Everything You Need to Know About Small Business Loans [Infographic]

— December 29, 2017

The lending process involved in getting a small business loan can often be frustrating and complicated for those who aren’t experienced in the realm of finances, but it doesn’t have to be. Here are some tips for preparing to apply for a small business loan and working with lenders to get your small business’ financial needs taken care of.

Types of Small Business Loans

Educate yourself regarding the types of small business loans that are available before you begin your search for a lender. This will help you understand what criteria a lender is looking for as well as what might be the best option for your business and your personal financial needs.

Small Business Line of Credit: Your small business will be able to access funds from a lender as needed rather than getting the money all at once. A line of credit will have a cap on the amount accessible as well as a fee, but you won’t get charged interest until you draw out the funds. These are generally useful when you need access to a steady cash flow or an emergency fund for unexpected expenses.

Working Capital Loans: These are typically used by companies to finance daily operations and to manage fluctuations in revenue and expenses. Working capital loans are usually short-term loans and can come in varying amounts, depending on your business’ needs.

Small Business Term Loans: Term loans are usually given as a set amount. Interest is paid monthly and the principal is typically repaid within 6 months to 3 years. These loans are good for small businesses looking to expand or needing a large sum of money for a one-time expense.

SBA Small Business Loans: Banks offer low interest loans for small businesses as well, and SBA loans are backed and guaranteed by the U.S. Small Business Administration (SBA). These loan amounts can range greatly and are generally attractive to small business owners because of their flexibility and repayment options. The loan process, however, can be time consuming and have strict requirements for eligibility.

Small Business Credit Cards: These kinds of credit cards can be used for smaller business expenses or short-term financing. Interest rates will depend on the kind of card you get as well as the general credit of the cardholder.

(This is a sampling of small business loan options available. Be sure to thoroughly research all your options before applying for a loan.)

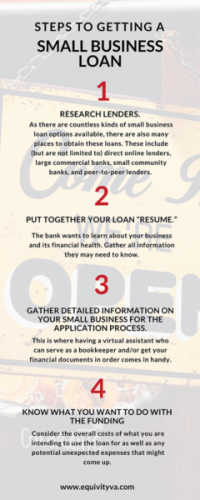

Steps to Getting a Small Business Loan

Once you have an idea of the kinds of loans available to you, continue to prepare for your application by following these steps.

![Everything You Need to Know About Small Business Loans [Infographic] | DeviceDaily.com Everything You Need to Know About Small Business Loans [Infographic] | DeviceDaily.com](https://www.devicedaily.com/wp-content/uploads/2018/01/Everything-You-Need-to-Know-About-Small-Business-Loans-Infographic.png)

1. Research lenders. As there are countless kinds of small business loan options available, there are also many places to obtain these loans. These include (but are not limited to) direct online lenders, large commercial banks, small community banks, and peer-to-peer lenders. Direct online lenders can involve a relatively easy application process; just be sure you are borrowing from a reputable company. Loan amounts will vary depending on your needs, your financial history, and the lender. Borrowing from large commercial banks is the traditional route to getting a business loan. The process will also tend to be a bit more time consuming and include more strenuous underwriting criteria. In addition to large banks, small community banks also offer loans as they have the desire to invest in the community they are a part of. These are good options for single brick-and-mortar stores as well as “mom and pop” shops. There are also a number of peer-to-peer lending website that function as a “middleman” between lenders, individuals, and borrowers.

2. Put together your loan “resume.” Unless you’re applying for a loan online, you’ll likely be speaking to a bank’s representative about your business and needs so that you can learn what kind of financing is available to you. This talk with the bank interview is similar to an interview for a job. The bank wants to learn about your business and its financial health. Information they may need to know includes your credit score, any outstanding loans you might have, your cash flow, business assets, how long you’ve been in business, and the ownership of company. You may also want to prepare to offer information about personal sources of collateral, such as your house.

3. Gather detailed information on your small business for the application process. This is where having a virtual assistant who can serve as a bookkeeper and/or get your financial documents in order can come in handy. The application process may require that you provide your federal tax ID, tax returns, bank statements, a list of executive officers involved in your business as well as their backgrounds (if applicable), your business’ legal structure information (LLC, S corporation, C corporation, etc.), financial statements from the past few years (including a balance sheet, income and losses, cash flow, shareholders, etc.), state filings for your company (like a Certificate of Incorporation or good standing certificates), liability policies, and a business credit report.

4. Finally, know what you want to do with the funding before approaching a lender. A lender will ask you how much funding you are looking for and how you intend to use the money. Consider the overall costs of what you are intending to use the loan for as well as any potential unexpected expenses that might come up. Take into account the repayment terms of different loans and their interest rates. The amount you ask for has the potential to determine when you get the money as well as how much you have to repay and when you have to repay it.

There are an overwhelming number of options to choose from to get small business loans, and the best thing you can do for yourself and your business is to carefully prepare before you begin the borrowing process. By anticipating your company’s needs, what lenders will ask you, as well as what documents they require, you can not only make the process less grueling but also increase your chances of successfully of obtaining a loan for your small business.

Digital & Social Articles on Business 2 Community

(16)