Crypto Markets Pump after FOMC Meeting – Fed to Hike Interest Rates

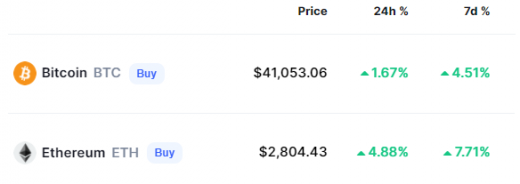

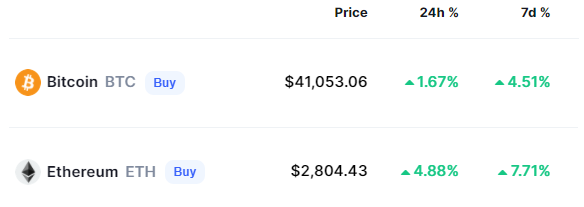

Crypto price rises via Coinmarketcap.com

As reported by CNN Business, Bloomberg and the Wall Street Journal, the Federal Reserve is set to raise interest rates for the first time since 2018, to combat inflation.

The crypto markets and S&P 500 both rallied in response to the news, suggesting investor confidence has improved and that fears of a bear market or recession amid the Ukraine-Russia crisis may finally now have abated.

FOMC Meeting

‘We feel the American economy is very strong. As I looked around the table at today’s meeting, I saw a committee that’s acutely aware of the need to return the economy to price stability and determined to use our tools to do exactly that.‘ – Federal Reserve chairman Jerome Powell.

The Federal reserve holds several FOMC meetings throughout the calendar year, the last taking place in January. FOMC stands for Federal Open Market Committee.

The Fed announced they will hike interest rates by 25 basis points – one basis point is equal to a hundredth of a percent, meaning the Fed has raised rates 0.25%. Powell acknowledged to reporters at a post-meeting press conference that inflation is too high and the central bank will tackle that.

Yahoo Finance quoted chief economist at Grant Thornton, Diane Swonk – ‘The Fed has now waged a war on inflation. They want to bring inflation down with the most aggressive surge in rates in decades.’

Crypto Market Pumps

While more ‘risk off’ assets like Gold, and the US dollar declined in value, stocks and Bitcoin, alongside Ethereum and altcoins, have seen a price rally, suggesting buyers entered ‘risk on’ markets.

Some of the largest gainers in the last 24 hours include altcoins which outperformed BTC:

- Lucky Block +18%

- Solana +7%

- Cardano +5%

- Polkadot +4%

- Dogecoin + 3%

- Yearn Finance +2%

The Bitcoin price rose 1-2%, currently back over $ 41,000.

Elsewhere in the market DeFi coins such as AAVE and ATOM also spiked in price, as investors show an interest in decentralized finance projects.

Tokens related to the Metaverse and non-fungible tokens (NFTs) such as MANA are also up on the day.

Altcoin Season

Alternatives to Bitcoin, or ‘altcoins’, outperforming the major coins, could suggest an incoming ‘altcoin season’, as money that moved into Bitcoin trickles down to the lower marketcap coins.

Low cap coins tend to pump the hardest – the native token of Lucky Block which tops the list, LBLOCK, is a relatively new project ranked #3129 on Coinmarketcap.

Ethereum is up about twice as much as Bitcoin on the day, and many altcoin projects run on the Layer 1 Ethereum blockchain. ETH leading BTC is typically another indicator of a potential alt season.

Bull Market Signs

The total cryptocurrency market capitalization has now moved back above $ 1.8 trillion. The overall crypto markets are a sea of green.

Confirmation of a new bullish market structure however would require Bitcoin to break the $ 45,000 resistance level it was rejected from earlier this month.

That would also see the Ethereum price reclaim the $ 3,000 level and could signal an altcoin season heading into Q2 of 2022.

Both have been stuck in a sideways trading range for the last two months, and it remains to be seen if this was consolidation and accumulation before a move to the upside, or distribution before a move lower. The positive news out of FOMC this week makes an uptrend more likely.

The S&P 500 is back over 4365, the monthly open. If the monthly candle closes green that would be a good sign as Bitcoin and the wider crypto markets have been correlated to stock market prices in 2022.

The next FOMC meeting is scheduled for May 3rd – 4th, and the Fed signalled a further six more increases to interest rates by the end of this year.

(47)