Retailers Big And Small Want A Piece Of The Thriving Korean Beauty Business

I showed up at a Korean beauty blogger panel discussion in Los Angeles this past July because I wanted to understand the appeal of snail mucus face masks. The panel was part of KCON, the world’s biggest Korean culture convention.

I was turned away at the door. The hall at the L.A. Convention Center, which could hold hundreds of people, had become a fire hazard.

“We’re filled to capacity with this one,” a guard told me. I begged, and eventually he let me inside, where representatives from top Korean beauty blogs discussed such topics as oil production and acne scarring and something called “bubble peeling” to an audience so rapt you’d think they were in the presence of deities. It didn’t matter that near-deafening drums next door threatened to drown out the speakers or that the room suffered a two-minute blackout. These people—men and women of all ages—were devoted.

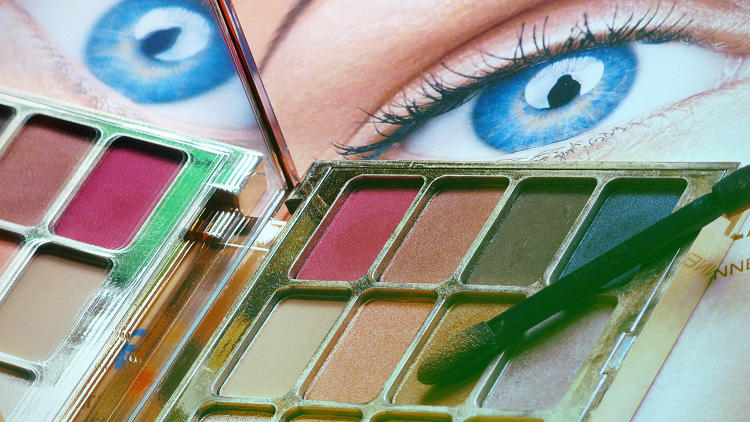

Korean beauty encompasses a wide range of both skincare and makeup products and is known for a few key factors—most notably, creative innovation in packaging and product formulas that often rely on unusual natural ingredients, like bee venom or artichoke extract.

The category has been popular in the States for several years now, and demand is showing no signs of slowing down. According to the Korea Customs Service, the country’s exports of cosmetics totaled $2.5 billion last year, up 53.1% from 2014. (In comparison, their cosmetic exports were at $1 billion in 2013.) Specifically within the U.S., exports hit $663 million last year, a 56% uptick from 2014. Last month, Goldman Sachs Group Inc. and Bain Capital Private Equity announced they will acquire a majority stake in the Korean cosmetic firm Carver Korea Co. Ltd., while the luxury giant LVMH bought a minority stake in South Korea’s Clio Cosmetics for $50 million. Smaller upstart companies have jumped in as well—from Korean beauty incubators to e-tailers that double as content providers.

The hyper-competitive Korean makeup business pushes brands to innovate at a rapid rate, which accounts for the high number of products released each season—and the need for sites to review them. Many of these brands are trying to do more than just sell products: They’re promoting a whole cosmetics culture, an attitude toward skincare that is all about indulging oneself and enjoying the ritual of doing so. And of course they hope to instill the idea that these practices should become a permanent part of the American beauty routine.

The fascination with Korean beauty brands can be traced to BB (beauty balm) creams, a makeup-skincare hybrid of foundation mixed with anti-aging properties. Sephora took notice of innovations coming out of Korea seven years ago, but it wasn’t until they came in contact with BB creams as a category that they decided it would be a good business investment.

“These all-in-one color and treatment products were perfect for the fast-paced North American consumer who wanted more multitasking products,” says Cindy Deily, senior director of Merchandising for Sephora.

BB creams were the ultimate gateway drug: easy, quick, and effective. For the average time-strapped American woman, convenience is crucial, and BB creams offered multiple benefits in one little package. While many aspects of Korean skin rituals involve multiple complex steps with various products, importers knew to cherry-pick simplicity for an audience in the States.

“I don’t think U.S consumers are ever going to use 12 products—that’s not realistic,” says Margie Nanninga, beauty analyst at the market intelligence agency Mintel. “Skincare isn’t a high enough priority for where we would adapt such thorough routines, so we’re kind taking the bits and pieces from the Korean market.”

With BB creams firmly perched on their bathroom shelves, American women became more curious about Korean beauty. It has an allure of something foreign and exciting, thanks to ingredients like salmon eggs or sake. As Deily says, it’s the combination of “innovation, dedicated routines, efficacy, and playfulness.”

“American consumers are very results-driven and they’re recognizing that Korean women put a very strong emphasis into their skincare routine,” Nanninga says. “They think there might be a secret that the Korean market has figured out that we’re missing out on.”

Today, Sephora sells hundreds of Korean products and even hosts a dedicated K-Beauty page on the company website. “We believe our early adoption of this trend at Sephora, along with the increase in social media and YouTube vloggers from around the world really helped to accelerate our clients’ interest,” Deily says. The company’s top sellers include Dr. Jart+ sheet masks—serum-infused masks that you can use and toss—and Too Cool for School Egg Mousse Soap, a whipped egg white mousse cleanser infused with egg yolk extract to hydrate skin.

Ulta, another giant beauty retailer, has also ramped up its offerings, now selling eight different Korean brands and over 150 products. Masks are a hit. “They’re an approachable, inexpensive way to treat yourself to an indulgence,” says Julie Tomasi, SVP of Merchandising. Ulta consumers increasingly prefer non-chemical ingredients, which is a staple of Korean skincare. “The interest for natural ingredients continues to grow,” Tomasi says.

Birchbox, meanwhile, launched a Korean beauty limited-edition box in September 2015 that sold out in less than a week. “We saw huge demand and engagement from our customers,” says Eric Neher, VP of Merchandising at Birchbox. “Our customers prioritize treating their skin over concealing it, and the Korean focus on great skincare really resonates.”

One of the leaders in this category is AmorePacific, a cosmetic company in South Korea that boasts more than 20 brands, including Sulwhasoo, Laneige, Mamonde, and Etude. They alone account for 40% of all Korean beauty market sales worldwide, and the company is growing more than 30% a year.

AmorePacific’s products are sold at Sephora, Neiman Marcus, and Nordstrom. Its biggest hit is the innovative AmorePacific “cushion foundation,” a portable compact application for coverage infused with Asian botanical ingredients and SPF. The compacts’ soaked cushion applicators allow consumers to apply liquid makeup mess-free on the go. Some beauty bloggers have said it revolutionized the foundation sector.

“Everyone had a very specific view on what foundation should be and look like, and we disrupted that,” AmorePacific president Brad Horowitz says.

Korean beauty is not just a mass-retailer game. Smaller independent retailers are now dedicated entirely to this sector. Glow Recipe was founded in 2014 by Sarah Lee and Christine Chang, two former L’Oréal employees. They wanted to educate consumers on the diversity of Korean brands, emphasizing items that would resonate with the American market.

“A lot of the Korean products were brought over to the U.S. as they were, and what we learned [from our L’Oréal experience] is that if you have products that work in a specific country, it doesn’t mean it will translate the same way or be perceived the same way in the U.S.,” Lee says. The duo localized the positioning of the products so American consumers could understand and easily use them, demystifying the perception that Korean beauty is complex and overwhelming.

For example, they created the term “rubber masks” for an existing Korean skin treatment that involves applying a thick layer of vitamin-enriched rubber that conforms to one’s face. “We created a new category,” Chang says.

In Nov. 2014, Glow Recipe made $3,000 a month, but within five months—with a boost from an appearance on ABC’s Shark Tank—Glow Recipe raked in half a million. Now they not only boast a successful online business, they’ve begun consulting for more established retailers, Sephora among them, on which Korean brands to sell in stores. In addition to curating new and upcoming products, Glow Recipe provides Sephora with a range of content, including video tutorials that explain in detail some of the more complex processes. (I personally had to watch the video for “splash masks,” mini-facials that demand specific product-to-water doses and repetitive splashing, four times.)

“Sephora was curating well, but we want to make sure to give them products that have great ingredient lists and can deliver well,” Lee says. Glow Recipe also helps Sephora keep up to date with the influx of Korean brands that are constantly launching new products. “There are no breaks within innovation. It’s why the world is looking at Korea for inspiration.”

There are more niche American retailers, including Soko Glam, Cosmetic Love, and Via Seoul. The latter, previously known as Insider Beauty, sells a meticulously curated line of cult favorites from Korea, like temporary tattoos for eyebrows and a face mask infused with real 24K gold. It caters to women in their 30s and 40s with more mature skin needs. Via Seoul boasts a 70% growth in sales year-to-year, but according to CEO Angela Kim, would like to expand to a broader consumer base.

The online beauty destination Peach & Lily launched in 2012, when there were 1,200 beauty brands in Korea. “Today there are over 9,000,” founder Alicia Yoon says. She explains that her American audience was originally drawn to the uniqueness of Korean products but became repeat customers after benefitting from what she says are real results.

“Korean beauty consumers are some of the most globally demanding beauty consumers, who push beauty brands in Korea to meet sky-high expectations,” Yoon says via email. “The result is highly efficacious and gently formulated products with a delightful sensorial experience when it comes to texture, scent, and application. To boot, the products need to be retailed at a value-driven price point and the packaging and applicators all need to wow and stand out.”

To that point, this is just the beginning. Currently, a good portion of Korean beauty is limited to higher-end, prestige brands like AmorePacific, but Mintel is betting that interest will trickle down into more mainstream players over the next few years.

“Skincare is a very competitive market, and brands are looking for ways to stand out,” Mintel’s Nanninga says. “And I think [incorporating Korean beauty culture] is going to be one of the strategies to stand out to consumers.”

One idea that the more affordable cosmetics companies might want to master if they do decide to pursue Korean beauty is already old hat to the upscale niche retailers. “We’ve been using the term skin-tertainment,’” says Glow Recipe’s Lee. “The idea that skincare is not a chore—it’s just as fun as makeup.”

Korean beauty is no fleeting fad. It’s one of the fasting-growing sectors in the cosmetics industry.

Too Cool for School’s Egg Mousse Pack is enriched with egg yolk extract to nourish and calm the skin ($20, sephora.com).

Yuri Pibu’s Artichoke Power Essence is made with 60% artichoke extract ($38, Glowrecipe.com).

AmorePacific’s Color Control Cushion Compacts offer buildable SPF coverage in a mess-free compact ($60, sephora.com).

Skin Food’s Peach Sake Pore Serum is a lightweight essence containing rice sake, peach extracts, and silica powder to help minimize the appearance of pores ($16, ulta.com).

May Coop’s Raw Sauce is a hydrating essence that is highly concentrated in maple tree sap and botanical antioxidants ($43, peachandlily.com).

Dr. Jart+ Dermask Laugh Line Lift has skin-firming hydrogel patches to target deep lines saggy skin ($12, birchbox.com).

Clio’s Tinted Tattoo Kill Brow + Pouch lets you fill in sparse areas for a look that can last up to 7 days ($25, viaseoul.com).

Fast Company , Read Full Story

(30)