How Moda Operandi Is building the posh division retailer Of the longer term

How do you reach the wallets of the 1%? by means of their telephones, of course.

June 4, 2015

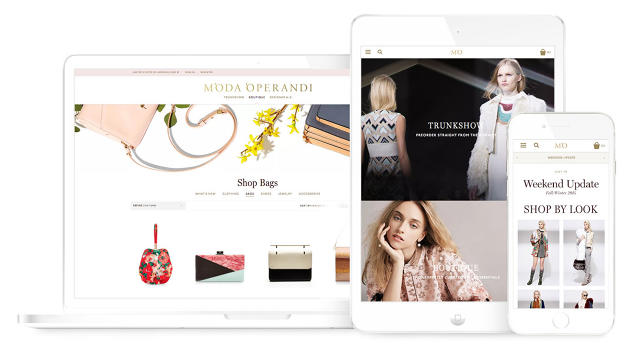

When Deborah Nicodemus took over as CEO of on-line luxurious retailer Moda Operandi, she quick realized that she would want to rebuild the company’s know-how from the ground up. “Our mission is to increase on-line procuring so that it’s a luxury expertise,” she says, “however there were quite a lot of frailties inside the web site.”

Moda’s images was once first class, however basic e-commerce options were significantly absent—there wasn’t even a search bar, to not point out the back-end consumer administration systems which have transform de rigueur. Nicodemus set out to remodel the experience and introduce higher inside instruments, with out sacrificing the editorial aptitude that had set Moda aside.

“We need to share stories,” she says, but with clever merchandising at the back of them.

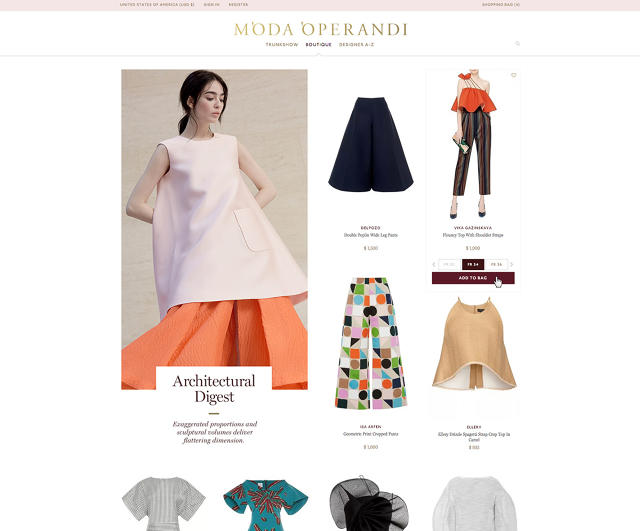

Now, thanks to a major remodel that launched in April, her workforce can do just that. click on via to a “story” from Moda’s home web page—Fringe & Feathers, or Cocktail Hour possibly—and the whole thing is store-ready, the content material and commerce one and the same.

“good e-commerce design, particularly in the luxurious area, is way more experiential,” says Keiron McCammon, chief technology officer, as he scrolls through the brand new pages, the blush red on the web site header matching the blush-purple hue on the walls of Moda’s headquarters. “You’ve acquired to romance the product.”

Moda’s revamp arrives as luxury e-commerce kicks into high tools. global, the choice of individuals worth more than $50 million has more than tripled on the grounds that 2000, in step with a new credit Suisse record. and those ultra-rich households, and their common-wealthy friends, are increasingly more buying online: ultimate 12 months, online gross sales represented 6% of the luxurious market; by 2019, analysis firm Euromonitor world expects that share to have grown to 40%.

“Bricks and mortar remains to be the most popular channel for today’s luxury consumer, with just below ninety four% of all world luxury gross sales nonetheless happening in-retailer,” says Fflur Roberts, head of luxury goods for Euromonitor. “That stated, the web has been transformative now not simplest in the way in which luxurious shoppers have interaction, but in addition in the best way the trade operates. This boom will open up enormous alternatives.”

The race is on to seize that shift in worth. Moda raised a $60 million collection E in February, bringing its whole funds raised to $138.four million. The very subsequent month, Farfetch raised an $86 million collection E, bringing its complete dollars raised to $194.5 million, and Yoox bought net-a-Porter for $775 million.

which you can buy that must-have Prada backpack on all three websites, but in the back of the scenes the businesses look vastly completely different. Farfetch’s offerings are structured around its relationships with local boutiques; the corporate depends on boutique homeowners in cities around the globe to curate product and handle stock.

“Our consumers are searching for newness, for area of expertise,” says Farfetch founder and CEO José Neves. “That’s truly what differentiates us. It’s extra concerning the fashion and the products than the label and the logo.” He used to be calling from the street out of doors Browns, the long-lasting London boutique he had recently purchased with the intention of reworking it into an offline laboratory.

“it can be a super marriage,” he says, arguing that bodily stores will stay a critical element of the luxury market. online, he is seeing buyers gradually warm to the Farfetch concept of looking by way of boutique. “in the first couple of visits, [visitors] have a tendency to head with the aid of product category or model,” he says. “and then, they discover the boutiques after they buy the first time. they tend to get rather more loyal to the boutique, and searching that method.”

Moda, against this, is all about brand-first retail. again in 2010, when skeptics have been nonetheless questioning whether or not online luxurious sales would ever take off, the company burst onto the scene with an revolutionary edition that allowed consumers to pre-order gadgets from model’s top runway displays. thru editorial partnerships with publishers like Condé Nast—cofounder Lauren Santo Domingo is a Vogue contributing editor—Moda increase-hacked its way to a loyal purchaser base of die-laborious model lovers, eager to assert the latest Dolce & Gabbana gown of their dimension. No flash gross sales, no discounts.

“We’re now not interested within the mid-market,” Nicodemus says. “We simply had a shopper purchase a $50,000 fur on our app.” whereas web-a-Porter has opened the door to extra available manufacturers like J.Crew, Moda has been adding jewellery, high quality art, and commissioned items, and lavishing consideration on the posh labels.

That technique has produced stratospheric reasonable order values. “the first yr, she spends $2,300. the following year, it’s $5,000. The year after that, it’s $8,000,” Nicodemus says of her typical purchaser. The runway-based totally aspect of the industry, which Moda calls “trunk exhibit,” represents 60% of the corporate’s complete volume. In that adaptation, buyers create wish lists on the company’s mobile app, as designers release new collections, and then work with stylists to pre-order their favourite objects, paying half of the cost upfront and the remainder when the objects ship.

Moda also sells women’s apparel and accessories via a more traditional retail model, in which it holds the inventory. That aspect of the trade benefits from the pre-order information collected thru trunk show, Nicodemus says.

Like Farfetch, Moda has noticed that consumers are all in favour of looking for out offline experiences. the company began renting out resort suites in Paris all through fashion week, and shortly after made up our minds to open a everlasting London region. “Our plan was once to do $350,000 in a 3-month duration, and we did $472,000 in every week,” Nicodemus says of the London showroom. further areas are slated for Miami, Asia, and the center East.

those moves carry Moda extra in an instant into competitors with conventional shops, who in parallel were playing digital capture-up. As Barneys, Nieman, and Saks enhance, why should a purchaser make a choice Moda?

“We supply them get right of entry to to one thing they do not have, in the form of the trunk shows,” Nicodemus says. Moda has no middleman purchaser filtering probably the most business items in a clothier’s assortment: “We empower shoppers to make their very own decisions.”

Amid the joy over high-finish e-commerce, Sucharita Mulpuru-Kodali, a luxury knowledgeable at Forrester analysis, sounds a be aware of caution. “These companies are completely profitable,” she says of the based avid gamers. “The question is how giant you want to be.”

Moda, after a slow but regular begin, appears to have grown in its aspirations. Commissioning, menswear—Nicodemus, two years into her tenure, is already eyeing new increase opportunities. And on all fronts, she says, “We’re going to continue to spend money on technology. It’s the lifeline to our client.” model may be increasingly global, however its Most worthy customers are only one click on away.

fast company , learn Full Story

(116)