Adblock Plus Is Going To Start Brokering Online Ad Sales

The number one company that makes money from blocking online ads is now looking to make money by brokering ad sales. Whether that’s hypocritical or evolved may depend on your feelings about internet advertising and your appetite for nuance. Germany’s Adblock Plus (ABP), by far the most popular ad-zapping software maker, said today it is joining with ComboTag, an Israeli ad-tech startup, to broker the sale of certain advertisements that target Adblock Plus users.

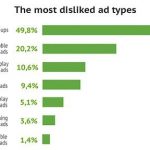

What makes this a service rather than a betrayal, say the companies, is that they will sell only “acceptable” ads that don’t bug people with things like pop-ups, animation, or covering over the web page content. In the process, publishers will have a chance to see some of that ad revenue they otherwise would not have seen, goes the sales pitch. “What it does is it opens up just strictly the ad-blocking market,” to online advertisers, says Ben Williams, a spokesman for Adblock Plus.

More than 90% of Adblock’s 100 million users already see commercial messages, says the company, but only those that meet its acceptable ad guidelines and have been placed on a whitelist that allows them through the software filter. (The default setting is to allow acceptable ads, but Adblock can be configured to block all ads.) Both advertisers and publishers pay to get ads reviewed and whitelisted. Adblock takes 30% of the extra revenue enabled by ads getting through the filter, only if more than 10 million new impressions get through per month. As a result, only the biggest websites pay the fees, says Adblock.

By forming an ad-brokering service with ComboTag, Adblock is streamlining the whitelisting process, says Williams. Launched in September 2015, ComboTag is a “supply side” service that lets web publishers sell space to advertisers. It had been more or less following the acceptable ad guidelines related to the style and position of ads. “We were without even being aware of it,” says ComboTag founder and CEO Guy Tytunovich. “We established guidelines for a proper advertising mix that would not annoy users.”

Tytunovich says he was a fan of Adblock Plus software, but didn’t know about its acceptable ad guidelines until early 2016, when he sent an email to its founder and CEO, Till Faida. “When we started talking to them, it was like, I don’t want to say preaching to the choir,” says Adblock’s Williams. “It was more like two different preachers preaching to each other about the same thing.”

With the deal, Adblock won’t have to work out parameters for acceptable ads, such as placements, through consultations with individual sites: ComboTag’s software enforces all those rules automatically on sites that sign up. And ComboTag doesn’t have to worry about ads getting blocked by Adblock. It will broker sales of ads that ABP has already whitelisted. Working through ad-placement services like AppNexus and Google’s DoubleClick, Adblock will get just over a 6% commission on all the ads sold. “We can now work within the known architecture of advertising,” says Williams, “rather than in this very, very … time-consuming old way of whitelisting.”

Tytunovich says he’s briefed clients on the upcoming deal and gotten a positive response. “So we’re talking to tier 1 [ad] agency trading desks and … we’re talking to digital publishers,” he says. “And I haven’t heard a negative response yet. Everybody seems to get it.” The biggest client he names is Trinity Mirror, publisher of 260 titles in the U.K., mostly regional papers but also national titles including the Daily Mirror/The Sunday Mirror and the Daily Record/Sunday Mail. (The publisher is also known for eavesdropping on celebrities’ phones and paying out large legal settlements.) Tytunovich also claims to have 500 publisher clients in the U.S., which he is not authorized to name.

Tytunovich says that the company is brokering about 5 billion ad “impressions” (a single display of an ad) per month and expects to earn $40 million for the year, calling the company significantly profitable. “We’ve got the track record that shows that this is possible, that publishers can indeed make more money with less disruptive ads,” he says.

That may all go away, however. AppNexus and Google say they were not briefed on the ABP-ComboTag plan, and they both suspended their relationships with ComboTag shortly after the announcement. Tytunovich, however, still claims that he can work things out with the two ad exchanges that his company utterly depends upon.

This is Adblock’s second new revenue-generating strategy of the year. In May, it announced a deal with Flattr, a kind of digital tipping service for websites cofounded by Peter Sunde, who also cofounded the Pirate Bay (and served a brief prison term for aiding piracy). The upcoming Flattr Plus service, expected to launch in beta before the end of the year, will integrate with Adblock’s browser plugin. Ad-hating users can elect an amount of money to put into their digital wallets, and Flattr Plus will automatically divvy up the money based on how much the person uses various websites or apps. Adblock and Flatter would split a commission of around 10%.

Shakedown Or Savior?

Looked at cynically, Adblock Plus is running a shakedown or protection racket: disrupting business deals between advertisers and web publishers and charging a toll. “When people call it a shakedown, I think they mischaracterize it,” says Williams. “I would even go so far as to say this mischaracterization has been hatched inside some PR labs, perhaps of member organizations that will remain nameless.” He may be taking about the company’s archnemesis, the Interactive Advertising Bureau, whose president, Randall Rothenberg, famously called ABP “an unethical, immoral, mendacious coven of techie wannabes” back in January.

There’s also been an issue of trust. ABP and its parent company, Eyeo, have taken heat for some of the whitelisting deals, such as with Taboola. The company places those “Around The Web” paid-content links to ads that masquerade as articles, like “25 Stars Who Are Literally Unrecognizable Without Makeup.” Engadget security and privacy columnist Violet Blue labeled this an example of “pay-for-play” in a February piece called “RIP: Adblock Plus.”

Williams says that this deal covered just some Taboola ads: Each had to be approved individually. The deal still took a lot of heat in ABP’s user forums, and steps were taken to more clearly label them as advertorial, the company said in response to users. “This is actually a great example of how the Acceptable Ads initiative is an evolving, two-way process between advertisers and users,” writes Williams in a follow-up email to me. “We’re not going to get it right every time, of course, but the policy evolves with time and with user feedback.”

Last year, ABP announced plans to avoid conflict-of-interest concerns by moving the decision-making about whitelisting outside the company to an independent Acceptable Ads Board. Williams says that the organization’s bylaws are “99.9%” complete, that members are being recruited, and that the committee will first convene in early 2017. “I think that will quash a lot of that criticism, because we are creating in essence a firewall between our monetization … and what is considered acceptable and not,” says Williams.

UPDATED: This article has been updated to include the response by Google and AppNexus after the AdBlock Plus and ComboTag announcement.

Fast Company , Read Full Story

(22)