How to Make Sense of Your W-2

— January 31, 2017

You get it every year. The piece of paper that comes in the mail or online detailing your earnings history over the past 12 months. You call up your accountant, log in to an e-file site or if you’re like me, you call your dad and prepare to file your Form W-2.

But what if something doesn’t seem right? What do all those numbers in all those boxes actually mean? You’re not the only one with those thoughts. In fact, we’ve gathered some of the most frequent questions and answered them for you!

Check it out:

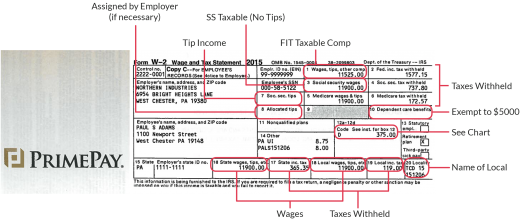

Q: Why are the amounts in Boxes 1, 3, and 5 different? Aren’t those showing the wages I made this year?

A: The quick explanation –

- Box 1 includes the total taxable wages for federal income tax

- Box 3 includes the total taxable wages for Social Security tax

- Box 5 includes the total taxable wages for Medicare tax

If Box 1 wages are more than Box 3, you may have earned more than the Social Security wage limits for withholding (which, in 2016 were $ 118,500).

If Box 3 and Box 5 are greater than Box 1, you may have some deductions that are not subject to federal taxes. If you contributed to your 401(k), there would be a difference. The wages in Box 1 would be lower than those in Boxes 3 and 5.

If Boxes 3 and 5 are not equal, the Social Security wage base was met.

Q: Why do I have two W-2s? Is this a mistake?

A: There are several things that can cause the production of two W-2s. First, there is not enough space in several of the boxes such as Box 14. Any additional amount shown in Box 12 or Box 14 may end up producing a second W-2.

Second, if you live in a state such as Ohio, Kentucky, Indiana, Maryland, Oregon, Pennsylvania or New York that has local taxes, this will produce a second W-2 to have these amounts included (especially if at some point during the year you changed status from married to single, etc.) Please remember to always bring both W-2s to your tax preparer.

Q: Why is Box 2 empty? Why was no federal tax withheld?

A: If your wages were below a certain amount, like if you claimed married 2 exemptions and were paid less than $ 100 per week on a biweekly payroll, no federal tax will be withheld. You can check the Circular E to determine what your federal withholding amount will be.

Going forward, if you want federal tax withheld in 2017, you can submit a new W-4 to your employer to send to your payroll specialist asking for a fixed additional dollar amount or percentage of your pay to come out for federal taxes.

Q: What are all the codes and numbers in Box 12 and what do they mean?

A: See the chart below or click this link to visit the IRS website.

Q: Does it matter if my address has changed? Do I need a new W-2?

A: The IRS uses your name and Social Security number to identify your tax return. If your address is incorrect, you will want to update it with your employer by providing a new W-4 to ensure it is correct for next tax year. You do not need an updated W-2 with your current address if your W-2 had the old address on it.

Want the full rundown that walks you through every single line of the W-2? Click here and scroll to page 15.

Take the stress out of tax season with this free 2017 state-by-state Quick Wage and Tax Guide. Click here to download.

The original version of this post can be found here.

Business & Finance Articles on Business 2 Community

(29)