Apple, Google And PayPal Jockey For position In cell funds

the general market is growing but in-app funds will drive mainstream adoption.

among the anticipated announcements tomorrow at Google I/O is a revamped and reinvigorated payments technique. Google is broadly anticipated to unveil “Android Pay,” a replacement for Google pockets for cell and offline funds.

Android Pay’s performance seems to be typically the same as the original Google wallet with the exception of that there will probably be a new emphasis on in-app funds, following Apple’s lead. surprisingly, in step with the the big apple occasions (NYT), Google wallet will continue to exist. however it’ll morph right into a peer-to-peer cost device very very like sq. money.

It strikes me as bizarre that Google would maintain these two funds manufacturers, despite the fact that I take note the explanation at the back of changing the “flagship” brand. Google pockets is slightly tainted because of its failure to realize adoption, though that wasn’t solely its fault.

Google pockets at the start launched with much excitement and anticipation in late 2011. It used to be nearly immediately blocked or resisted by the key US wireless carriers with the exception of sprint. This was once for the reason that three other carriers, Verizon, AT&T and T-cellular, have been companions in an ill-conceived funds venture then referred to as ISIS (later rebranded as Softcard). prior this yr Google sold the foundering Softcard to win choose with the carriers and gain get admission to to their distribution.

The NYT outlined the huge scope of Android Pay, essentially the two.zero model of Google wallet:

Google’s new Android Pay will also be used at brick-and-mortar shops along with letting merchants settle for bank card payments from their cell apps, mentioned the people acquainted with the corporate’s plans. customers who use Android Pay for a purchase may even mechanically add factors to loyalty applications run by means of participating retailers, they mentioned. The revamped Google pockets might be on hand for Android and iOS gadgets, they introduced.

NYT also reviews that Apple will offer some new features and enhancements to Apple Pay at its June developer conference in San Francisco.

last week PayPal held a press event in San Francisco, a kind of coming out celebration for the quickly-to-be-impartial firm. It emphasized cellular funds however defined itself more expansively, now not as a payments firm, however as “the operating system for digital commerce.”

Of the most important players within the mobile payments arena, PayPal has probably the most established model, greatest person base and broadest array of fee assets. through a sequence of rather up to date acquisitions that embody Braintree, Venmo and Paydiant, the corporate can strengthen payments between peers, online, in apps and in bodily outlets. The latter capability, constructed on Paydiant, includes loyalty and cell advertising.

And let’s no longer fail to remember Amazon, every other main player in this segment. sq. and Stripe are there too. moreover fb might relatively easily (by the use of an acquisition) turn out to be a worldwide funds platform. It has dabbled and continues to incrementally move in payments.

paradoxically it’s Apple, Google’s biggest cell rival, that has revived Google’s fee potentialities. Apple Pay and its massive backing by using banks, bank card issuers and shops has helped to coach the general public and power new levels of pastime and utilization.

the information counsel that thus far penetration and in-retailer utilization of Apple Pay is quite limited. however it’s rising and quite a few outlets, including complete foods, have pronounced vital utilization growth of mobile payments in its outlets. Millennials in particular are interested in cellular funds.

Many analysts and the brand new York times still describe cellular funds as “a solution in search of a problem.” That’s not precisely proper. many individuals who haven’t used Apple Pay don’t recognize its advantages. And though it’s relatively painless to pull out a plastic card and swipe it at a point of sale terminal, the speed and comfort of the Apple Pay user expertise make conventional credit card utilization appear in an instant clunky and outdated by comparability.

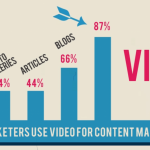

the entire focus on the in-retailer POS use case, on the other hand, is rather misplaced. essentially the most rapid rollout and adoption of cellular payments will come and is coming within the form of in-app funds, either for e-commerce or tran

advertising Land – web advertising and marketing news, methods & guidelines

(172)