Data Shows Marketers In Competition For Discretionary Dollars

by Laurie Sullivan, Staff Writer @lauriesullivan, August 25, 2016

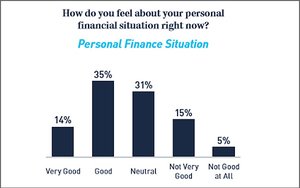

Only 35% of the 1,000 consumers participating in a recent survey say they feel comfortable about their financial situation today, which should suggest to marketers that this holiday season will become all about the competition for discretionary dollars.

The signals point to a higher demand in value shopping, channel shifts, mobile, and the rise of spending by Millennials ages 18 to 35.

While the majority of consumers will do some sort of shopping online this holiday season, at least in the U.S., 20% felt bad about their personal financial situation, although 49% said they felt good or very good, according to a recent Berkeley Research Group (BRG) survey of 1,000 adults in the United States.

Despite a generally optimistic tone among shoppers when evaluating their personal finances, there is little indication from the findings that consumers are ready to open their wallets and splurge.

Seventy-six percent said they plan to spend about the same or less than last year, 57% expect to spend the same and 19% expect to spend less. Just 15% expect to spend more than last year.

The BGR study analyzes how consumers shopped, both online and in-store last year and what they expected to spend during the 2016 holiday season. Nearly all — 88% — said they made an online purchase in the past year. Some 84% of Baby Boomers, ages 52 to 70, had shopped online, while more than 90% of younger shoppers had done so.

About 49% of Millennials said their online spending increased in the last 12 months, while just 37% of Baby Boomers reported an increase. Some 42% of Gen Xers, ages 36 to 51, reported an increase.

Employment will remain an increasingly important factor, and it will likely influence sales and the way marketers reach prospective consumers.

Unemployment has leveled off, but many are “underemployed,” according to the report, which points to recent survey by PayScale where 46% of working Americans consider themselves underemployed.

BGR also points to declining personal savings rates, and based on Federal Reserve statistics, total revolving credit held by consumers has reached its highest level in years. The report cites The Wall Street Journal report that estimates total credit card debt in the United States could surpass $1 trillion by year end — close to the record level of $1.02 trillion in July 2008.

When it comes to spending this holiday season, shoppers said they expect to spend less on holiday gifts in 2016, 30% cited rising household expenses, 27% said their income had gone down, and 25% said they had too much debt.

Indirectly, the report also provides marketers tactical tips, other than bringing in Remarketing Lists for Search Ads or Customer Match to think about when planning out holiday campaigns. Focusing on reigniting loyalty programs, cater to local preferences, accentuate visual displays on Web sites and in search ads, and improve online merchandising tactics.

MediaPost.com: Search Marketing Daily

(10)