Facebook Wants You To Know That Zuckerberg’s 99% Initiative Is Not A Charity

The company is going out of its way to make the point, which is raising questions about the exact nature of the new initiative.

Facebook is going out of its way to emphasize that CEO Mark Zuckerberg’s pledge to give away 99% of his company shares is not about charity, but philanthropy. It’s a distinction that has non-attorneys scratching their heads and raising questions about the exact nature of his massive donation to a new venture, the Chan Zuckerberg Initiative, LLC. The initiative will fund nonprofit organizations and make private investments, and any profits from such investments “will be used to fund additional work to advance the mission,” explained Facebook.

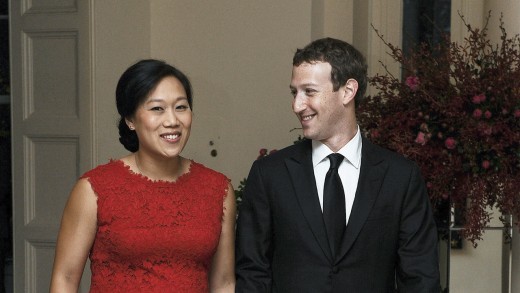

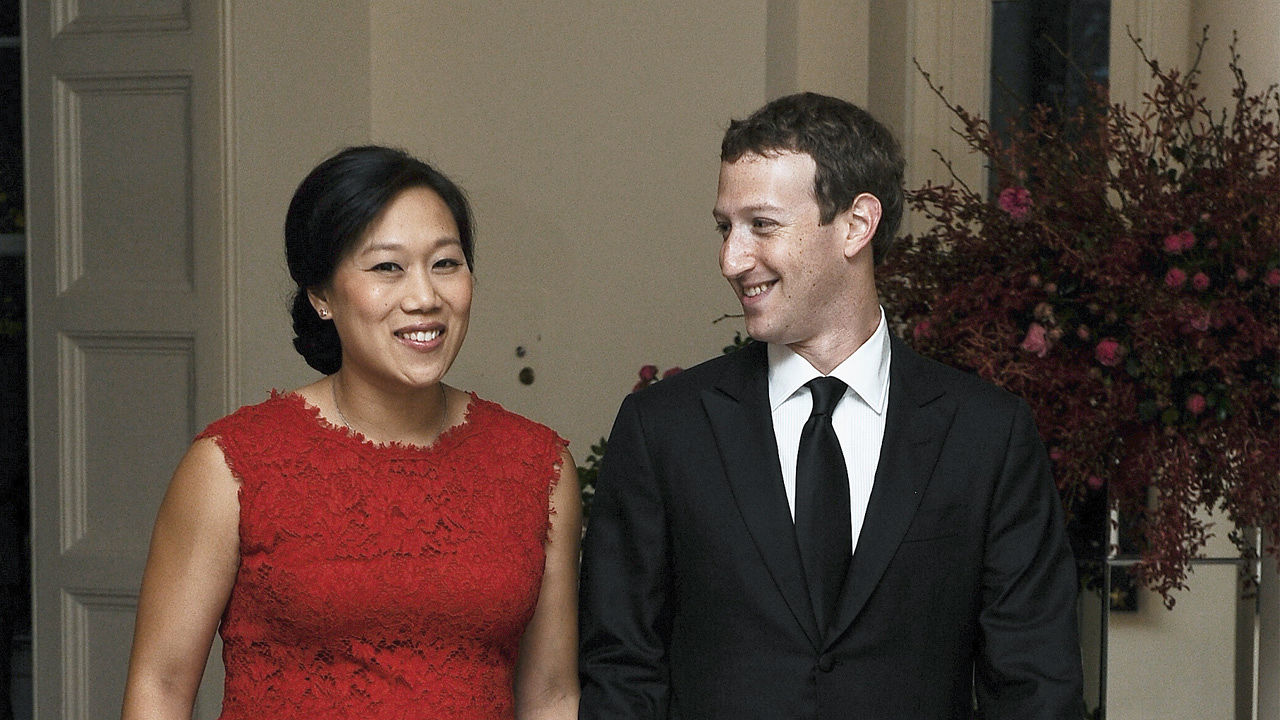

But in a letter sent to Fast Company “on behalf of the Chan Zuckerberg Initiative,” an executive with ad agency GMMB requested a correction to clarify that Zuckerberg and wife Priscilla Chan are not donating their shares to charity but to “broader philanthropic efforts.” Further, GMMB managing director Megan Sather specifically suggested using “philanthropy” rather than charity in a sub-headline and “philanthropic efforts or new initiative” rather than charity in the text of the story.

It’s not clear why Facebook prefers the term philanthropy to charity, except to clarify its purpose. There is no legal distinction between the terms, explains nonprofit lawyer Errol Copilevitz. He explained that giving money to the Red Cross is contributing to charity but “if I go out on the streets during Christmas to a poor neighborhood and give out $100 bills to people, I’m acting like a philanthropist and engaging in philanthropy but not giving to charity.” He speculated that Facebook is trying to emphasize that Zuckerberg’s money will be invested in number of projects where the recipient will not be a charity but the result will be of public benefit.

As ever, Zuckerberg is ahead of the curve since setting up LLCs, a limited liability company, for philanthropic purposes is “an avant-garde approach,” adds Copilevitz, that’s becoming increasingly popular because it allows for the same tax-exempt status as traditional charitable organizations but has a lot more flexibility when it comes to how the money is used.

Typically, philanthropic ventures are nonprofit organizations exempt from federal taxes. It is unusual to engage in philanthropy through an LLC, which is generally used to set up businesses, according to nonprofit tax lawyers. Under California law, it is legal to have nonprofit LLCs, but they are relatively rare. Tax-exempt LLCs need to be owned by a nonprofit organization or philanthropy in a quirk of the law, explains Gene Takagi, the managing attorney of the NEO Law Group. Otherwise, typical LLCs would need to pay federal and state taxes.

According to the Chronicle of Philanthropy, the couple will guide the Chan Zuckerberg Initiative by looking to other philanthropists and “experts and advisory boards to inform opportunities, guide investments, and ultimately determine the areas with the most need and the ways in which their investments can have the largest impact.”

Fast Company , Read Full Story

(24)