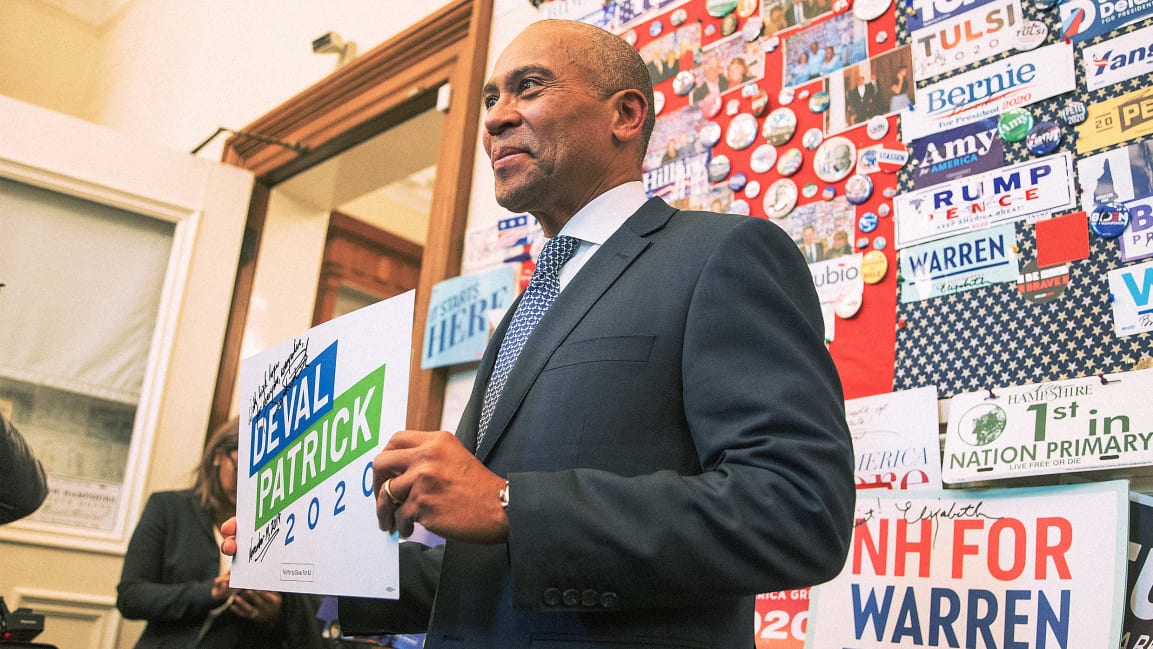

Can Deval Patrick convince voters his work at Bain Capital was a force for good?

As Mitt Romney was solidifying his spot as the front-runner in the 2012 Republican primary, Barack Obama came out with a devastating campaign ad. Romney, an accomplished businessman who cofounded private equity firm Bain Capital in 1984, was running on his ability to resuscitate a struggling economy. But Obama’s team, seizing on the populist mood of the time, flipped the script. In a two-minute ad that ran in multiple states, the Obama campaign described in excruciating detail how Bain Capital would buy a business, saddle it with debt, and then sell it for parts. “They came in and sucked the life out of us,” said a former steel mill worker whose factory went bankrupt shortly after it was acquired by the firm. Another called Romney a “job destroyer.”

One high-profile Obama ally who didn’t join in the Bain bashing was the Massachusetts governor, Deval Patrick. Throughout the campaign, Patrick, who was the campaign cochair, refused to cosign the party’s reelection message, saying Bain “wasn’t a bad company.” Patrick’s stand made some political sense at the time: Bain & Company, after all, is headquartered in Boston. The move also paid off long-term: After leaving government in 2015, Patrick himself got a job at the firm, where he helped launch Bain Capital Double Impact, a fund designed to “help mission-driven companies scale and drive meaningful change.” (Patrick has also worked for other controversial companies, like subprime lender Ameriquest.) Since then, even as the Democratic base drifted to the left, with candidates such as Elizabeth Warren making the case for a wealth tax, Patrick has stood firm in his defense of the private equity company.

Of course, all that is bound to change, or at least become more complicated, with Patrick’s sudden, late entry into the 2020 race. Patrick didn’t just resign his post as a managing director at Bain—the company’s website also appears to have deleted his bio page. In a statement Thursday, he reiterated that political attacks on Bain are misplaced but admitted that capitalism “has a lot to answer for.”

A closer look at Bain Capital Double Impact reveals how Patrick’s work differs from the leveraged buyouts that Bain is known for. When the new fund launched in 2017 with $390 million, it was relatively large for the impact investment space, though small for Bain, which had around $75 billion in assets under management at the time. (As Patrick departs, Bain is raising a second Double Impact fund with a target of $600 million.) Like other impact investing funds, it’s premised on the idea that investing in the right companies can help solve social problems while investors make market-rate returns. But Double Impact also focuses on convincing CEOs of more traditional companies to consider “impact goals in addition to just financial goals,” says Adam Bendell, the CEO of Toniic, a global action community for impact investors. In other cases, it has helped companies that were already focused on social impact to scale up.

Bain Capital Double Impact currently has 10 companies in its portfolio:

It’s a quickly growing space—a report from the Forum for Sustainable and Responsible Investment estimates that $12 trillion went into impact investment funds last year—but Bain Capital Double Impact is unusual in that it sometimes focuses on converting successful businesses into socially conscious ones. While other funds chase the same pool of companies, Patrick’s team would “find a business that maybe doesn’t think of itself as an impact business, but [they] see the latent impact in it and unleash that,” Bendell explains. For gym chain Impact Fitness, for example, Bain Capital helped the company think about how it could better reach underserved communities.

Other companies in its portfolio already have a social impact lens. Because all of the companies are evaluated for their ability to provide market-rate returns, it’s likely that they would have been able to get investment from traditional investors anyway, a common criticism of the impact investment space. (By Chloe, the vegan restaurant chain, is one example of a company in the space that is already attracting no shortage of capital.) But for companies with a strong mission, impact investors can offer alignment with that mission along with business expertise.

The Sustainable Restaurant Group, which includes restaurants such as Bamboo Sushi, the first sustainable sushi restaurant, had already been working on its environmental impact for years when the fund invested in it last year, but it needed investment to open restaurants in new regions, and it wanted a partner that understood its core mission. “For us, we had had a long time to work on our sustainability,” says Kristofor Lofgren, the company’s CEO. “But we were just getting started in our ability to run a very successful, bigger company.”

Bain’s benchmarks for success are somewhat hazy. In its latest annual report, the Double Impact fund explains that it evaluates each investment based on its potential financial and social returns, and it identifies two or three metrics against which to evaluate a company’s progress. B Lab, a nonprofit that tracks the environmental and social performance of companies and funds, reports that Double Impact has increased the impact score of its portfolio by 42% on average. (Patrick also sits on the board of B Lab, which declined to comment for this story.)

While some of the metrics are obviously positive for the world—the Sustainable Restaurant Group lowered its emissions per meal served, and By Chloe increased the number of plant-based burgers it served—others are fuzzier. The chain of gyms increased gym visits (a standard metric from any gym) but was touted merely for including a new statement of values at staff meetings. (Bain was unable to respond before the deadline of this article.)

The more vexing question for Patrick is whether he can spin those successes in a way that neutralizes the political stench that Obama put on Bain Capital. Abe Rakoff, Patrick’s campaign manager, said in a statement Thursday that the governor’s life “has always been about rejecting false choices, and this new fund was created to show that private companies can be a force for public good.” But it remains to be seen whether the positive impact of Patrick’s mission will outweigh the left’s negative perception of his former employer. Will voters buy the argument that Patrick helped companies to become more socially conscious, or will they view his work with Bain as just slick marketing for a standard investment portfolio?

(14)