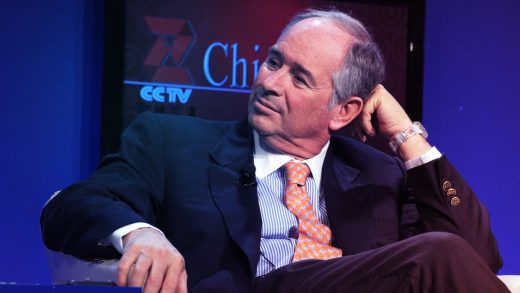

Stephen Schwarzman, Trump’s China whisperer, reveals the extent of his role

Stephen A. Schwarzman is the ultimate master of the universe. From running Blackstone, the world’s largest private equity firm with almost $500 billion in total assets under management, to acting as President Trump’s “China whisperer” during the last two years of tense trade talks, the 72-year-old financier wields plenty of power. He played a key role in advising the government to bail out the big banks during the 2008 financial crisis, steered Trump’s short-lived business advisory council, and is a major philanthropist who gave $100 million to launch a scholarship program in China.

Praised for his financial acumen and massive gifts to charity, Schwarzman has also attracted his share of controversy for his support of Trump (especially after the president’s Charlottesville comments, which led to the disbanding of the advisory council led by Schwarzman), Blackstone’s stake in companies that some consider responsible for much of the destruction of the Amazon rainforest (a claim disputed by Blackstone, which asserts that the company objects to illegal deforestation), and potential conflicts of interest inherent in his role during U.S.-China trade talks.

For the last five years or so, Schwarzman says he’s thought about writing a book to tell his life story and show readers how to build, transform, and lead thriving organizations. In What It Takes: Lessons In The Pursuit of Excellence, he describes his upbringing and his motivation, includes some surprising anecdotes, such as a bar fight in Trinidad, and is quite frank about some of his worst business decisions. Schwarzman also reveals many more details about the extent of his trade diplomacy for the Trump administration, saying that in 2018 alone he made eight trips to China on behalf of the White House “trying to assure China’s most senior officials that the president was not looking for a trade war.”

As a sign of the trust placed in him, Commerce Secretary Wilbur Ross requested in July 2017 that Schwarzman ask then-Chinese vice premier Wang Yang if China would consider cutting its steel capacity by 15% to 20%. (Wang said yes and Ross was “delighted,” but Trump rejected the deal.)

Schwarzman talked to Fast Company about the book, his leadership of Blackstone, and the China trade war, among other topics. This interview has been lightly edited for concision and clarity.

Fast Company: Looking back, what’s the most important lesson you would impart to young go-getters, who might be intimidated by all the competition in high school and college and are concerned about their future in a country where the growth in automation threatens so many jobs?

Stephen Schwarzman: I think what’s important from the perspective of a young person is to study something you like, and worry less about the world. In that sense, you have to adapt to where the world is going. That means having a grounding in basic principles, find out where you’re comfortable, where you can be a winner regardless of how the world evolves. And when you graduate, to find something to do that builds on something you like and more in terms of where the world is going.

Most people, when they’re young, would like to be instantly successful. It doesn’t work that way. You have to build skills, learn at a place from individuals with remarkable skills. When you associate with people who are terrific, they have something to teach you.

FC: Tell me about that moment when you were a senior in high school and had been accepted into Yale, but you still called the head of admissions at Harvard to try to convince them to let you in.

SS: I was petrified with fear—breathing heavily, soaked with sweat. But I made the call anyhow, because I thought it might work. As it turns out, it didn’t work. I gave it a shot.

FC: What marked the tipping point for Blackstone, when it really started to go from small and not that well known to the behemoth it is today?

SS: We had a lot of tipping points. The first one was having the right strategy, to be in the advisory business, in the private equity business, and the affiliates business. Going into new areas that we thought would be super successful, the same business plan we’ve been executing on for 30 to 40 years.

The second tipping point was doing our first private equity fund and setting an exceptionally ambitious target, which was a billion dollars. That was equivalent to the equity capital of a major investment bank. We got very lucky. By the end, after raising very little money with all of our top relationships, on our 18th meeting Prudential gave us $100 million. They were the number-one investor in private equity at that time. That was the Good Housekeeping seal of approval, enormously important. We didn’t have a particularly close relationship with them, so expectations were very low. I remember having a funny pitch meeting while [Prudential chief investment officer] Garnett Keith was eating his tuna fish sandwich. I kept watching his Adam’s apple go up and down. Halfway through the second part of the sandwich, he says, “Well, that sounds really interesting.” One hundred million dollars in 1987 was for a first-time fund almost like $400 or 500 million for an impact fund today.

The third tipping point was in 1991, when we hired a class of business school students. The idea that a firm that was just six years old would be acceptable enough to get the highest-quality people from Harvard and Wharton was a major proof of concept for me. Then you could hire your own people. The fourth tipping point was to get into real estate at the bottom of the 1991-1992 recession. Now it’s turned into our largest business. We’ve become the biggest owner of real estate in the world.

Another one, of course, was in 2007 when we went public. That was a really big deal. It was the second-largest IPO of that decade. We raised a lot of capital right before the financial crisis because I was worried the world was getting too overbought, and I sensed something bad was about to happen. As part of that decision, we attracted the country of China to be a minority investor in the firm. It was the first time that China had invested in a public company. This was a huge paradigm shift for the second-largest economy in the world. And the final tipping point, 11 years after the crisis, the firm has grown six times in size.

FC: What do you think will happen with U.S.-China trade talks?

SS: There’s a group in China that would like to go ahead with something and there’s also some internal resistance to that. Logic would say that it’s not only in the interest of U.S. and China, but also the rest of the world, to work something out. Between U.S. and China, that’s something like 35 to 40% of the world’s economy: If the parents are having an argument, it’s tough for the children. Logic says that something should be worked out. At the moment, it appears to be at a stalemate.

FC: When did you last talk to the president?

SS: I can’t talk about the substance of our conversations. But it was recent.

FC: You say that you’ve been to China eight times in 2018 on behalf of the administration? How many times in total—over a dozen?

SS: I always have several things going on. When I go to China, I usually have three things to do, with the government, with Schwarzman Scholars, and we manage money for certain institutions. I usually stop off and see those relationships. It’s not necessarily the same ratio every time.

FC: How do you balance that role as Trump’s “China whisperer” with being the head of Blackstone, which does a lot of business in China with Chinese companies and once was partly owned by China’s sovereign wealth fund—without making it a conflict of interest?

SS: I never talk to the government people about anything other than the relationship between the two countries, and that’s important. The school is independent of anything; that’s to the benefit of the world, and we have students from all over the world. And money management is part of what we do on its own, and that doesn’t mix with anything else. From my perspective, as long as we keep everything in its own silo, that works out pretty well.

FC: If you could sum up one lesson from the book, what would that be?

SS: It’s just as easy to do something big as it is to do it small. We all have limited time, we can only do one really big thing at a time. You should make your life worthwhile, and try to do something innovative, do something involving a new paradigm that the world wants. And when you see it, that’s when you commit yourself, and people you know and resources to make it successful.

Making everyone in an organization feel important, because they are important. You have to recognize what it takes to have everyone enthusiastic. Don’t lose money, which is pretty simple. I know that sounds primitive and against the ethos of where you all specialize, but in the nontech world losing money is greeted with less than enthusiasm by the people who give it to you. It’s like in baseball, if you always get on base and have no outs, your team can score an enormous amount of runs.

FC: How do you see your business changing—with all these changes, from machine learning to technological developments to disruptions in the economy?

SS: No matter what asset you own, the chance that it will be disrupted, and its business model challenged, is something you have to assume. It’s much more challenging than in the days when things were relatively slow-moving. You want to be part of that disrupting trend, benefit from it, rather than be a victim.

As Amazon was growing and the internet became more dominant in terms of shopping applications, we looked at that and said, ‘That’s a tech thing, that’s a part of the economy that is changing.’ So we decided in our real estate business that one of the beneficiaries would be warehouse space. For deliveries, you needed that. There would be an explosion of deliveries for internet-based companies, so we became the largest owner of warehouses in an 8- to 10-year period. That’s the way you can take an existing asset and take advantage of disruption.

(23)