Bank of America: Mortgage rates could hit 5% under these conditions

The

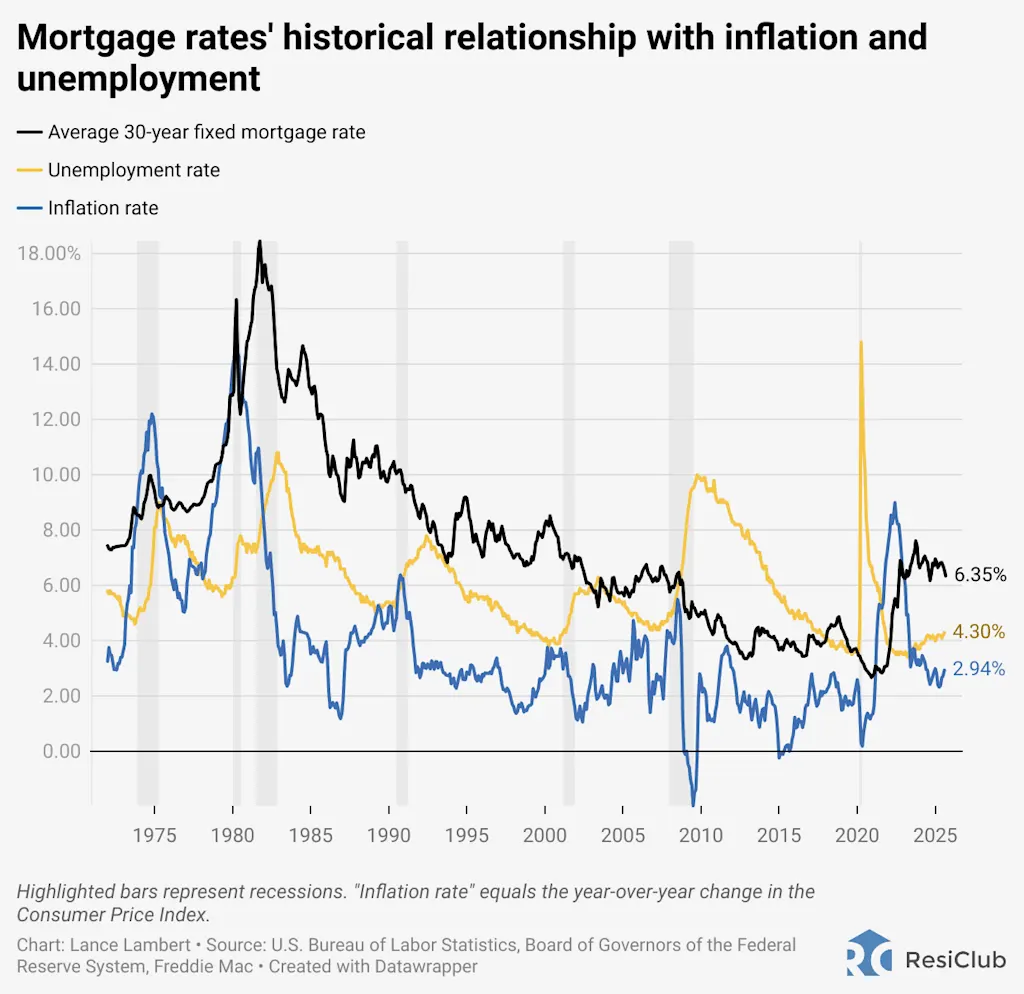

average 30-year fixed mortgage rate just hit a 2025 calendar-year low.

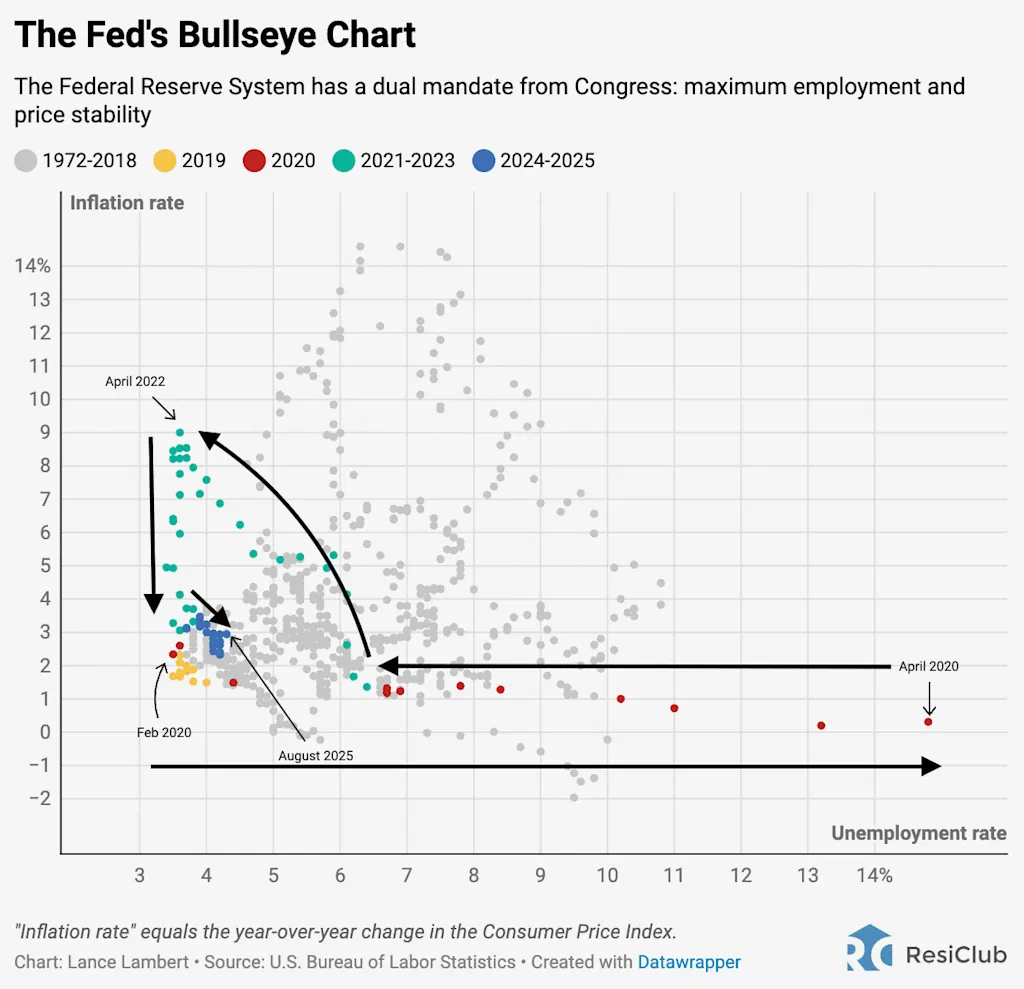

Here’s what Bank of America thinks it would take to see a bigger drop.

Lance Lambert

Want more housing market stories from Lance Lambert’s ResiClub in your inbox? Subscribe to the ResiClub newsletter.