3 Fintech Firms and 1 Established Bank Leading the Way in Product Personalization

— November 18, 2016

Product personalisation is a growing and important trend in the world of financial services. This is driven by two key factors. The first is in big data. Through advances in data analytics platforms, banks are increasingly able to explore opportunities to tailor their products to individual customers. Secondly, developments in adjacent industries such as online shopping and streaming – think tailored recommendations from Amazon, Netflix and Asos – mean that consumers are increasingly demanding more personalised services.

A number of innovative players are taking advantage of this trend to offer product personalisation to their customers. In this post we will examine 3 of the best from fintech challengers Simple, Monzo and Loot as well as exploring the work that established bank, Bank of the West, is doing to lead the way in this field.

1. Simple

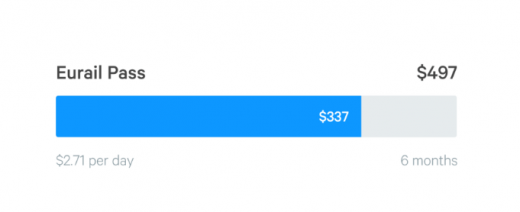

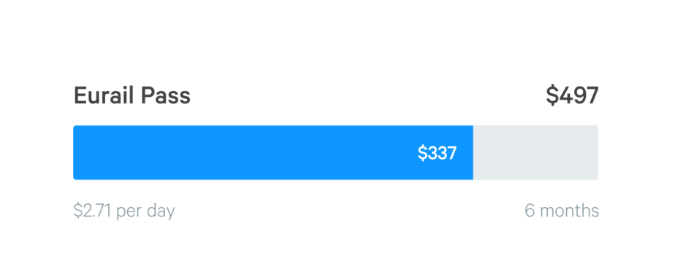

Launched in 2012, Simple offers an online-only banking service in the US. Simple’s mobile app features handy budgeting tools such as Goals. These give customers the opportunity to set money aside in labelled “envelopes”, which calculate how much you need to save each day or week to reach your target in the desired time period.

Customers that save using Goals are said to save twice as much as those who don’t. What’s more the bank claims that it has helped customers to save 10% of their yearly income on average, clearly demonstrating the service’s effectiveness. By automating the savings process, Simple limits the amount of work customers need to put in to organize their savings, achieving their goal of providing a ‘simple’, efficient and effective banking service.

2. Monzo

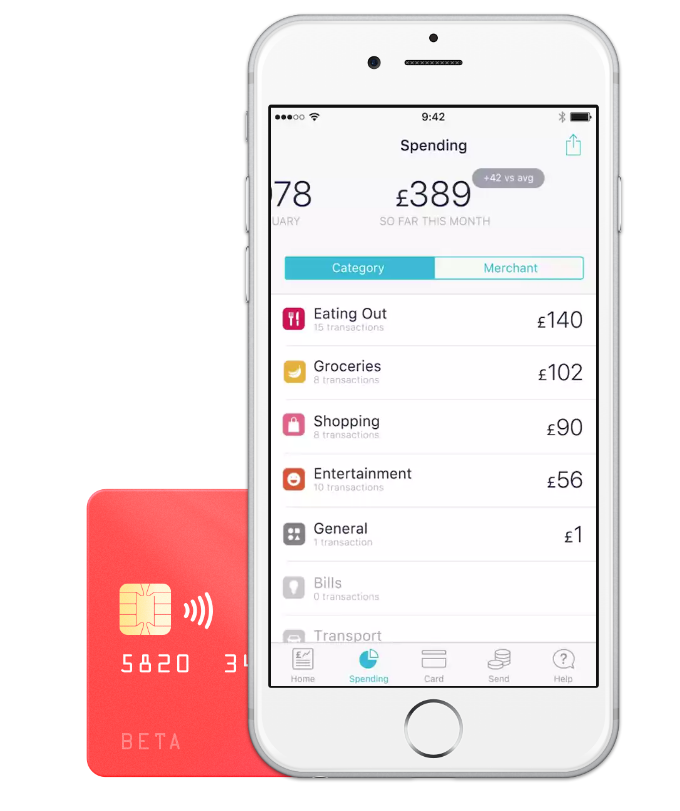

This UK based app-only bank earned the record for the ‘quickest crowdfunding campaign in history’ by reaching £1m in funding within just 96 seconds of launching its appeal on the crowd funding platform Crowdcube. Monzo provides current accounts and pre-paid cards, which allow the customer to track their transactions in real time.

The service categorises expenditure and provides an overview of the consumer’s spending habits. By clicking on the vendor icon, Monzo will provide you with information such as your number of visits to the store, your average and your total spend. This method of tracking helps customers to see where savings can be made.

There’s a lot of excitement surrounding this product, and beta testers are enthusiastic about the potential for sharing tracked data with retailers to create loyalty schemes. Monzo are taking full advantage of this and have taken the initiative to ask customers how they would like to be rewarded for loyalty.

3. Loot

Loot is another fintech firm leading the way in product personalisation. The brainchild of 23 year old Ollie Purdue, Loot hopes to bring a new banking experience to students.

By analysing and then empowering customers with the data it holds, Loot hopes to help its customers budget and manage their money whilst at university.

Like Monzo, Loot categorises the transactions you make so that you can break your spending down by type. What’s more, it allows you to see how you compare to other (anonymised) users so you can identify ways to save. The app also features a clever tool which predicts how much users can spend each day to get to the end of the month safely and provides tailored offers at different bars, shops and restaurants to help customers reduce their spend.

4. Bank of the West

Almost uniquely amongst big traditional banks, Bank of the West are ahead of the product personalisation curve with their innovative ‘relationship pricing’ program. Based on analysis of customer data, this offers loyal customers personalised rates on new products tailored to their individual saving or borrowing needs. This approach has allowed them to improve their customer service and customer loyalty and, thanks to their embrace of the kind of personalised service demanded by customers, they currently rank as the USA’s top bank for customer satisfaction

These developments from Simple, Monzo, Loot and Bank of the West are exciting. But what do they mean for traditional bank’s products and services? Simply put, changing customer expectations mean that traditional banks will have to start developing similar offerings to compete. Those that are able to stay ahead of the curve on product personalisation will be able to prosper in the near future as personalisation drives better customer service and an improved product offering for customers and greater loyalty and opportunities to sell additional products for banks.

Business & Finance Articles on Business 2 Community

(52)