Measuring Media Driving In-Store Foot Traffic In Multichannel Campaigns

Measuring Media Driving In-Store Foot Traffic In Multichannel Campaigns

by

Laurie Sullivan , Staff Writer @lauriesullivan, January 29, 2018

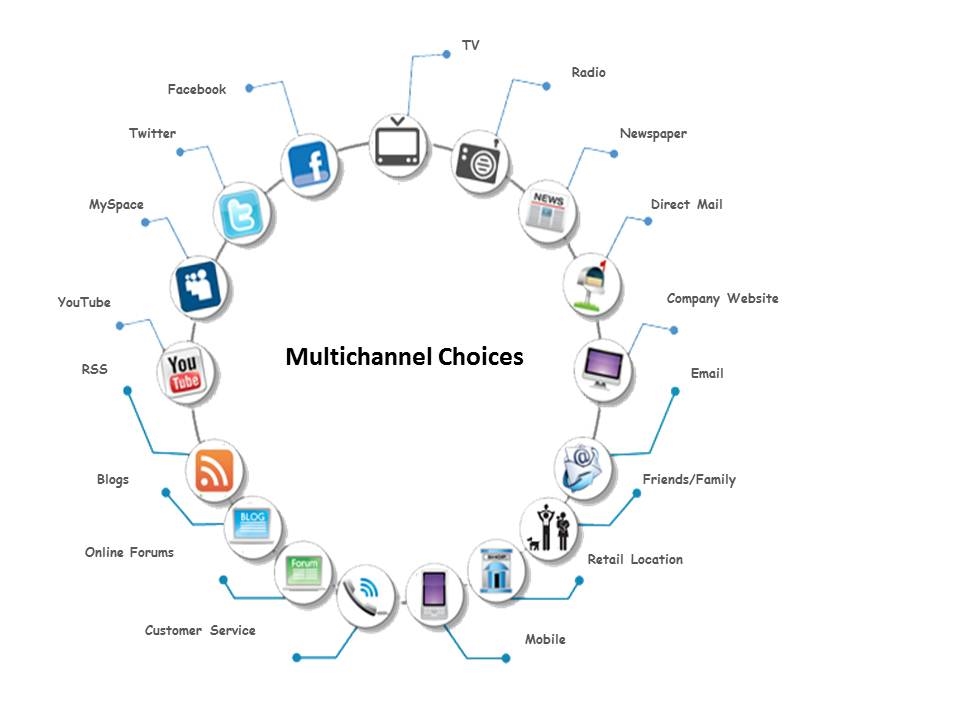

Marketers are just about there — that is, having the ability to measure in a multichannel campaign the type of media that drives foot traffic into a store.

Some companies, like Reveal Mobile, can measure and compare foot traffic. But the key will become measuring the foot traffic based on the media channel.

Google made it easier to identify when search drives in-store visits, but it’s still a bit difficult to determine the type of media driving visits from a multchannel campaign. More companies are getting closer to making that connection.

in late 2017, Reveal Mobile analyzed social-media events at Chick-fil-A, McDonald’s and Wendy’s and matched them to location-based data.

The analysis revealed that paid campaigns tend to sustain foot traffic in stores longer and more effectively than organic campaigns. In the case of McDonald’s, however, the data showed it took about 24 hours for the campaign to kick in and drive the traffic, but once it did more people visited the restaurant on October 8, 2017 to try its Schezuan sauce than the actual day of the promotion, Oct. 7.

Reveal Mobile used the latitude and longitude data from phones to analyze foot traffic. The company has about 100 million devices month that provide location data to track consumer phones.

Identifying the type of media in a multichannel campaign that drove consumers into the store would become much more valuable, but it does get a little complicated.

“For the Chick-fil-A’s campaign we could not identify the media, but the McDonald’s and the Wendy’s campaigns took place primarily on Twitter, so it was easy to tell,” said Brian Handly chief executive officer at Reveal Mobile. “We would have the ability to tie ad impressions to foot traffic if we had a list of the mobile advertising ID that saw an ad.”

The analysis wasn’t about tying online ad impressions to in-store visits, but it should be. However, Handly said Reveal’s technology would have the able to identify the total number of mobile ad IDs in a physical location. “In theory, you could do that,” he said.

Reveal Mobile also supports what Handly calls an audience extension platform that identifies a phone’s ID based on where it’s been and uses its mobile ad ID to target advertisements.

Today the company focuses on being able to find the device at the location on a specific day, similar to the way it identified a lapse in store visits for the McDonald’s campaign.

Users must grant the app and phone permission to share their location data. And this type of data can provide a wealth of foot traffic knowledge.

Brands can get a pretty good idea of when consumers visit their locations when the app is installed on the phone.

During the holiday season, for example, Reveal Mobile data identified that on Dec. 24 Wal-Mart Stores actually received 38.4% of the foot traffic, compared with Target at 17.4% and and Lowe’s at 10.2%.

MediaPost.com: Search Marketing Daily

(22)