After Dominating The Consumer Drone Market, DJI Sets Its Sights On The Business World

When it comes to the consumer drone industry, China’s DJI came, saw, and conquered. Just ask companies like 3D Robotics, Parrot, Yuneec, and GoPro what happened to their drone programs after DJI devices like the Phantom 4 and Mavic Pro came along. Now, DJI is hoping to repeat its success with the enterprise and industrial side of the drone market.

Already, DJI had offered mobile and onboard software development tools that allowed third-party developers to build software solutions on top of DJI drones. Now, it’s adding hardware to the mix–and that is likely to substantially broaden the number of ways businesses use the company’s drones, making it ever harder for its competition to keep up.

Today, it unveiled what it calls Payload SDK, a tool that, in conjunction with DJI’s new Skyport gimbal adapter, allows third party sensors, cameras, and things like air-to-ground communication tools and devices to integrate directly with its M200 series drones. It may seem like an incremental move, but the company is hoping that PSDK will allow it to grab a stranglehold on the lucrative enterprise and industrial drone business–things like agricultural and infrastructure inspection, construction, emergency-management, and much more–by making it easy for third parties to plug their sensors, and the data they generate, directly into DJI’s already robust end-to-end system.

And while many enterprise users were already deploying DJI drones with third-party sensors and applications, they had to jerry-rig them, and it would be difficult to get real-time data from the systems without adding substantial weight in the form of extra batteries and communications equipment. Now, it can all be integrated, streamlining the process and giving these users easy access to real-time data from a wide range of external cameras and sensors.

Integrating Third-Party Sensors

Drone industry analyst Colin Snow says that the ability for users to automatically integrate third-party sensors is a big deal, especially because it means their applications can take advantage of the drone’s onboard GPS. “It should improve sensor and image geotagging needed for post-processed kinematic (PPK) surveys,” Snow says.

“PPK surveys are generally used for mapping or for surveying points where only several centimeters of precision are needed….Proper geotagging improves the horizontal and vertical accuracy of drone mapping projects, regardless of the project control strategy. If done right, PPK surveys can save hours of site labor because it reduces or eliminates a ground survey necessary to place control points.”

The combination of PDSK and Skyport makes it possible for just about any external sensor or payload to be installed and controlled as if it was one of DJI’s own cameras or sensors. Plus, the third-party sensors will also be able to pull power directly from the DJI airframe, and operators will be able to communicate directly with their sensor and receive data in real time via DJI’s Lightbridge 2 communications system.

The first external devices to take advantage of PSDK are Slantrange’s 3PX system for aerial crop management and Sentera’s agricultural surveying tool.

Prior to utilizing PSDK, Slantrange, which develops multi-spectral imaging systems for agricultural customers, had been able to mount its sensors on DJI drones, but its operators weren’t able to get any real-time visibility into what was happening on missions. “This new integration allows the sensor to be plugged into the drone,” says Michael Ritter, Slantrange’s CEO, “We get access to power, and communications, and that opens up a whole new range of capabilities.”

The biggest, Ritter adds, is real-time in-flight data from the sensor, meaning that the operator can know while the drone is in flight if they’re getting the data they need. Previously, it was often necessary to repeat missions because for one reason or another, the required data wasn’t collected—and there was no way to know until the drone landed, and the data could be downloaded and analyzed. “It’s all available to them live now,” he says. “That makes it more efficient—they know they’re collecting what they need to collect.”

“A Swiss Army Knife Of Capabilities”

These new tools give DJI’s drones “a Swiss Army knife of capabilities,” Ritter says.

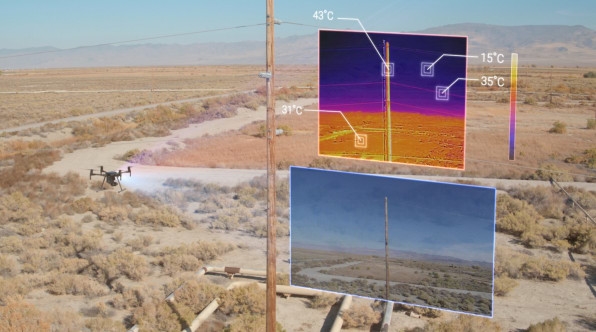

Oregon’s FLIR developed its new Zenmuse XT2 camera in partnership with DJI. FLIR is best known for its thermal imaging cameras, which are ideal in firefighting and other emergency-management and search and rescue situations.

But the company develops many other types of sensors, and sees the value of DJI’s new tools. “The PDSK really opens an opportunity for us and others to exploit their sensors in drone applications where it might have been challenging before,” says Jeff Frank, FLIR’s senior vice president for global product strategy. “One of the key attributes of the DJI product offering is their end-to-end ecosystem, and so it’s not just the drone hardware, it’s all the pieces…from the flight platform, the software, downlinks, and the [new] SDK really enables its use especially in enterprise and industrial applications.”

Frank notes that FLIR has previously had “the keys” to DJI’s gimbal mount, but recalls that it was difficult integrating its sensors and cameras with DJI drones prior to getting that access. “PDSK enabled us to think about a lot of other sensor applications we have inside the company.”

Among other things, FLIR builds full drone/camera solutions for some of its customers, and with the addition of PDSK and Skyport, it “going to expand our capability to develop additional sensors for that platform and deliver fully-integrated solutions to a broad cross-section of our customers.”

To Jan Gasparic, DJI’s head of enterprise partnerships, bolstering the company’s position in the enterprise drone market is crucial. He says that data suggests there was 43% growth in the number of commercial drone operators in the United States between 2016 and 2017, and the company is expecting similar growth going into 2018 and 2019. He also cites an IDC study that estimates the enterprise drone market will hit $9 billion with 30% annual growth in the next five years.

Gasparic says that the addition of DJI’s mobile and onboard SDKs helped accelerate the company’s move into the enterprise drone market. “We see PSDK as another flywheel that’s going to drive us forward,” he says.

While the obvious types of sensors that could be added to a drone are new cameras and things like thermal-imaging systems, it’s also cool to imagine things like radiation detectors or even small robotic arms. DJI is hoping that by opening up its platform, there will be countless new creative uses of its drones. All of which are likely to cement its position as the leader in the space, of course.

One simple application Gasparic likes is mounting spotlights or laser pointers on an M200 for use by search and rescue personnel. “One of the wonderful pieces of an SDK,” he says, “is that you don’t know the solutions people will build. You open it up to the creativity of the market. It’ll be exciting to see where we are in six months.”

(36)