Uber Launches excessive-Tech insurance device For UberX Drivers

Uber is hoping that UberX drivers will plug in—literally—to a new insurance policy.

January 28, 2015

In a transfer that’s sure to have repercussions for Uber’s ongoing war with regulators and the taxi business, the experience-sharing massive is rolling out specialized insurance coverage for UberX drivers. Uber and Metromile, an insurance firm that produces a special “good dongle” for cars that tracks mileage, made the announcement in San Francisco on Wednesday. the brand new insurance product will be available in California, Illinois, and Washington state within the coming months.

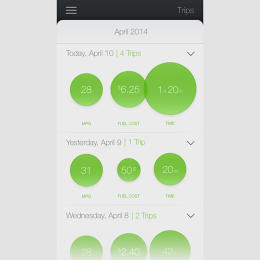

Metromile’s trip-sharing insurance coverage product, which is offered at the side of Uber, works on a variable pricing plan. It covers drivers for Uber from the time they settle for a trip request from a consumer to the time a purchaser exits the auto. The product, in an effort to charge drivers for the selection of miles they pressure in their nonwork time on top of a flat price, offers each private insurance coverage and insurance for his or her function as a experience-share driver.

Drivers shall be charged per mile and shall be coated handiest beneath their non-public insurance policies, on the other hand, as they power round looking for fares. Metromile’s dongle, which plugs in underneath the dashboard, uses Uber’s API to distinguish between when a driver is “on the job” or using their car for private or ride-seeking use.

Dan Preston, Metromile’s CEO, informed fast firm that the insurance coverage product would swap from charging drivers by means of the mile to flat protection for his or her function as UberX drivers once brought about by Uber’s app. “From the purpose the place an Uber driver accepts the ride, they’re now not being billed thru Metromile. They’re being billed thru Uber,” he added.

the decision to supply drivers specialized policies tailor-made in opposition to section-time journey sharing takes care of one of the vital vexing complaints that has adopted Uber, Lyft, and Sidecar: That drivers are underinsured, and that the personal insurance many section-time drivers depend on doesn’t provide protection when they’re on the clock. In anti-ridesharing promotional subject matter aimed at the public, taxi business exchange associations have been attacking Uber on the insurance entrance with frequency.

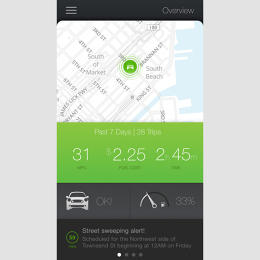

in line with Metromile, the insurance coverage will work on a pay-per-mile adaptation for Uber drivers, and will function as a private insurance coverage product with a view to additionally duvet drivers as they work for Uber. In San Francisco and Chicago, customers will even obtain push alerts to assist them keep away from alternate facet parking tickets. beyond solving insurance coverage concerns for some drivers, the Metromile/Uber partnership has a secondary advantage: Locking part-time drivers even further into Uber’s ecosystem. The journey-sharing firm bargains everything from loans to buy new vehicles to partnerships with Spotify that allow riders to regulate the tune in drivers’ automobiles.

San Francisco-based totally Metromile, which used to be founded in 2011, is a uniqueness car insurance supplier whose trade adaptation revolves round their plug-in dongle for automotive OBD-II ports. In alternate for giving their insurance coverage company a gradual information circulate of their using activity and the place they are always, drivers receive steeply discounted insurance costs. An app displays users Fitbit-fashion insights about their riding habits and analytics of their lifestyles on the highway; the corporate’s flagship product is a pay-per-mile insurance product aimed at irregular city drivers.

users shall be able to join a waiting list for the insurance policies beginning January 28, and enrollment will open in February. Metromile says they have been working on insurance coverage for Uber drivers for approximately three hundred and sixty five days.

(151)