Prime Membership Growth Is Slowing—But By How Much?

Amazon hailed this year’s Prime Day, held July 11, in typically cryptic fashion. It was the “biggest global shopping event in Amazon history,” with sales up 60% over last year and a “record” number of Prime shoppers participating, the company announced (July 21, 2017). The only thing missing? The number of Prime members participating, or a sales total for the day overall. Even sales figures for the Echo Dot, Prime Day’s top-seller, were kept under wraps.

Twenty years in, Amazon analysts have seen this movie before. They know better than to expect CEO Jeff Bezos and his e-commerce empire to provide the answers they crave about Prime and other aspects of Amazon’s business. Instead, they have learned to look for clues in how the company behaves.

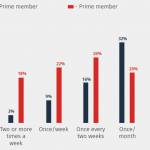

This year, those clues came in the form of the deals Amazon chose to promote. If Prime Day used to be a tool for acquiring new Prime members, it is now a tool for further cementing Amazon’s broad relationship with its customers.

“Prime membership growth has started to plateau,” says Michael Levin, cofounder of Consumer Intelligence Research Partners, a Chicago-based firm that surveys Amazon customers. “This year’s Prime Day was designed to train Prime members to do other things—to download the Amazon app, to buy an Echo. They were trying to dig deeper into that base of Prime members and do more with it.” The more time customers spend in the Amazon ecosystem, the more profitable they become.

In parallel, there are other signs that Amazon is starting to look beyond its largely affluent customer base. Among U.S. households making over $75,000 per year, Prime penetration is approaching 65%, according to Morgan Stanley. But an enormous swath of America earns far less. As of June, shoppers eligible for government assistance can now sign up for Prime at the reduced rate of $5.99 per month. “They might learn some stuff about how lower-income consumers in less developed economies think about Prime and want to buy,” says Levin.

Evidence that Prime is nearing market saturation in the U.S. has brought new urgency to a question that has dogged analysts since Prime launched in 2005. Bezos routinely boasts that Prime membership is somewhere in the “tens of millions”—but how many tens of millions, exactly? That’s where things get tricky. It’s 65 million, says Morgan Stanley, which backed into that number based on Amazon’s 2016 subscription services revenue. More like 80 million, says competing Wall Street firm Cowen. Try 85 million—in the U.S. alone, says Chicago-based firm Consumer Intelligence Research Partners, based on its proprietary online surveys.

Bezos has yet to weigh in and resolve the debate. At times, his reticence has approached the level of farce. In 2014, for example, he proudly presented a bar chart depicting Amazon Prime member growth—with no Y-axis scale or data. When the company does release data, it focuses on “showing the strength of Amazon without showing the strategy of Amazon,” says Forrester e-commerce analyst Brendan Witcher.

Jeff Bezos standing in front of a chart with … No actual figures!!! pic.twitter.com/WibrJ1kSvv

— Tim Stenovec (@timsteno) June 18, 2014

To some extent, all retailers keep mum about their customer data. “This is typical,” says Witcher. But Amazon arguably takes that competitive imperative to a new extreme—and gets away with it, because of Wall Street’s current faith in Bezos (Amazon’s stock, today trading at over $1,000, has doubled in value over the last 18 months). Investors’ overwhelming trust in his ability to deliver results means that naysayers have little leverage to force disclosures. In return, Bezos occasionally releases a data point designed to assuage any skeptics. This past February, for example, Amazon finally provided an annual sales number for Prime and other retail subscriptions: $6.4 billion for 2016.

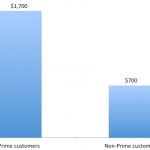

If Amazon charged its standard $99 fee for every Prime subscription, doing the math on its member numbers, based on that $6.4 billion figure, would be relatively easy. But Prime is an increasingly complicated mix of price points, with some customers paying a student rate and others taking advantage of free trials. Plus, a Prime member’s value to Amazon continues to evolve, as the company expands into categories like fashion and grocery. Going forward, the estimated $1,300 that Prime members spend with Amazon each year will likely increase—as it must, in order to offset the loyalty program’s slowing growth rate. In that context, Amazon’s recent purchase of Whole Foods, for $13.4 billion, makes perfect sense.

Jeff Bezos continues to keep Amazon’s data under lock and key.

Amazon hailed this year’s Prime Day, held July 11, in typically cryptic fashion. It was the “biggest global shopping event in Amazon history,” with sales up 60% over last year and a “record” number of Prime shoppers participating, the company announced (July 21, 2017). The only thing missing? The number of Prime members participating, or a sales total for the day overall. Even sales figures for the Echo Dot, Prime Day’s top-seller, were kept under wraps.

Fast Company , Read Full Story

(40)