Why The Runaway Success of “Pokémon Go” Says Little About Nintendo’s Future

In the minds of some industry analysts, Pokémon Go is the start of a major transformation at Nintendo.

The game’s overnight success, they say, is just a taste of the potential rewards if Nintendo fully commits itself to making mobile games. Just imagine, they say, how well the company would do to bring other franchises like Mario and Zelda to iPhones and Android devices. Nintendo’s stock prices have soared in anticipation.

But upon closer inspection, the narrative doesn’t hold up. Nintendo still faces major challenges in mobile gaming, and Pokémon Go barely begins to address them. In this brutal business, the weight of expectation from Pokémon Go may even do more harm than good.

Here’s why Nintendo’s success in mobile is far from certain:

Nintendo Is Still Starved For Mobile Experience

Here’s a fact that many analysts have glossed over: Nintendo didn’t make Pokémon Go. The primary developer is Niantic Labs, a former Google company, and the game is largely based on Niantic’s previous creation, Ingress. (As Kyle Orland at Ars Technica points out, during the Pokémon Go announcement in September, Nintendo’s Shigeru Miyamoto didn’t speak much about the game itself, and instead focused on Pokémon Go Plus, a wearable device—still unreleased—that will alert players to nearby Pokémon.)

Niantic is the game’s publisher as well, while the Pokémon Company markets and licenses the franchise. Nintendo is a one-third stakeholder in Pokémon Company, and is also an investor in Niantic Labs, so it’s fair to say that on some level, Nintendo helped bring Pokémon Go to life. Still, this situation is nothing like Nintendo’s console experience, where it serves as the main developer and sole publisher of its own franchises.

For Nintendo, understanding the mobile games business will be a lengthy process, which is why the company has enlisted DeNA, a Japanese mobile gaming firm, as a long-term collaborator. Together—in a separate effort from Pokémon Go—they’re developing and operating games based on Nintendo franchises, including Animal Crossing and Fire Emblem. (Their first creation, a social app called Miitomo, got off to a hot start and then faded away.)

Among the things Nintendo will have to figure out: how to bring its unique design talents to a completely different audience, how to sell substantial gaming experiences through free-to-play business models, and how to operate online games at a larger scale than anything it has offered before. Nintendo’s vague involvement in Pokémon Go isn’t a magic shortcut.

Mobile Mega-Hits Are A Volatile Business

Let’s assume for a moment that Nintendo has, in fact, achieved mobile gaming enlightenment through Pokémon Go. If that’s the case, then the company must also understand the hostile environment it’s stepping into. Making a smash-hit mobile game is hard, but parlaying it into a sustainable business is even harder.

Rovio, for instance, built an entire business around Angry Birds, continually betting on its hit franchise instead of putting effort behind new ones. As Angry Birds lost its luster, the company has struggled mightily, with falling revenues and mass layoffs. A long-awaited initial public offering never came.

OMGPop is another cautionary tale, reaching 50 million users with Draw Something and never achieving the same heights with later games. Zynga bought the company for $180 million in 2012, and shut down the studio in 2013.

Even mobile gaming’s high-profile successes aren’t always surefooted. King Digital Entertainment managed to ride the Candy Crush Saga franchise to strong annual revenues and an initial public offering. But by the time Activision agreed to acquire the company last year, revenues and active users were slipping, and Candy Crush still made up 40% of gross bookings.

And what about game makers whose riches are tied to recognizable names? Just look to Glu Mobile, which generated $74 million in revenue from Kim Kardashian: Hollywood in 2014. Successive celebrity tie-ins haven’t generated the same excitement or revenues, and Glu’s share price is now the lowest it’s been since 2013.

Finally, there’s Minecraft, a game whose rousing success on PC allowed it to become an even bigger hit on mobile devices. The rise of developer Mojang seems like a modern fairly tale, but the studio struggled creatively to move beyond Minecraft, and is now just a feather in Microsoft’s cap with no other franchises under its belt. That’s hardly the outcome Nintendo wants.

Most Nintendo Franchises Can’t Touch Pokémon

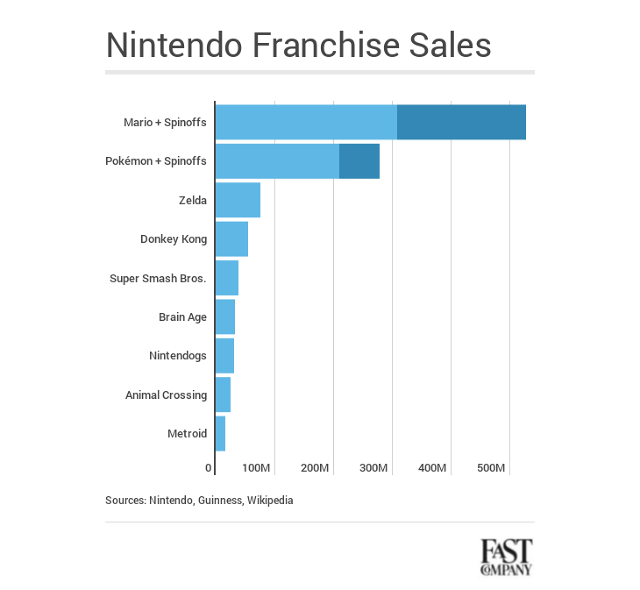

One might argue that with Nintendo, the pitfalls of mobile gaming don’t apply because the company has so many popular franchises already. But a look at Nintendo’s franchise sales figures tells a different story: Compared to Pokémon and Mario, nothing else comes close.

Over its lifetime, Pokémon has enjoyed 210 million unit sales, or 279 million including spin-offs. Only Mario has done better, with 310 million lifetime game sales, or 529 million including spin-offs. Zelda, in third place, has seen far fewer sales of 76 million over its lifetime, and the list quickly tapers off after that.

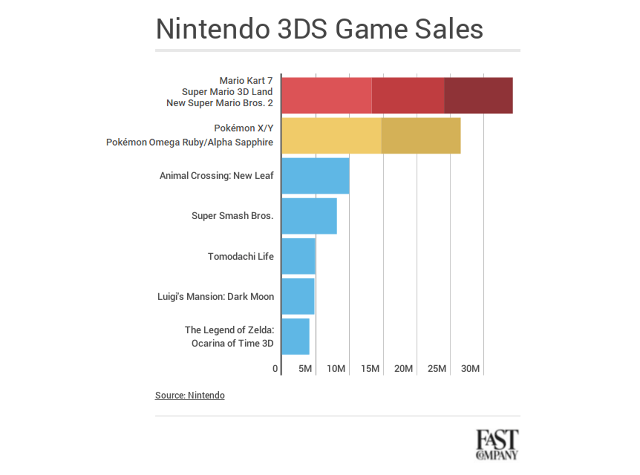

Even if we only look at recent history, Pokémon represents the first and third best-selling games on Nintendo 3DS. Mario games occupy second, fourth, and fifth places. Only Animal Crossing and Smash Bros. games are near the same ballpark.

That’s not to say Nintendo can’t achieve modest success in mobile with its stable of franchises. But modest success isn’t what analysts are banking on after Pokémon Go; the company may now face pressure to produce similar hits before it’s even figured out its own strategy.

Nintendo Must Decide What Kind Of Company It Wants To Be

This last point is more philosophical: Does the essence of Nintendo lie in its design ethos, or in its intellectual property?

Former president and CEO Satoru Iwata clearly saw Nintendo as the former—”a company of Kyoto craftsman,” he told Time’s Matt Peckham last year, just a few months before dying of cancer. It’s worth noting that some of Nintendo’s greatest achievements in recent years—the commercial success of Wii Sports, the critical acclaim of Splatoon—are unrelated to its long-running franchises. Nintendo’s institutional creativity may still be its greatest asset.

On the other hand, we have Pokémon Go, a game whose strongest link to Nintendo involves ownership of intellectual property. It’s possible to imagine a scenario where placing Nintendo-owned characters into other developers’ games proves more lucrative than creating entirely new ones. Farfetched as this may seem, consider Nintendo’s partnership with DeNA: Is the end goal for Nintendo to learn how to create games on its own, or to bring even more outside parties into the fold?

With Pokémon Go, we have a sense of which direction analysts are looking for. It just might be at odds with what made Nintendo great in the first place.

Correction: The original version of this article said that the Pokémon Company, not Niantic, is the publisher of Pokémon Go.

Fast Company , Read Full Story

(30)