What Trump Might Mean For The Economy

What will Donald Trump’s victory mean for the economy, businesses, and financial markets? The Conversation asked four of its regular economic writers to weigh in.

Healing The Divide

Christos Makridis, PhD candidate in labor and public economics, Stanford University

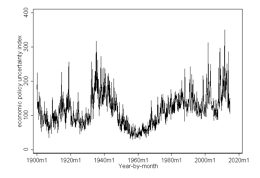

In the past few months, economic policy uncertainty has been higher than it has been in the country’s history, marginally surpassing the uncertainty associated with the Great Recession, September 11, 2001, and even the Great Depression. The United States faces a number of fundamental challenges: entitlement reform, health care, economic growth, race relations, geopolitical instability in the Middle East and Russia, and environmental degradation just to name a few.

Trump’s ascendancy to the presidency fundamentally disrupts the business-as-usual tradition in Washington. While there is concern, there is also significant opportunity for genuine and long-lasting improvement, and in a bipartisan way. Motivated by the remarks in his victory speech, Trump should continue to provide an olive branch to Democrats for cooperation.

How is this done in an authentic way? Ask the other side for the top three issues that are most important to them and develop a meeting point that compromises on style but not principles. For example, while conservatives believe less regulation tends to be better than more, both parties can agree that small businesses are an important component of the economy and the government could do more to facilitate their creation and ongoing operations.

Perhaps the most salient issue that draws both sides of the aisle together is the decline of the middle class. What can the government do to help millions of people whose jobs are not experiencing wage increases or are being outsourced? The solution, in my view, is not to simply tax and transfer wealth, nor is it to stop trading with other countries.

In the first 100 days, Trump has the opportunity to craft a bipartisan plan that engages the private sector on ways to reach back out to millions of disenfranchised workers. One example of this is Skillful.com, a platform that Arizona State University is producing through the support of the Markle Foundation. The platform provides individuals with the tools and information to not only connect with jobs that are potentially more aligned with their skills but also retrain themselves with new skills, for example, by taking community college classes and pivoting into a new career. Trump can encourage these types of initiatives directly by subsidizing human capital investments and indirectly by providing the authority behind the Office of the President.

While there are many issues that divide conservatives and liberals, this president has a unique opportunity to begin with a set of bipartisan issues that begin the healing process for the country and pave the way for continued innovation.

An Era Of Uncertainty

Steven Pressman, professor of economics, Colorado State University

The unexpected has happened. Next year the U.S. government will be controlled by Donald Trump and a Republican Party divided between blue-collar Trump supporters and business interests. What happens next will depend on how these two factions wield the power they have been handed by the American people.

The Trump campaign has been famously short on specifics and the few it has provided have more downsides than upsides. This raises the specter of market declines, less business investment, and slower economic growth—and more uncertainty.

Nonetheless, three likely priorities stand out for the new administration. Certainly near the top would be repealing Obamacare. It is also a prime objective for many Republicans. What is not clear is what will happen to the tens of millions of Americans who lose their health insurance if Obamacare is repealed.

Second, candidate Trump touted huge tax cuts. The Citizens for Tax Justice estimated that 44% of his cuts would go to the richest 1% of Americans (those making more than $500,000 a year) and the national debt would rise by $12 trillion over the next 10 years. We know from the Bush tax cuts of 2001, and from economic analysis, that tax cuts for the wealthy, which the government then borrows to pay for, do not generate prosperity—they only lead to greater government debt.

As such, the new government will have to deal with a U.S. debt ceiling that will be reached sometime in March. Republicans could increase it, but they have traditionally opposed greater debt. More likely, they will severely slash social spending, which will harm both the economy and the individuals (many Trump supporters) who depended on these expenditures.

Last, but not least, we come to trade and Trump’s trademark policy—the wall. Few believe Trump can get Mexico to pay for the wall directly. Mexico could pay for it indirectly if we place tariffs on their goods coming into the U.S. Building the wall will create jobs, but how do we go about paying for the wall while we build it? And what impact will tariffs have on inflation in the U.S.?

The tax cuts, debt problems, and higher inflation all portend higher interest rates in the U.S. The fact that candidate Trump had suggested renegotiating the U.S. debt will only add further upward pressure on rates.

And all this ignores what many people believe is the main problem facing the U.S. economy: rising inequality. Nothing that Trump has said indicates he is aware of this problem or has any ideas for dealing with it. We seem to be headed for a hard four-year ride.

Stocks And The “Presidential Puzzle”

Jay Zagorsky, economist and research scientist, Ohio State University

Research into a phenomenon known as the “presidential puzzle” has shown that the stock market performs better under Democrats than Republican presidents.

Does that mean it’s time to sell all of your investments now that Donald Trump has won?

This reaction by the stock market is puzzling since Republicans are typically viewed as more business friendly than Democrats. Republican candidates typically call for lower taxes and less regulation, which should be great news for corporate bottom lines and their shareholders.

How much is the difference? Since 1900, the Dow Jones Industrial Average has gone up about 3% in the average year under a Republican president and about 7% a year under a Democratic one. Money growing at 3% a year doubles in roughly 23 years, while money growing at 7% doubles in roughly 10 years, a sizable difference.

What explains the puzzle? Numerous researchers have suggested differences such as higher inflation, greater rewards for taking risks, and increased government spending under Democratic presidents among many factors as the answer.

In other words, many of the answers implicitly assume that Democratic presidents spend more than Republicans, which boosts the economy. Nevertheless, research published a few months ago suggests there will be probably never be agreement on the cause because “the presidential puzzle remains a popular and recurring subject of discussion . . . and any conclusion on this topic will undoubtedly bring out a flurry of passionate political reactions.”

Regardless of the right explanation, if one even exists, followers of the presidential puzzle believe now is a good time to sell. As for me, I will be waiting until the next administration starts offering concrete proposals before making any major new financial decisions.

Trump’s Legislative Agenda

Donald Grimes, senior research associate, Institute for Research on Labor, Employment, and the Economy at the University of Michigan

Donald Trump won the presidential election and the Republicans won the congressional race, leaving them in control of the House and Senate. That means Republicans’ ability to pass domestic legislation will only be limited by Democrat filibusters in the Senate.

But given that they just lost an election that most people thought they would win and that they will be defending 25 Senate seats in two years, I don’t expect them to be that defiant.

The areas where Congress will act on President Trump’s agenda include tax cuts, infrastructure spending, immigration, defense spending, and health insurance.

Since deficit hawks fear that the proposed tax cuts will explode the federal deficit, we’ll likely see a smaller tax cut than the one proposed during the campaign. It’ll probably be similar to the House Republican tax plan, which on a static basis would cost about $2.4 trillion over 10 years.

But with defense spending and infrastructure spending also likely to increase under his plans, the deficit will have to go up, although not as much as it would have been if the full Trump tax cut agenda were adopted.

The greatest risk to the economy, however, is if President Trump starts a trade war by unilaterally imposing tariffs on products imported from other countries. Hopefully cooler heads will prevail.

Necessity and politics will also force action on Obamacare (the Affordable Care Act). Despite the rhetoric I don’t think President Trump will actually kill the program entirely, but the individual insurance market portion of the ACA, better known as the “exchanges,” is failing financially. Too few healthy adults are buying insurance, causing the insurance companies, many of which are not-for-profit entities, to lose money on the exchange market and back out.

So something will need to be done. I am not certain what. This will be the most intellectually interesting part of Trump’s agenda to watch.

This story originally appeared at The Conversation.

Fast Company , Read Full Story

(40)