MarTech Nirvana or Bubble? You Be the Judge

May 20, 2016

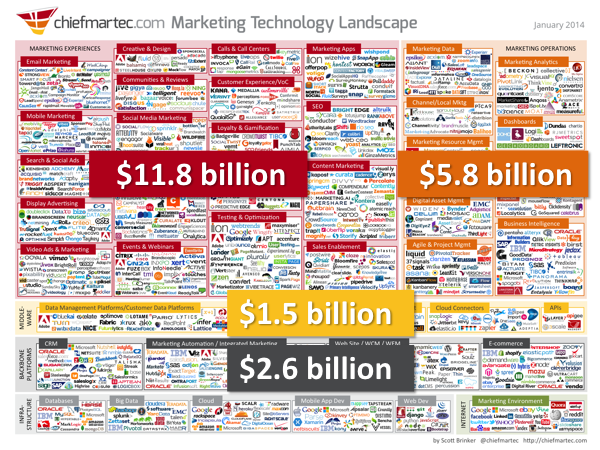

MarTech is reigning supreme. According to Chief Marketing Technologist blogger, Scott Brinker, there are close to 4,000 MarTech companies currently tracked in 2016, compared to just over 150 in 2011. That is an impressive 4,000% growth. In his latest MarTech supergraphic, Brinker identified 220 tools in Sales Automation Enablement and Intelligence, 186 in Social Media Marketing & Monitoring, 180 in Display and Programmatic Advertising, 161 in Marketing Automation & Campaign/Lead Management, and 160 in Content Marketing.

Analysts predict MarTech is only going to keep growing, with IDC forecasting that the worldwide spend for marketing software will grow to $ 32.3 billion by 2018 from $ 22.6 billion in 2014. Given the breakneck speed of growth, many are wondering if we are witnessing a MarTech Nirvana or Bubble. I would argue that the tipping point is upon us, the spring cleaning of MarTech is coming as rigid soloists and “all-in-one” uber-platforms fail to meet the needs of agile marketing and business leaders.

If history proves us right, let me offer two seminal books that contain the answers to the MarTech nirvana vs. bubble debate – Momentum: How Companies Become Unstoppable Market Forces by Ron Ricci and John Volkman and Strategy Rules: Five Timeless Lessons from Bill Gates, Andy Grove, and Steve Jobs, by David Yoffie and Michael Cusumano. The secret to tech success has and continues to lie in companies’ ability to build rich tech ecosystems – because killer brands are never finished and they never stand alone.

Companies like Apple, Google, Amazon and Cisco have become unstoppable market forces not only because of their product and tech superiority, but because they have also successfully mastered is the art of ecosystem-building. As of July 2015, according to Statista, Android users were able to choose among 1.6 million apps, while the Apple’s App featured over 1.5 million available apps. Where MarTech has come short is in this powerful ecosystem effect – as Scott Brinker puts it, MarTech has failed to build leading platforms, like the Windows operating system, or ecosystems, similar to Google’s Android or Apple’s app store.

The market is too fragmented, too similar and too noisy. So what is going to happen next?

Digital Darwinism Will Kick In – and Soon

There can’t be more technologies than there are companies to buy or use them. In the 2015 article “The Frankenstein Conundrum,” I discuss the mish-mash of disjointed tech emerging from a heavy year of mergers and acquisitions across the MarTech space. The growth argument at the time seemed to weigh in favor of all-in-one marketing clouds. Although the spirit of unification was there, the execution of it in MarTech was shortsighted. As Brinker notes, the results have been mixed at best – Salesforce played the platform card early — and at least within the CRM space, it has had the largest market share (18.6% as of last year), while Marketo made a big public commitment to being a marketing platform. And Scott is quick to add: “But for many, it seems like platformization has remained a secondary objective.”

There Is a Bubble, and It Will Burst – Soon

Remember the dot.com bubble of the late 90ies? It is hard to ignore the striking similarities of old and new times:

Growth vs. sustainability? One has to wonder if behind all the bombastic MarTech growth numbers lies the little told story of unsustainable business models. Yes, ecommerce and advanced analytics software were among the market segments with the highest rates of growth per Gartner. But this growth is not translating necessarily in increased value for the company, its stakeholders or customers. Twitter’s $ 100M investment in MoPub is a case in point. In 2013, this projected AdTech darling only pulled in $ 6.5 million.

Abundance of VC funding – a blessing or a boon? The estimated investments raised by MarTech firms via venture capital and private equity were in the $ 21.8 billion range in 2014, and this doesn’t include money raised from public offerings or untracked angel contributions. Examining this MarTech investment activity, Brinker tells it like it is – investors continue to believe “there’s room for multiple multi-billion dollar specialist platforms within the marketing domain.” Highly doubtful that this is the case in a MarTech space that continues to fragment, and doesn’t play together well.

It seems to me that MarTech is about to undergo some serious spring cleaning – the kind of cleaning you do when you move to a new house as opposed just tidying up the attic. Cloud marketing hubs need to fulfill their promise of one stop shopping. That means they need to tidy up their own batch of seemingly incomplete integrations. Remember, most cloud marketing hubs came together through multiple acquisitions, and while their marketing messages beam with themes of full integration, reports from the field still point to a mix of related yet not fully integrated modules. Marketing cloud hubs need to make full integration of owned modules a reality, and then they need to make it easy to connect to technologies outside of their ecosystem anywhere, at any time. Even the most complete hubs can’t provide coverage for emerging channels as consumers shift behavior, and as new shopping and buying models evolve. Those cloud hubs that position themselves well with proven integration models might be well positioned for a small buying spree as the best of breed players deal with increasing pressure to generate profits, or exit the market as discussed below.

The Best of breed solutions need to clean up old business models that might not be viable if they are indeed to survive by going it alone. There is only so much runway for the business model that piles up losses on the back of large client sign-ups. Marketing isn’t a discipline that lends itself well to churn and burn customer sign-ups. There will invariably be vendors who create compelling client value in their best-of-breed technologies, and should be able to monetize that value to generate both growth and profits. However, there also be vendors whose mix of value and business model simply don’t cut the muster. In fact, I think that there are hundreds of vendors in this category, and there simply has to be a shake-out at some point. Vendors who are neither profitable enough, nor growing quickly enough are in a tough spot. Their survival depends on VC funding and the ongoing patience of shareholders to see a light at the end of the tunnel.

I could be wrong, but I for one welcome this change and a bit of consolidation. I also think that Scott Brinker might hurt himself if he has to squeeze ten thousand vendors onto it next year’s Lumascape. MarTech needs to accept that the winners will have to play nice with each other to create the ultimate end-to-end value for the customer. Because if we don’t do it, our CMO friends will push us to do it. We can wait and see or we can jointly reverse the bubble and build the coveted MarTech nirvana the sustainable way, and on the backs of sustainable businesses that brands can rely on for the long haul.

Digital & Social Articles on Business 2 Community

(18)