Even the IRS knows the ‘Where’s My Refund’ tool sucks

The National Taxpayer Advocate—the branch of the Internal Revenue Service that audits the rest of the department to make sure that we the people are treated fairly—this week released its yearly review of tax season.

And 2021, it acknowledged, was “the quintessential definition of a perfect storm.” Between the global pandemic, a rush of past tax returns filed to claim stimulus checks, 170 million checks addressed and mailed in three distinct batches, policy edits around jobless benefits, and staff members juggling phone calls with childcare from home, the IRS was woefully swamped in every respect.

But for struggling Americans, it was hard to feel too sorry for the tax collector. The report cited “a historically high volume of unanswered telephone calls” and “historically low level of service” as tens of millions of 2019 and 2020 returns clogged the pipelines, with refunds stuck in limbo. And in a year when Americans were more cash-strapped than ever, they had no good way to check when those refunds were coming.

Are we forgetting about the IRS’s dedicated “Where’s My Refund” online status tracker? No, we’re not. It just doesn’t tell you where your refund is. Even the IRS seems to know it’s useless: “Unfortunately, many taxpayers checking the tool could not secure specific information as to when they would receive their refund and just as importantly, what is causing the delay,” the report read. “TAS has recommended that the IRS should strive to improve its Where’s My Refund tool.”

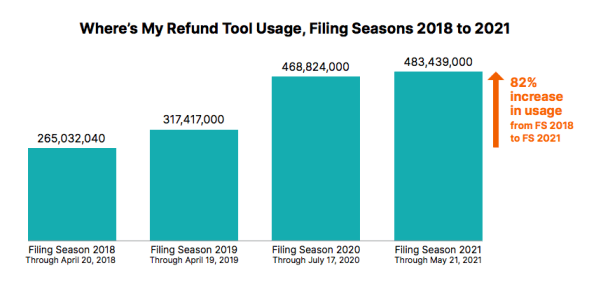

The tool, which has been around for years, saw an 82% increase in traffic from the 2018 to the 2021 filing season, and users were essentially informed that their refund was either sent or—for most—pending. Those who tried to phone for further clarification were caught in a stampede of, at one point, 1,500 calls per second, and “many did not receive fruitful information or satisfying results.”

According to TAS, the IRS could offer taxpayers specifics about what’s causing their refund delay, what information they must provide, and when their refund might be issued, all via the online tool, thus fulfilling their right to be informed. IRS—your move.

(10)