Why Capital One’s First Messenger Bot Skipped Facebook In Favor Of Texting

A strange thing happens when Capital One sends out automated fraud alerts via SMS. A significant number of customers seem to believe the sender is human, and begin responding with natural language.

“We kind of launched a chatbot and didn’t know it,” says Ken Dodelin, Capital One’s vice president of digital product development.

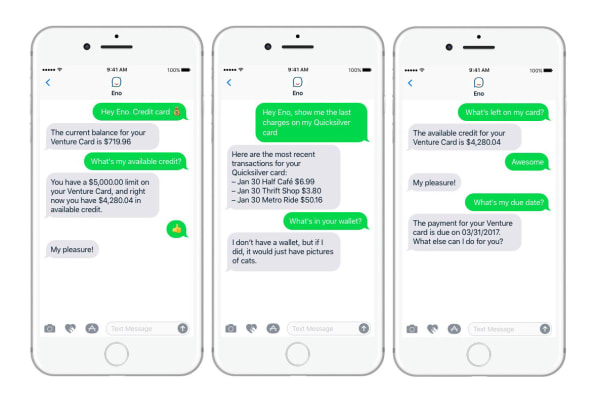

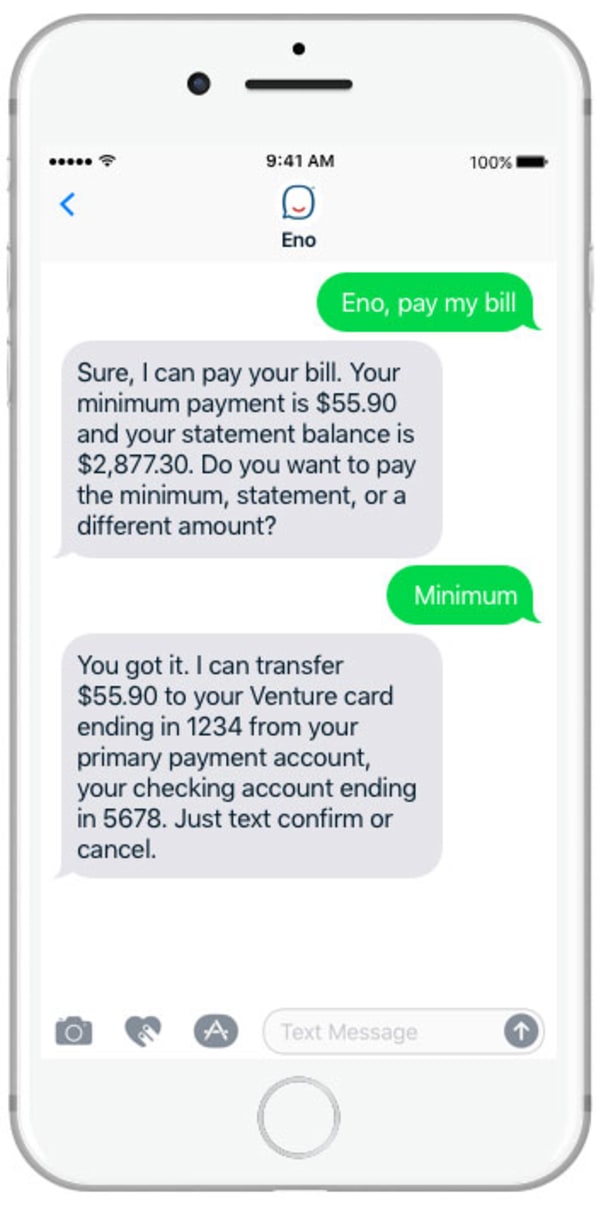

That behavior helps explain why Capital One is feeling confident in the actual chatbot that the bank is launching this week in a pilot test. Dubbed Eno–that’s “One” spelled backwards–it’s the first text-based chatbot from a U.S. bank. It’ll allow users to check their balances and recent payments, look up their checking account’s routing number, and transfer money between accounts. For more complex tasks, Eno will direct users to the appropriate section of Capital One’s website when possible.

But instead of launching Eno through an app like Facebook Messenger or Skype, Capital One is sticking with plain old SMS. While Dodelin says the goal with text messaging was to reach the largest possible audience with the least amount of friction, forgoing Facebook could also help protect banking customers’ privacy.

No App Necessary

To explain why Capital One is launching an SMS chatbot, Dodelin claims that 97% of smartphone owners regularly use text messaging. (He’s likely referring to a 2015 Pew Research Center survey that found texting was the most popular smartphone feature.)

“We want to go where the people are,” Dodelin says.

Text messaging also presents less friction for people who don’t have Facebook Messenger or other chat apps installed. During the pilot, Capital One will give certain users the chance to try Eno after they’ve logged into the bank’s mobile website. But over time, Dodelin imagines referring people to the SMS short code for Eno after they’ve texted the bank about other things, such as fraud alerts.

Sandeep Chivukula, cofounder of chatbot analytics firm Bot Metrics, has another theory for why Capital One–and all other U.S. banks, for that matter–have avoided Facebook: The way the platform works could conflict with privacy laws for U.S. financial institutions, which require a clear record of how personal information gets accessed.

When a brand offers a Facebook Messenger bot, any Facebook Page administrator can view full transcripts of the bot’s conversations, along with basic profile information for users who’ve interacted with the bots. While this does allow human representatives to step in when a bot conversation derails, it could expose personal data to the bank’s marketing team or other employees who aren’t supposed to have access, Chivukula says.

“That’s not to say you can’t have a banking chatbot on Facebook, but it just limits the kind of things you can do,” Chivukula says. So while a bot that provided generic information about fees and mortgage rates would be fine, a bot for checking your account balance could be troublesome.

“Now, you’re talking about personally identifiable information, because to get you your balance, I would have to verify that you are who you are, and then you start getting near the gray zone,” Chivukula says.

Capital One’s Dodelin, for his part, won’t comment directly on whether privacy was a factor in choosing text messaging for Eno.

“SMS is the most widely used smartphone feature, with no need to download or even open an app to use the service–simply text and get the information you need,” he says. “As we broaden access through third-party platforms, we will work to ensure the flow of customer information is protected, transparent, and under the customer’s control.”

Bye-Bye, Buttons

Opting for SMS isn’t without its sacrifices. Platforms such as Facebook, for instance, can offer interactive carousels, buttons, and quick-reply prompts that help guide users through a conversation. Dashbot, another chatbot metrics firm, has found that when chatbots include these buttons–in moderation, at least–users spend more time interacting and send more messages.

The flip side, according to Dodelin, is that by focusing on SMS first, Capital One can improve its natural language processing in ways it might not have if the bank had relied on buttons and quick replies at the outset.

“We feel like we have a very portable product now that can go lots of different places,” he says.

Either way, Capital One expects to get a better sense of what people actually want to do with a banking bot once Eno goes live. That wasn’t so much the case last year, when the bank launched a skill for Alexa, the spoken-word virtual assistant behind Amazon’s Echo speaker. Though Dodelin says he’s pleased with the feedback from Echo users, he notes that Amazon only shares data on specific capabilities that users activate. If users ask for something that the skill doesn’t support–for instance, information about a home mortgage–Capital One never learns about that request.

“What’s neat here for us is that we get the raw text from the user,” Dodelin says. “You can imagine there’s a lot of learnings that can be applied when you’re seeing exactly what the customer asks, and you can build your product around that.”

That knowledge could prove important as chatbots evolve. While the hype around messenger bots seems to have deflated in recent months, Bot Metrics’ Sandeep Chivukula sees great potential, especially in banking. After establishing the basics, such as account transfers and balance checks, he imagines banking bots that help people avoid impending overdrafts by offering a quick transfer from savings to checking. From there, it’s not a huge leap to envision a bot that can move more money into savings based on spending habits.

“The bank can’t write individual rules for each customer, because that’s just not efficient or effective,” Chivukula says, “but an AI could do that, and then leverage the infrastructure that was created [earlier] to deliver that information to the customer.”

Fast Company , Read Full Story

(129)