to send an employee on a trip, it can input the travel dates and destination, and get an estimate of how much that trip should cost based on current listings, taking into account your company’s travel policies, such as whether your employees fly economy or business class, or stay in two- or five-star hotels.

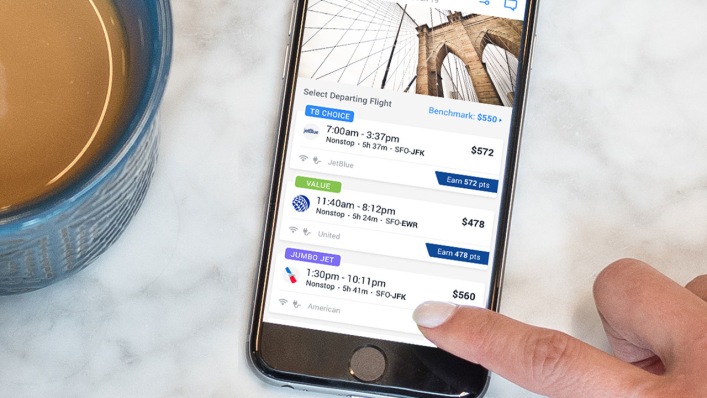

With that estimate, a business than can then issue an employee a travel budget and allow them to book flights and hotels as they please. Budgets are broken down into different sections, such as flight, hotel, and food. All of this is pretty standard already at most companies. The idea that makes TravelBank different, however, is that an employee can use their travel budget any way they choose.

For instance, the company’s travel budget might allow for a four-star hotel but an economy flight; however, the employee might prefer to fly business class so they can get some shut-eye on the way, and stay in a less-expensive hotel once they arrive. Expenses can be added as they happen within the app, and employees can keep a running tally of where they are in their budget, and how much they might have left to spend. The app can create a PDF expense report once the trip is over.

Making less-expensive choices along the way can also pay–literally.

Where TravelBank differs from some of its competition like Concur is that it incentivizes employees to come in under budget by having their company split the savings with them. For instance, if the budget for a week trip to New York was $3,000, but an employee saved $600 by taking the subway rather than taxis and staying in a slightly lower-rated hotel, then the employee will receive half the savings back–in this case, $300. Rather than cold hard cash, however; that refund will come in the form of purchasing credit at partners like Lyft and Airbnb.

“The reason we did it this way was mainly for tax reasons,” says Duke Chung, CEO of TravelBank. He says that when building the service it was important for them to create something where employees were getting rewarded for making smart travel decisions, not punished with complicating their taxes. Credits are handled in a similar way as credit card points, you can use them as a digital currency with companies TravelBank has partnered with, but you won’t be able to get cash deposited in your bank account or purchase a physical gift card.

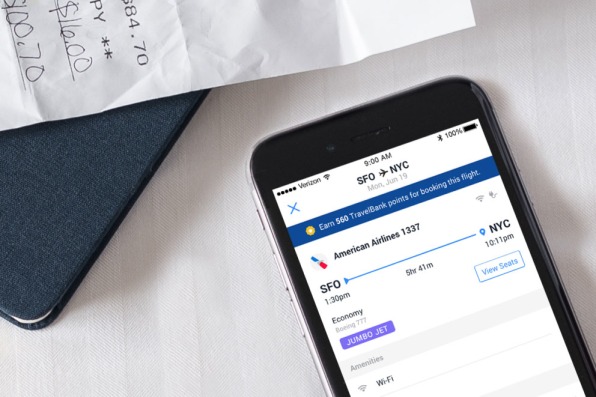

There are also some perks when it comes to booking those flights and hotels. Flights can be booked directly within the TravelBank app. The company has negotiated rates with airlines, so often what you see will be cheaper than pricing on sites like Expedia of Kayak. Those discounts are in part thanks to what Chung learned while working as an employee at Microsoft. He says while there he was astounded at what huge discounts airlines were giving to the company based on the volume of travel it was doing. By pooling together business travel efforts for a number of companies, TravelBank hopes to offer those deep discounts to smaller businesses as well.

Beyond booking, the app also offers a “Social Seating” feature where employees can see what flights, and even seats, their coworkers have chosen for a trip, and opt to book on the same plane (or not) accordingly.

All these are features geared specifically toward capturing millennial travelers. They believe that younger business travelers want to do things like stay in an Airbnb rather than a hotel or splurge on a fancy meal in a new town at the expense of a few cab rides. That millennial focus is something Chung says made it easier to get partnerships with airlines.

“Once you lose a generation of customers, it’s really hard to rebrand for the next generation, so it’s sort of a race to get to the cooler, hipper business traveler—and then the airlines get the benefit of keeping them as a customer for many decades,” he says. “Our ability to reach that younger traveler at scale was actually what was most appealing about us to these airlines.”

But what about the businesses that are paying for all this travel? With TravelBank a business would be responsible for paying for those credits its employees get for savings. So while that trip might have only cost $2,400 rather than the budgeted $3,000, the business still has to pay $2,700. While still a net positive for the business, paying for high-dollar rewards might be deterrent for some. And of course, if your employees are constantly coming under budget by hundreds or thousands, that might ultimately lead to smaller budgets, not larger employee rewards.

Chung, however, sees it as a win-win for everyone. Only in business for a few months now, the company has already signed on a number of tech companies Lean Data and WeddingWire, and has aspirations of bringing on some much larger companies soon.

Would you stay in a cheaper hotel to get some Airbnb credit? This app is betting millennial business travelers will.

There is one thing that’s the same no matter the size of the organization. From small three-person businesses to multinational corporations, employees are required to stay within travel budgets, adhere to company travel policies, and to file expense reports. Most employees likely find the process tedious.

Fast Company , Read Full Story

(26)