When Prude Investors Cockblock Sex Tech, No One Gets Off

Cindy Gallop had just purchased a sex toy.

“I opened this box, looked at this beautiful object, and found myself thinking, ‘How the fuck do you use this thing?’” she recalls. “So I think to myself, ‘There’ll be instructions inside,’ but all I find is this one-pager that tells you how to charge it. Nothing about what goes where.”

Officially, anyway, Gallop has been in the business of showing people “what goes where” since launching Make Love Not Porn, a user-generated adult video platform, in August 2012. But many people first heard about the venture in 2009, when Gallop gave a popular TED Talk challenging what she still sees as the porn industry’s warped and often misogynistic ideas about sex and sexuality.

Since then, however, Gallop has had trouble attracting investors, and she isn’t alone. The “sex tech” sector may in fact hold enormous untapped potential, but investors—mostly white straight male investors—appear to be keeping their distance.

Sex Sells . . . Sort Of

In a world where over 36% of internet content is pornography and where people collectively watch 4 billion hours of porn every year, our sex obsession is matched only by our inability to talk about it openly, Gallop argues.

After unboxing her new sex toy and finding no instructions, she recalls turning to YouTube, where she eventually stumbled on one explanatory video featuring a woman holding the device and demurely telling her how to use it. “I’m listening to her and going, ‘What?’” Gallop says. “‘So you put that inside and then the guy puts in his cock as well? How the fuck does that work?’” She adds, “You simply can’t overestimate how our unwillingness to talk about sex impacts the ability of every manufacturer out there to shift their product.”

Still, sex does sell. In the U.S. alone, adult sites generate over $3 billion in revenue a year, according to the research firm IBISWorld. Reliable figures aren’t easy to come by, but the global sex toy industry has been estimated at some $15 billion and is growing at more than 30% a year, potentially outpacing high-growth tech sectors like drone manufacturing, which is expected to hit $12 billion by 2021. Amazon currently stocks over 60,000 items classed as “adult.”

But Gallop believes the commercial opportunity is bigger than even these figures suggest, and in any other industry it isn’t hard to imagine investors flocking to an entrepreneur with her credentials. After over 20 years as an advertising exec, Gallop resigned as chairman of Bartle Bogle Hegarty to start two companies of her own and advise several more. Since going solo in 2005, she’s continued to work as a consultant, cementing her position as a go-to branding guru.

“Many VC friends of mine tell me that what I’m doing could be huge,” she claims, “but if they took it through the official channels, their partners would say, ‘What are you on?’ As a sex tech venture, I can’t even get across the threshold to pitch most of the time. Either investors don’t take you seriously, or they don’t even want to have the conversation because it makes them so uncomfortable.”

So Gallop bootstrapped Make Love Not Porn with her own savings and support from a single angel investor, then built a bare-bones platform. In the four years since launching, it’s signed up more than 400,000 users and successfully monetized their content—the site’s pay-per-view model splits revenue equally between the site and the creators—to the point where Gallop says many top users get regular four-figure payouts.

That profit-sharing model differs sharply from the porn industry’s typical practice of paying performers by the scene (one porn exec I spoke to said that figure usually caps out at around $2,000 for newbies and major stars alike). Gallop wants her platform to open up more new avenues for monetizing user-generated content, and to expand most people’s ideas about sex in the process.

The Travails Of Running A Taboo Business

For that to happen, investors will need to open their wallets as well as their mouths, both of which seem pretty firmly shut at the moment.

Many VC firms have “morality clauses” preventing them from investing in anything considered adult content. After contacting dozens of tech investors, including the top 20 VC firms as ranked by CB Insights, the only one willing speak on record was Tim Draper, who’s backed emerging sectors like bitcoin and one venture, Jimmyjane, that sells high-end sex toys.

But the most Draper felt comfortable sharing was that he “backs great entrepreneurs who are bold enough to take on the status quo and potentially transform an industry.” To do that, though, those would-be disruptors will need more and better data, and Forrester Research doesn’t even track the major industries that might fall under the sex tech umbrella, like sex toys or VR porn.

There’s more to the problem than just reticence and lack of information, though. Some entrepreneurs say they’ve been outright blocked from operating. E-commerce heavyweights like Amazon and PayPal won’t touch companies dealing with adult content. Both turned Gallop away. As she recalled in a 2014 Medium post, she “couldn’t find a single bank in America that would let me open a business bank account for a business that has the word ‘porn’ in its name.”

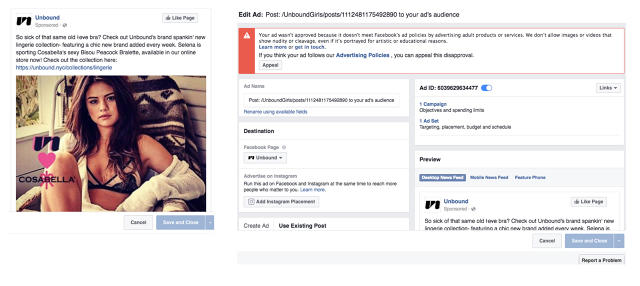

Facebook and Pinterest take a similar tack. Polly Rodriguez, CEO of Unbound, a lingerie and sex toy retailer, has found it difficult to market on either platform. “You can’t promote sex toys, videos, publications, live shows, sexual enhancement products, or services that provide casual sex, international matchmaking, or escorts,” Pinterest warns advertisers.

Facebook’s policy is to disallow the promotion of “adult products or services (except for ads for family planning and contraception).” Even this lingerie ad fell afoul of that rule because Unbound’s landing page also markets lubricants and sex toys aimed at millennial women:

Who Do You Have To Screw Around Here To Get Funded?

“Funding is difficult in our space,” concedes Ian Paul, CIO of Naughty America, one of the first porn companies to get into VR content. “We’ve had to rely on nontraditional methods of funding, like securing loans from vendors who already work with us.” That’s meant the company has had to pump profits back into its own R&D rather than investing elsewhere. Entrepreneurs who can’t self-fund or find like-minded angel investors often face a choice between playing into the narrow, damaging tropes Cindy Gallop railed against back in 2009, or else risk being labeled as “alternative” and commercially unviable.

Take Dutch “teledildonics” company Kiiroo. Its mobile-connected dildos and vibrators allow for long-distance interaction and incorporate social elements, two-way haptic feedback, and modular flexibility—all in real-time. That means you can mix and match your devices to your heart’s (or chosen orifices’) content, no matter the types or number of bodies you like to play with. Yet Kiiroo markets itself like any traditional sex toy: Its packaging tends to feature young, slim, busty women in stockings and suspenders. (Kiiroo is “selling an experience to our users,” says communications manager Ashton Egner, so despite being a self-avowed tech company, “talking about the details of how the products work is not what our customers want.”)

“Body technologies” researcher Ghislaine Boddington says Kiiroo’s case is typical; even the most innovative sex tech companies find themselves pushed “toward that objectification side” of things to get funded. According to Boddington’s research, 96% of VCs are men, and only about 8% of their money goes to companies cofounded by women. Women entrepreneurs in particular, Boddington says, are innovating on the margins of adult industries, like mindfulness and well-being, but those products’ crossover potential—as tools for enhancing erotic experience—isn’t being tapped. “One investor said to me, ‘Give us 10 years, Ghislaine, and we’ll get there, but at the moment it’s not going to bring a return for us.’”

One exception to this picture is Crave, which raised $2.4 million from no fewer than 60 angel investors. Founder Michael Topolovac says the investment community was actually open-minded to Crave’s pitch, which was geared to creating upscale, tech-savvy sex products aimed at the female market.

It was still tough going, Topolovac says. He and his business partners had to take a unique approach, wooing angel investors on one hand while doubling down on crowdfunding on the other. The company ultimately got booted from Kickstarter anyway, since the platform prohibits “pornographic material.” But as equity crowdfunding sites like CrowdCube and others gain traction, hybrid investment models like Crave’s may help otherwise anathema startups validate their business propositions early enough to attract investors more easily. John McCoy, CEO of teledidonics startup Intimuse, thinks VCs will eventually come around, and that “the only question is who will be first to seize that opportunity.”

If he’s right, there may not be just one tipping point but several. As technology advances, demand rises for sex tech products and services (especially from women), and a slow drip of successful companies show investors what’s possible, VCs may no longer be able to ignore an opportunity so large. Greater gender diversity in the investor community couldn’t hurt either, of course, but that unfortunately may be a more distant prospect by comparison.

In the meantime, obstacles like these are still fueling Cindy Gallop’s determination. Make Love Not Porn finally located a friendly a crowdfunding platform in iFundWomen (which just launched in beta this month and is geared toward women entrepreneurs) and is now kicking off its first-ever crowdfunding campaign. Gallop is also at work on an investment fund that she hopes will do for sex tech what Privateer Holdings did for cannabis, an industry that went from taboo to investment darling in just a few years. Gallop has upped her original funding target to $10 million, which she reckons is enough to finance not only Make Love Not Porn but to kick-start the entire sector.

If it works, not only might the world of sexual pleasure soon be better funded, more creative, and higher-tech than at present, it may also better resemble the world overall. For Gallop and plenty of others, that’s a pretty sexy idea.

Alice Bonasio runs the Tech Trends blog and contributes to Ars Technica, Quartz, Newsweek, The Next Web, and others. She is also writing VRgins, a book about sex and relationships in the virtual age. She lives in the U.K.

Fast Company , Read Full Story

(25)