Mobile Local Search Ad Share To Decline, But Maintains Largest Share

by Laurie Sullivan, , Staff Writer @lauriesullivan, June 16, 2016

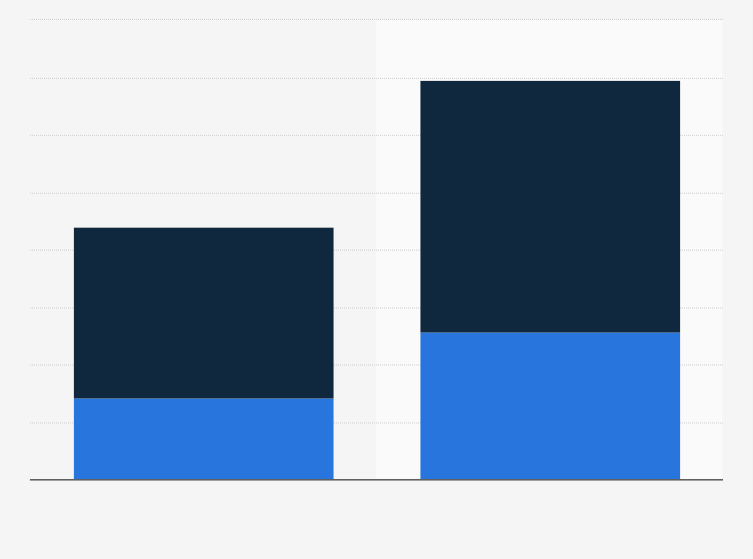

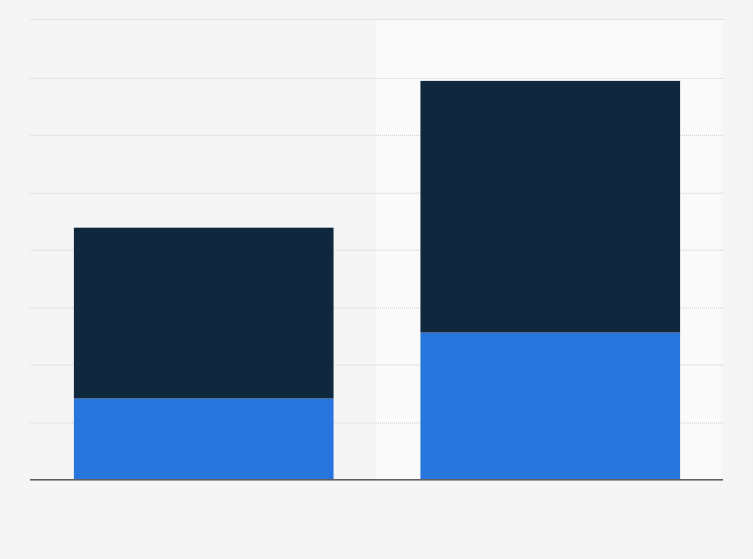

Mobile advertising represents 8.8% of local advertising spend in 2016 and will rise to 17.1% by 2020, according to data released Thursday by BIA/Kelsey.

The U.S. Local Media Forecast 2016 estimates the location-targeted mobile ad revenue at a 24.6% compounded annual growth rate, from $12.8 billion in 2016 to $16.3 billion in 2017 and $29.5 billion in 2019. By 2020, the ad revenue will hit $29.5 billion.

BIA/Kelsey’s estimates that for location-targeted mobile advertising is based on a user’s location or includes content relevant to an individual’s location to trigger local offline conversions. It includes large national advertisers, SMBs and local advertisers that are not SMBs, and location-specific ad copy or calls to action that classify a given ad as location-targeted.

Search will account for 57% of the local-targeted mobile ad spend by advertisers in 2016, falling to 42% in 2020 — and will be the only market segment to decline, yet continues to hold the largest share, according to data.

Traditional display will take 16.9% of the budget in 2016, rising to 19.2% in 2020. Native social will be another big winner, with 19.8% of ad spend vs. 28.1%, respectively. Traditional vision will remain relatively flat at 5.5% and 5.6%, and messaging will rise from 0.8% to 5.1%, respectively.

While search will continue to hold the largest share, most mobile use happens in apps, which BIA/Kelsey views as one of the biggest reasons for the decline in search ad spend for local-targeted mobile advertising. Google’s search volume is built from Web browser traffic, but it has done everything possible to force search into apps by building platforms like Google Now, and Gboard, an iOS app the company released in May. Google’s success with these emerging apps will determine its position in mobile advertising.

The search category in this forecast includes in-app search as well as the performance-based advertising that occur within local listing apps such as Yelp and YP. It also includes pay-per-call advertising that happens through tools like Google AdWords Extensions.

In a forecast released earlier this month, BIA/Kelsey estimated that the overall local media marketplace should reach approximately $172.2 billion by 2020, driven by exceptional increases in mobile and social advertising, continued strong political advertising in even-numbered years, and an overall growth in the U.S. economy.

MediaPost.com: Search Marketing Daily

(10)