Apple Earnings Preview: Here Are 7 Things We Expect

Apple is expected to announce an adequate to half-decent quarter when it reports earnings after market close on Tuesday. Anything that beats analyst expectations (see below) would be pretty much OK with everybody.

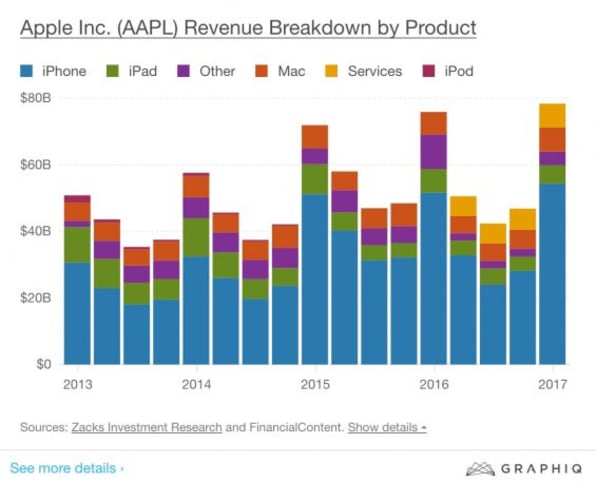

Why such low expectations for one of the most valuable companies in the world? The iPhone remains Apple’s bread and butter, and the company will announce two or three new ones this fall, so we expect that lots of people are holding off buying iPhones until then. The first quarter also tends to be seasonally depressed every year. Given those factors—and that Apple’s Q1 last year was not very impressive—the bar is pretty low.

Here’s what we expect to see:

Phones. Apple will likely sell close to 52 million iPhones for the quarter—a one percent increase over the same quarter last year. Anything above that is gravy. Last quarter Apple sold a surprising 78.3 million devices, ending a three-consecutive-quarter trend of declining sales.

Revenue. Apple said early that it expects to report between $ 51.5B and $ 53.5B in revenue for the quarter. Yahoo’s analyst consensus calls for just shy of $ 53B. I’m betting Apple will report revenues just above $ 53B. Happy days.

Services Business. Everybody’s been downright bubbly about the surprising growth of Apple’s services business, meaning all the digital content we can buy from the App Store or iTunes. The services business grew 18% in the final quarter of 2016, contributing $ 7.2 billion of revenue (CEO Tim Cook said the services business contributed $ 20 billion in revenue in 2016). Analysts will be looking for a continuation of that growth this quarter. Cook says Apple is trying to double its services business in the next four years, so any setbacks will be looked at harshly.

China Market. Everybody’s keeping a nervous eye on China, a market that Apple is counting on for growth but that has been underperforming in the past year. But, as Jason Snell at Six Colors points out, Apple’s China sales have slipped below its European sales in the last three quarters. If this trend continues, CEO Tim Cook will have some explaining to do.

Mac. Mac sales slid down for an entire year before growing slightly last quarter, when Apple reported 5.4 million units sold worldwide. Gartner believes Apple sold 4.2 million Macs in the first calendar quarter of 2017, which, if accurate, would mean another quarter of growth (4 million were sold in the same quarter a year earlier).

iPad. We’re expecting more bad news on the iPad front. Sales are likely to continue to falter—we’ve gotten used to it now—as they have for the past couple of years. Apple recently announced (in early April) a competitively priced $ 329 iPad, but we suspect it’s too early to really see how enthusiastically the market will receive that device.

Watch. The Apple Watch doesn’t contribute a whole lot to the bottom line yet, but the device had what I’d call a break-out holiday quarter. Based on some online sales tracking numbers, we’re inclined to believe the Watch sold as many as 5 million units in the quarter. Apple won’t say how many it sold in the March quarter (or any quarter), but we’ll be looking for signs that it sustained those sales figures, thus opening a new chapter in the story of Apple Watch-as-mass-market-device.

Apple will announce results after market close on Tuesday and then hold an earnings call with analysts. We’ll be reporting the earnings and listening in on the call.

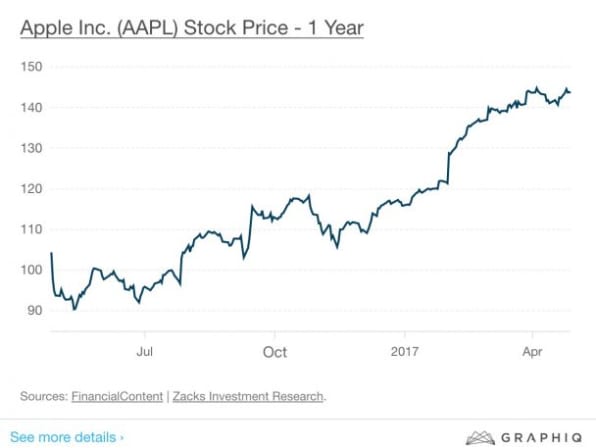

And here’s some CHARTS!

(52)