For damaged ACLs, It’s Aperion and Pig Tendons to the Rescue

The premise of Aperion Biologics’ business is a bit of a no brainer: present the market with a product used to repair anterior cruciate ligaments of the knee, as a result of there is demand and no longer essentially sufficient provide.

the best way the San Antonio, TX-based totally firm does that is a little more sophisticated. Aperion uses a patented course of to make pig tissue akin to tendons, which can be with ease on hand, usable for human ACL reconstruction. usually, the human body rejects animal tissue that docs attempt to use surgically.

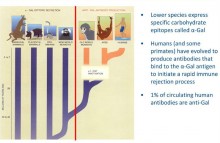

The cells of most mammals , together with pigs, include a carbohydrate known as alpha-gal that human our bodies lack, consistent with Aperion. When animal tissue is placed within the human body, the immune machine responds and tries to attack that carbohydrate, rejecting the tissue. Aperion solves the issue via treating the pig tissue with an enzyme (referred to as alpha galactosidase) that makes it compatible with the human body, while nonetheless keeping the tissue intact, the corporate says. the company additionally makes use of a process to help “humanize” and sterilize the implants, the corporate says.

final yr, Aperion obtained regulatory approval in Europe to sell the treated tissues for use in ACL surgical procedures—which it is starting to do—and now the corporate has plans to are seeking approval in the U.S. with a pivotal trial it hopes to start out in 2016. however first, Aperion is looking for funding and is the usage of a lesser-known choice of coming near the general public markets.

every week ago, Aperion filed documents with the Securities and change fee below what is often called law A-plus, an option for selling up to $ 50 million in inventory throughout the public markets. It hopes to boost as a lot as $ 20 million through the providing, and could listing itself on the NASDAQ Capital Market if the deal goes thru, consistent with chief monetary officer David Cocke. the corporate hasn’t yet mentioned how many shares it will sell or at what worth it would promote them.

regulation A public choices have been imaginable for decades, supposed to lend a hand small businesses lift funding within the public markets, although companies might in the past best elevate as a lot as $ 5 million. In March, the SEC amended the rules of the tool, taking into consideration better choices and requiring firms to provide sure disclosures, akin to two years of audited financials and details in regards to the industry.

Now, Aperion plans to make use of the funds it’ll raise to pursue a 300-person, two-year pivotal trial to are seeking classification III acclaim for its product, which is referred to as Z-Lig. the corporate’s founder, orthopedic surgeon Kevin Stone, led a section 1 security trial in the Bay house earlier than the company was once moved to San Antonio in 2009, says CEO Daniel Lee.

the current management staff led a 66-patient, section 3 trial in Europe in 2011. half of the patients acquired allografts (transplants from a cadaver) as a regulate, whereas the remaining bought a Z-Lig. The latter sufferers have had the Aperion implant for as many as four years, Lee says.

The Z-Lig would compete with these allografts, which will also be in restricted provide, and autografts, that are tissues taken from the affected person’s personal physique, Lee says. That the Z-Lig is quickly available and doesn’t use a patient’s different body elements are advantages, as are the sturdiness and the physique’s acceptance of the software, the corporate says.

“Having an off-the-shelf graft may be very appealing,” he says. “Our complete plan is to deal with the worldwide need for tissue-based totally merchandise.”

around 800,000 folks receive ACL strategies globally every year , which, at a value of about $ 2,500 per process, way it’s a $ 2 billion annual market, in keeping with Cocke. Aperion may also use its process for other ligaments and tendons, as well as for bone alternative and wound therapeutic, the company says.

based in 1996, Aperion commenced looking to market the software when Cocke and Lee joined the corporate in 2008, the executives say.

the corporate expects to make use of one of the most cash raised in the IPO-like offering to make 10 to fifteen hires within the subsequent year for gross sales administration, marketing improve, engineering, manufacturing, quality, and accounting.

Aperion had regarded as raising cash through project capital, however selected as an alternative to are trying to find funding throughout the public markets after the new rules went into effect in June, Lee says. The law A-plus offering is more cost effective and burdensome than a conventional initial public offering, which usually requires more important points of the trade, reminiscent of five years of financials, Cocke says.

“In a public market, you’ll have improved liquidity, higher visibility for the company,” he says. “For the investing public, it’s a chance for them to put money into deals that heretofore have been funded with the aid of a make a selection few private traders.”

traders who aren’t considered permitted—permitted buyers are most often regarded as folks that make more than $ 200,000 in annual profits or have a net price of $ 1 million—are restricted to investing 10 % of their annual earnings, consistent with the SEC.

(78)