2017’s holiday e-commerce sales projected to grow 10% over last year’s holiday season

Retail search marketing firm, NetElixir, says e-commerce sales are increasing at a slower rate than previous holiday seasons.

Based on nine years of aggregate data from mid-sized and large online retailers, NetElixir forecasts this year’s holiday e-commerce sales will see a 10 percent year-over-year growth rate.

The retail search marketing agency’s projected 10 percent increase is a slight drop compared to last year’s growth rate of 11 percent.

In a news release announcing its 2017 Holiday Forecasts report, NetElixir listed three specific reasons holiday e-commerce growth is slowing down: Amazon’s growing user base along with Prime Day shopping; lower price-points online; and, a general drop in online sales as more retail stores close.

“This year, we have seen an overall sales slowdown and retail drop with more store closings,” claims NetElixir in its news release, “We compared this year’s revenues, orders and average order value (AOV) for our clients to last year’s. We saw a significant drop for all of these with revenues down ten percent, orders down nine percent and AOV down one percent.”

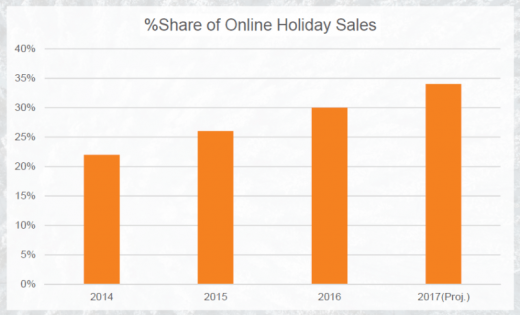

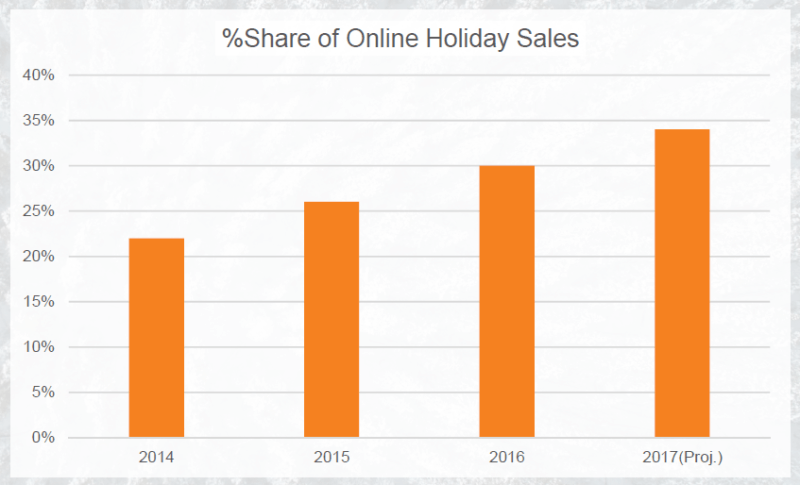

NetElixir also predicts Amazon’s share of holiday e-commerce sales will reach 34 percent, up from the 30 percent share it owned last year.

Amazon’s Share of Online Holiday Sales

NetElixir’s forecasts around Amazon are actually lower than reports we’ve previously covered from Slice Intelligence’s data. While NetElixir has Amazon’s market share of online sales at 30 percent during last year’s holiday season, Slice Intelligence reported Amazon owned a 38 percent share of the holiday sales market – and that it’s market share grew to 40.9 percent in Q1 of this year.

The difference in market share numbers can be attributed to each company’s report methodology. NetElixir’s forecasts are based on data sets pulled from their customer base of online retailers. Slice Intelligence collects its report data from a panel of more than five million online shoppers.

Either way – there’s no question that Amazon will own the biggest share of holiday e-commerce sales. NetElixir says Amazon’s take will equal $28.5 billion in holiday sales — up $5.5 billion from last year.

“With Amazon continuing to play a huge role in e-commerce consolidation, retailers need to prioritize e-commerce in order to stay competitive during the holiday shopping season,” says NetElixir CEO, Udayan Bose.

In addition online retail sales growth and Amazon market share, NetElixer also predicts a rise in mobile shopping during the holidays. The company estimates 35 percent of all online purchases will happen on smart phones.

Marketing Land – Internet Marketing News, Strategies & Tips

(36)