If anyone can take on Google and Facebook’s ad duopoly, it’s Amazon

In the wave of big-tech quarterly financial announcements this week, we learned that the interactive advertising businesses of Google and Facebook had strong quarters, helped by both the pandemic and the return of the economy. But so did Amazon’s much-lower-profile ad business. Indeed, Amazon, on the strength of its horde of purchasing data, is growing the fastest of all and could eventually challenge the long-standing Facebook-Google duopoly.

Google’s parent, Alphabet, reported $55.3 billion in revenues for the March quarter, a rise of 46% from the March quarter in 2020. The pandemic shutdown began roughly midway through March last year. Its advertising revenue grew 32 percent in the quarter on the strength of search-ad sales. YouTube alone brought in $6 billion in ad revenue, almost doubling from the year-earlier quarter.

Facebook’s revenue, which comes almost completely from ads, jumped 48% from 2020’s March quarter to $26.17 billion.

But Amazon’s ad business appears to have grown the most. The company reports ad revenues as part of its “other” unit, and ads make up the lion’s share of that bucket. For the March quarter it reported $6.9 billion in “other” revenue, marking a stunning 77% increase from the year-earlier quarter.

Most importantly, the Amazon ad business’s growth is accelerating. In the March 2020 quarter the company reported a 44% annual growth in the business.

Amazon’s CFO, Brian Olsavsky, told analysts on an earnings call this week that the company’s ad business has benefited from an increase in traffic to the e-commerce site during the pandemic. But he said that Amazon’s new ad products are attracting attention, and the company’s technology for delivering more relevant ads to users is helping too.

Winners and losers in the digital-ads business are decided based on the quality of the targeting data they use. Google can gauge buying intent based on what people search for or discuss in emails. Facebook can understand product interest based on what its users socialize about and the sites they visit on the internet. But Amazon’s data on what people actually buy may be the best predictor of future product interest. That’s catnip to advertisers, and Amazon is sitting on a pile of it.

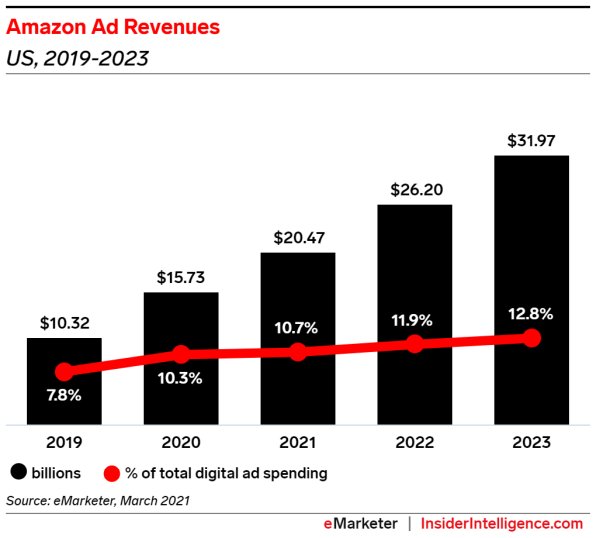

eMarketer said Amazon held a 10.3% share of the U.S. digital-ads market in 2020 (up from 7.8% the previous year), with Google holding 28.9% and Facebook 25.2%. In March the researcher reported that Amazon’s U.S. share had risen to 10.7%, but that calculus didn’t include Amazon’s first-quarter numbers. eMarketer expects Amazon’s share to continue growing steadily through 2023.

Amazon’s ad business started out by offering display and search ads on Amazon sites, a big opportunity in itself. But the company has added more ad products, and its offering now looks more like those of Facebook and Google. For instance, Amazon now operates a demand-side platform (DSP) where advertisers can programmatically bid on ad spots that appear on partner sites around the web. If Amazon’s ad revenue ever grows to rival Google and Facebook in size, such off-Amazon activity will be key.

(19)