Snap’s AR is getting down to business

In a world in which augmented reality can feel like it’s perennially tomorrow’s news, Snapchat is one of the few places it’s already being embraced at scale. Each day, 250 million of the app’s 375 million daily active users summon its AR lenses to transform themselves with new virtual hairstyles (or no hair at all), baby faces, instant face tattoos, rainbow teeth, fantasy pets, and much, much more.

But for one of its latest forays into AR, Snap is going in a direction that’s less about quirky entertainment than a more practical concern: helping other companies sell stuff. It’s a new business called AR Enterprise Services—or ARES for short—that the company unveiled last month and is spotlighting today at its Snap Partner Summit conference in Santa Monica.

ARES takes the foundational technologies that power Snapchat’s AR and turns them into a software-as-a-service platform that developers can use to incorporate AR in their own apps and websites. It’s a logical way to make the company’s sizable investment in AR pay off in ways that go beyond keeping Snapchat fans glued to the app.

Over the years, Snap has “learned a lot about what we need to do from a technical perspective and a creative perspective to deliver AR that actually adds a lot of value in someone’s life,” says Snap cofounder and CTO Bobby Murphy. “We do that through the hundreds of millions of people who are engaging with AR in our service every day. And now we have a chance, through ARES, to work with other companies and really work on delivering similar value.”

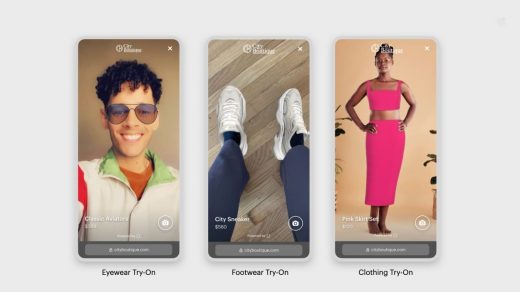

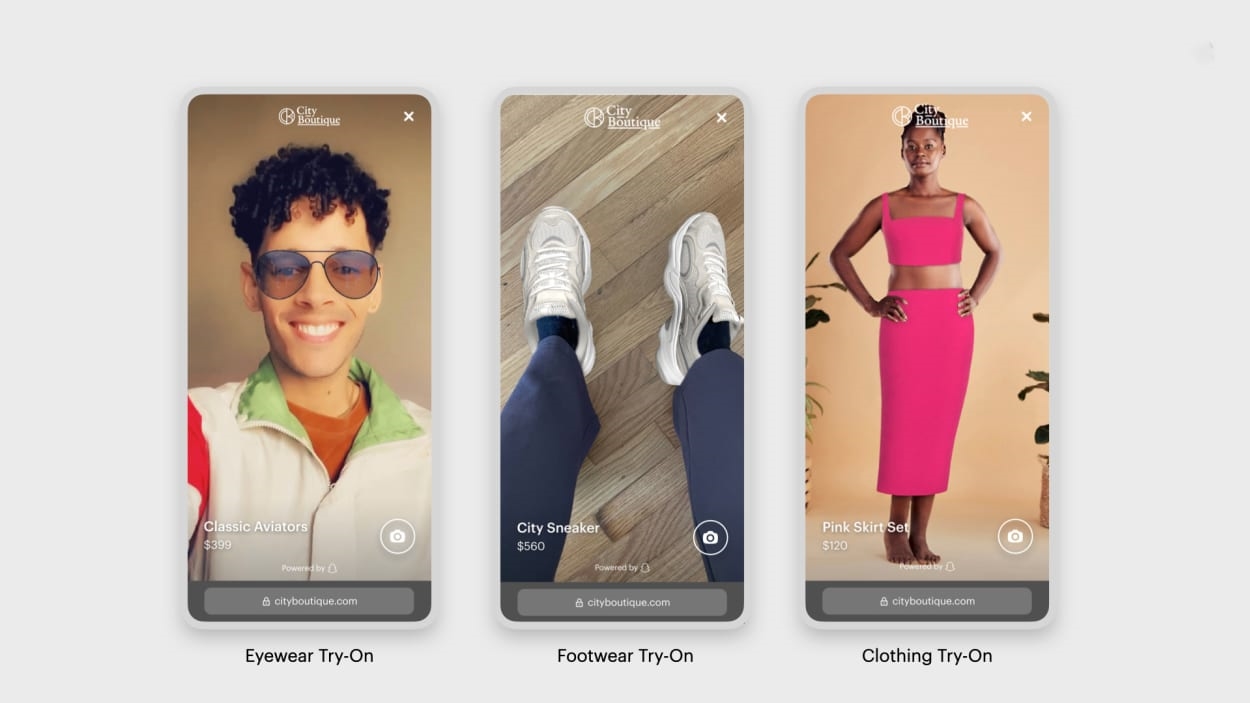

For starters, most of that value will come from using AR to improve the shopping experience for clothing, shoes, and related accoutrements. ARES’ Shopping Suite service includes technologies such as Fit Finder, which assists consumers with size recommendations tailored to their taste and body shape, and AR Try-On, a virtual dressing room. Snap’s early customers for these tools have included fashion brands Princess Polly, Gobi Cashmere, and Farm Rio, along with sunglasses maker Goodr.

The goal is to give shoppers the best possible sense of how they’ll look before they purchase items, in a way that conventional e-commerce can’t match. “We’ve proven that you can reduce returns, which gives you a more predictable revenue stream,” says Jill Popelka, who heads up ARES. “We’ve proven that you can increase conversions. This use of augmented reality with artificial intelligence—the experience plus the fit and sizing—give you an incredibly confident consumer.” According to Snap, Princess Polly has already used ARES for 50 million size and fit interactions, reducing the return rate by 24%.

Even before it decided to offer an AR platform, Snap had a fair amount of experience as a technology provider to other organizations. It’s collaborated with companies such as Disney and Samsung on AR projects and offers Camera Kit, an SDK that lets developers build its AR lenses into their own apps. But Popelka, who joined the company last June after 25 years deep in the enterprise weeds at SAP and Accenture, says that she quickly learned that for all of Snap’s expertise in AR, it needed to rethink some of its cherished values to make ARES work.

“[Snap CEO] Evan [Spiegel] and his team are developers of consumer apps,” she explains. “They believe it should be 1,000% perfect before it’s released. And I said, ‘Well, actually, each of our customers, each of these big retailers, they’re going to want to have some flexibility in what they do with it. So you can’t create perfectly productized, lines-drawn, no-changes products. You have to allow for some flexibility.’”

There’s a brick-and-mortar retail element to ARES as well. The service powers “AR Mirrors,” large camera-enabled screens in public places that let you see a full-body image of yourself with AR overlays. In pilot programs, Men’s Wearhouse and Nike have offered in-store virtual try-ons via AR Mirror. Nike has also used the technology for in-store games and plans to test an AR Mirror optimized for footwear try-ons that will let shoppers see how they look in custom shoes at retail before they order the real deal.

Working with Snap, the Coca-Cola Company has built an AR Mirror into a prototype vending machine, turning the area where you might expect to see a giant, static Coke logo into an interactive experience you can initiate with a wave of your hand. Along with helping you purchase drinks, it will offer diversions such as the ability to play with animated soda-pop bubbles and try on virtual Coke apparel.

This AR vending machine is one of several ventures into immersive technology that Coke has made recently. (Others include creating an AR music experience based on technology from Niantic and launching a soft drink on Fortnite.) Though the beverage giant certainly hopes that the end result could be more people bonding with its brand and buying its products, it’s still in a mode where it’s happy to experiment. Pratik Thakar, Coca-Cola’s head of global creative strategy and content, says that reaction to the prototype will determine where it goes with Snap’s AR: “We want to create, learn, listen, and perfect it.”

For all the possibilities of Snap’s initial ARES services, there’s a lot more the company could do with AR in an enterprise context. The new business could intersect at some point with Snap’s Spectacles glasses, which have been around since 2016, with the newest version offered by invite only to selected creators. Murphy says that could open up an array of world-facing AR experiences, extending ideas already seen in efforts such as a virtual Cinderella’s Castle mural at Disney World that Snap created in partnership with Disney.

Then there’s a mundane but crucial question about ARES: Will helping other organizations do cool, profitable stuff with AR boost Snap’s own bottom line? The company would certainly benefit from a robust enterprise business. It’s currently dependent on advertising revenues, which have been squeezed by factors outside its control, such as the changes Apple has made to help consumers opt out of ad tracking. Last August, as the tech industry began to gird itself for tougher economic times, Snap announced plans to lay off 20% of its workforce. Its stock is currently down 87% from its September 2021 peak. (Snap will report first-quarter results on April 27.)

According to Murphy, Snap is optimistic about ARES’ potential to become a real business. But for the moment, it’s focused on making sure it’s a reliable partner for those who are embedding Snap technology in their own products.

“Our primary objective now is to really work on developing the tools and the support function and our enterprise function to be able to deliver as much value as possible to our partners,” he says. “But absolutely, we see an opportunity for this to become a meaningful source of revenue over the long term.”

(19)