LevelUp Bags $50M From JPMorgan Chase & Others For Mobile Payments

LevelUp’s story is one of twists and turns and ups and downs. Right now, it looks like the company is on an upswing.

Today the Boston-based mobile payments firm announced a $ 50 million funding round, which includes $ 37 million in equity funding and $ 13 million in debt financing, according to an e-mailed statement attributed to Alex Shuck, LevelUp’s director of marketing and analytics. Investors in this round include earlier backers JPMorgan Chase and U.S. Boston, as well as new investors such as CentroCredit Bank, according to a news release.

Nine-year-old LevelUp had previously raised around $48 million in equity funding, Shuck said. The company’s other investors include GV and Highland Capital Partners.

LevelUp started out as SCVNGR, offering a text-message-based platform that corporations, associations, and nonprofits could use to set up interactive scavenger hunts and other on-site activities. It later introduced a consumer app that took a gamified approach to location “check-ins,” and then added a deals service called LevelUp that incentivized consumers to unlock additional discounts after making an initial discounted purchase.

The company eventually shut down the SCVNGR app, ditched that name, and moved into mobile payments processing, primarily for the restaurant industry.

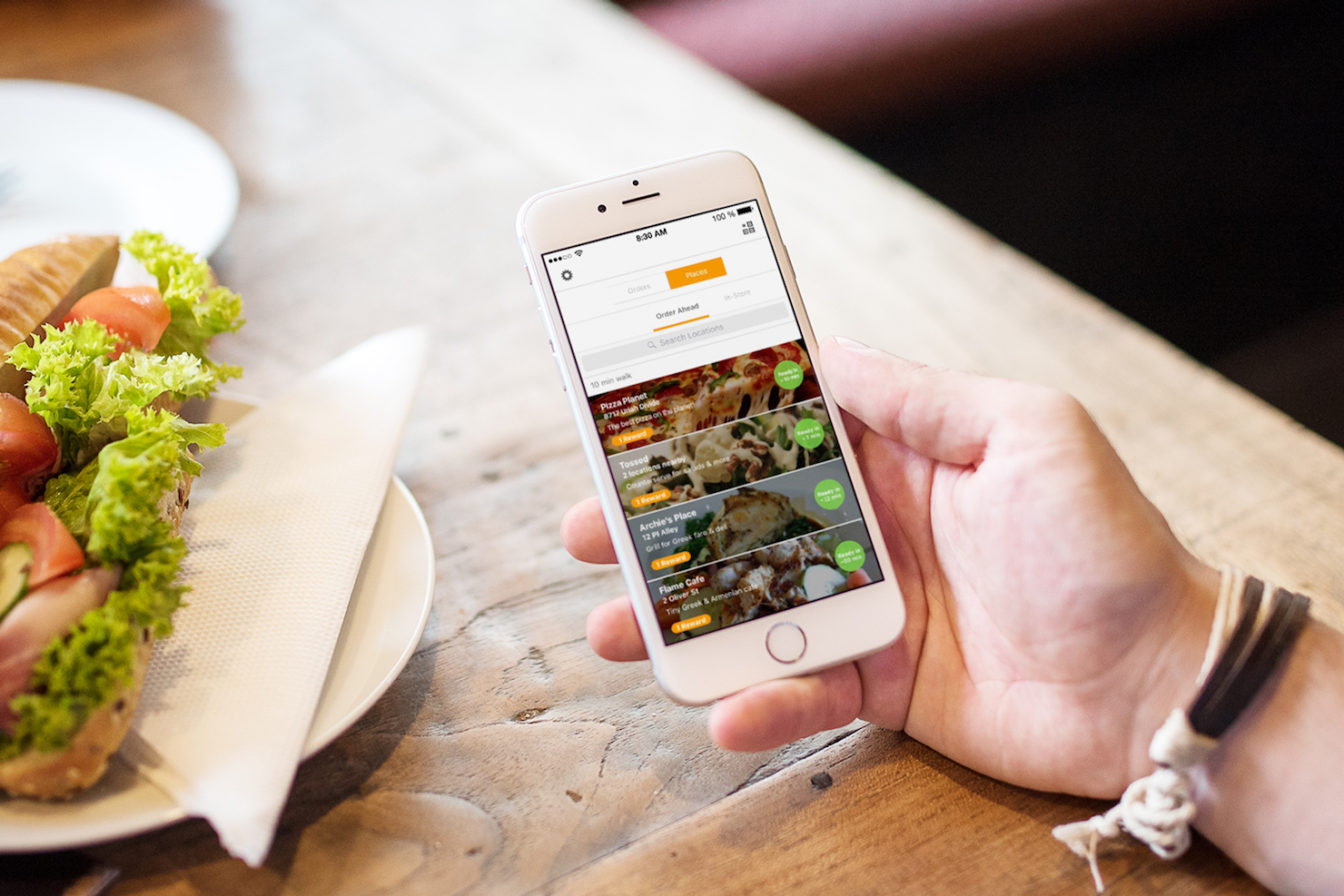

Now, the company’s products include a LevelUp app that enables consumers to order food for pickup from thousands of eateries nationwide. The company also helps restaurants such as Potbelly Sandwich Shop, Sweetgreen, and Tropical Smoothie Café build their own apps to handle transactions and customer loyalty programs. In addition, the company provides data analytics tools and customer relationship management software that can help deliver targeted promotions to patrons.

LevelUp also has a developer platform that enables merchants and other businesses to use its technology tools and data in their apps. For example, Chase uses LevelUp technology to power certain aspects of its mobile payments app.

The company declined to share its current valuation, its annual revenues, and whether it’s profitable. Shuck said nearly 1 million people use its software to complete transactions each month.

Other players in the mobile payments sector include Stripe, Square, Apple, Samsung (which acquired Boston-area startup LoopPay), and PayPal (which bought local companies Paydiant and Where).

LevelUp’s employee count has risen and fallen over the past few years as the business evolved. The company currently employs 150 people, up from approximately 85 employees a year ago, Shuck said. It’s hiring across engineering, marketing, and customer support, he added.

Photo courtesy of LevelUp.

(17)