This Women-Led VC Fund Wants To Show The Valley What Real Gender Equality Looks Like

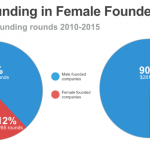

If there’s one thing we’ve been reminded of over the past few months in Silicon Valley, it is that chipping away at sexism depends on addressing the issue of diversity. What women entrepreneurs really need is more female investors—not a proliferation of tepid apologies on Medium.

Enter XFactor Ventures, a pre-seed and seed stage fund launching today that seeks to invest $3 million into 30 female-led companies over the next couple of years. The Boston-based VC firm Flybridge Capital Partners is sponsoring XFactor and has invested 20% of the fund’s capital.

This is by no means the first investment fund catering to early-stage startups helmed by women: Organizations like Female Founders Fund and BBG Ventures also offer early-stage funding exclusively to companies with at least one female founder; other firms like Forerunner Ventures and Rivet Ventures are female-run, and the latter focuses on investing in startups for female consumers.

What sets XFactor apart is that its investment team is itself comprised of women who are already VC-funded entrepreneurs in their own right. And as such, the fund is moving the needle with respect to female representation on both the investor side and founder side.

“The biggest differentiation for XFactor is the fact that the investment team is all sitting CEOs or founders looking to bring all their skills and expertise to the companies that we get involved with,” Chip Hazard, Flybridge general partner and XFactor investing partner, tells Fast Company. “Regardless of gender, I can’t name a single fund that has nine existing operators as the investment team.”

That team, which includes The Muse CEO Kathryn Minshew and Mattermark CEO Danielle Morrill, is spread out across New York, San Francisco, and Boston and is fairly diverse in terms of industry and background. In total, the nine entrepreneurs managing XFactor have cumulatively raised more than $150 million in capital for their respective startups. (The other two investing partners are Hazard and Flybridge marketing partner Kate Castle.)

Unlike the scout program at Sequoia Capital, which quietly doles out money to individual entrepreneurs to invest as they wish, XFactor requires far more collaboration and agreement among the team, according to Hazard. “While each individual partner has the power to be able to invest behind their conviction . . . they also have to report back to their peers as to why they think that’s an interesting investment opportunity, and articulate what gets them excited about a particular company and founder,” he says.

Of course a major goal is to “generate phenomenal returns,” as Hazard says—in part to prove that XFactor need not reduce expectations when funding women.

“I think the whole fund is really passionate about the idea that gender-diverse teams, specifically, can outperform the rest,” says Bow & Drape CEO Aubrie Pagano, one of the entrepreneurs on XFactor’s team.

And that applies to investors, too. “One of my first meetings with [fellow XFactor team member] Anna Palmer and Chip, we were laughing because we were saying one of the great things about this fund is that no potential company is going to have to hear from us, ‘Let me talk to my wife about your idea,’” says Pagano.

XFactor Ventures, which launches today, has recruited nine female founders and CEOs to invest $ 3 million in 30 female-led companies.

If there’s one thing we’ve been reminded of over the past few months in Silicon Valley, it is that chipping away at sexism depends on addressing the issue of diversity. What women entrepreneurs really need is more female investors—not a proliferation of tepid apologies on Medium.

Fast Company , Read Full Story

(16)