Big Sean’s latest collaboration? Teaching kids about finance—on Minecraft

All too busy soaking up the basics of algebra, world wars, and Shakespearean sonnets at school, you probably learned very little, if anything, about how to save money, pay taxes, or handle credit. While it’s a pivotal part of daily adult life, financial literacy isn’t prioritized in school. Less than a third of adults ages 18 to 54 can answer basic financial questions. “You’re teaching the Pythagorean theorem—and that’s great,” says Diane Morais, president of consumer and commercial products at Ally Bank. “But how about how to balance a checkbook?”

It turns out that the unlikely answer to this omission was a multi-platinum-selling rapper and the most popular video game of all time.

Since 2019, musician Big Sean’s nonprofit foundation has worked with Ally Financial to place minority college students into internships, and onto a path toward economic success. Four interns from that debut year came up with a bold idea: to create a brand-new world in the video game Minecraft, which would teach middle-school kids to be financially literate. And so launched Fintropolis, which young, virtual explorers can now play at home or in school, to make them better prepared for life’s pecuniary necessities.

The journey to Fintropolis began with an annual competition that Ally Financial developed with the Sean Anderson Foundation and the Thurgood Marshall College Fund. It started in Detroit, Big Sean’s hometown, and a frequent topic of pride in his songs. Ally Financial, too, has its roots in Motor City; it started as GMAC, or General Motors Acceptance Corporation, helping auto dealers and buyers with financing. The Ally team was impressed by an event that Sean had set up in Detroit with Puma, where he invited budding entrepreneurs to design a sneaker, and used it as a template to start a similar contest in the finance realm. In February 2019, they launched the first Moguls in the Making, a 48-hour “pitch competition,” giving students from historically Black colleges and universities, a chance to win scholarship money and internships at Ally.

At the Moguls event, Big Sean serves as a motivator for the competitors, and as a judge at the event’s culmination. It’s a different style of collaboration for the Roc Nation-signed rapper, whose past link-ups were with the likes of Kanye West, Lil Wayne, and fellow Detroiter, Eminem. But, Sean had long been into giving back. “I grew up in a household where to give is to receive,” Sean says. “It’s something that’s been instilled in us for as long as I can remember.” The rapper’s mother runs his foundation, which works on many programs focused on elevating the disadvantaged and historically excluded. “It’s part of my purpose, to be the best person I can be,” he says. “But I can’t do it all through music.”

For Ally, Moguls is part of a commitment to providing pathways to economic mobility and social inclusion for Black and brown students, many of whom are the first in their families to go to college, and try to make a dent in the historic wealth gaps. “When we looked at our employee population, we said, we need better pipelines,” Morais says. “We need to bring in talented individuals early in their careers, and continue to elevate them throughout our company.” The Thurgood Marshall College Fund also helps, with the recruitment of 50 HBCU students, from an applicant pool of 500.

The participants were so impressive that Ally hired not just the winners, but 15 students as interns for the summer. Four of them—Erin Martin, Earl Perry, Keishon Smith, and DeMari Tyner—were assigned to Ally’s TM Studio, its creative R&D base. Because Ally Bank, the banking branch of Ally Financial, is relatively new, built digitally in 2009, it puts a lot of focus on constantly iterating its technology to best serve account holders. “When we get to a point where there’s a real idea that’s resonating with consumers,” Morais says, “then we bring it to market.”

When tasked to create the prototype for a financial literacy product for middle-school kids, the four interns’ minds went to a familiar concept: video games. Specifically, Minecraft, which allows players to build, explore, and survive within 3D block worlds—and which has sold 200 million copies as of 2020. They developed the prototype for a new money-oriented Minecraft world. When the interns left to return to college that fall, Ally continued to develop the game. “We [couldn’t] just let this idea die on the vine,” Morais says. They worked with Microsoft, the game’s owner, and video game developer, Blockworks, to turn Fintropolis into a (virtual) reality.

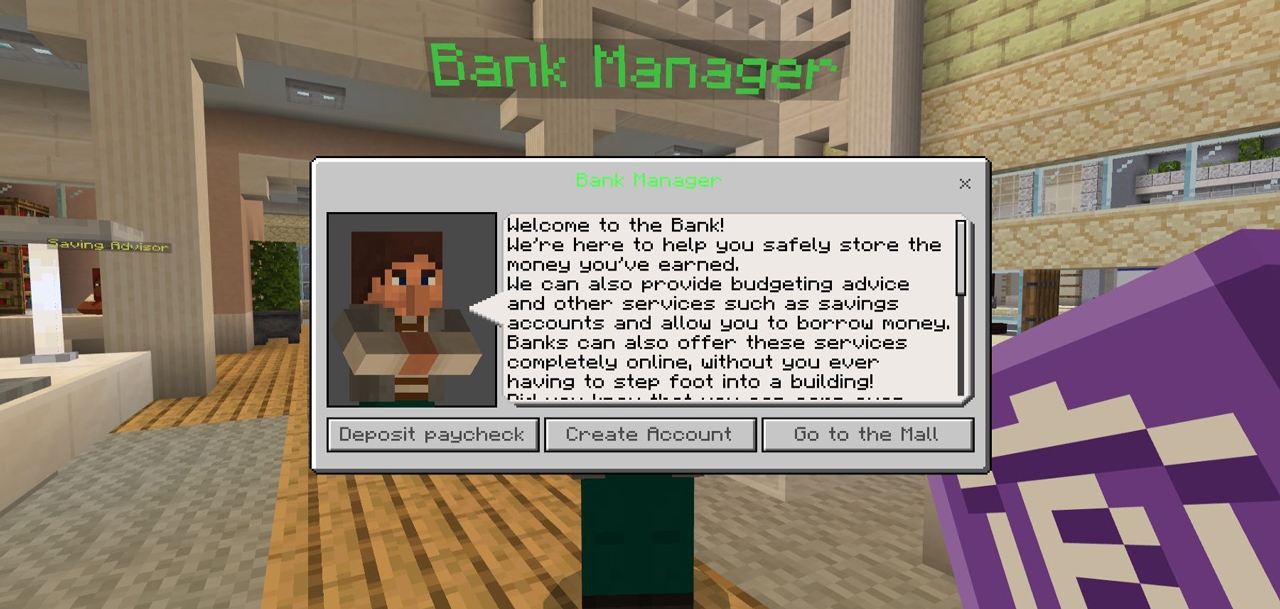

[Image: courtesy Ally Financial]

In its finished version, players (who have purchased the base package) can download Fintropolis as an add-on, and be taken through a “financial literacy 101,” exploring concepts like credit, debt, and cash flow as they go. They can meet the mayor at City Hall and learn about taxes; open an account at the bank and do responsible budgeting; get a mortgage and buy a house; invest at the stock exchange; and be clued in on identity theft at the police station. Fintropolis was finally released in late July 2021, and at the time of writing, has been downloaded more than 672,000 times.

Both consumer and education versions are available, so kids can play it at home, but also at schools that choose to fit finance into their curricula, a move that Morais strongly urges. “They can get a credit card when they turn 18,” she says. “If they don’t know what they’re doing, they get into trouble.” Only 21 states require students in high school to take a personal finance course to graduate, let alone in middle school. Sean warns of the detriment of skirting the subject early on. “Everyday things that some of us had to learn the hard way, [they] ruin some people, because nobody taught them.”

The next Moguls contest will take place this September, and Sean’s excited by the prospect of witnessing the young achievers in action again. “It was cool to see everybody’s gears turn so rapidly,” he says. “It was just good to see Black kids thinking and coming together on such a high level.” Eight interns in total have been hired full-time from the Moguls programs; of the four Fintropolis creators, three are back at Ally, and one, Martin, is finishing school and has a place waiting for her after graduation. Sean expresses his pride in the young innovators. “I don’t know if they know what a great accomplishment this is,” he says. “This is revolutionary. Genius level, for real.”

Fast Company , Read Full Story

(26)