Switzerland is becoming the global center for innovation to decarbonize construction

By Ted Fishman

This is the third part of a series of articles on concrete. The first installment appeared on December 3, 2022; the second on December 10, 2022.

What’s the first thing that comes to your mind when you think of Switzerland? The Alps, sure. The nation consistently ranks at or near the top of “most beautiful countries” lists. But beyond skiing, it’s also known for its chocolate, its finely crafted watches, its pharmaceuticals industry, and its banking system. With a population of 8.6 million (fewer than the U.S. state of New Jersey), this landlocked, resource-poor country has achieved outsized global clout and mindshare, punching far above its weight, like Heidi walloping Thanos.

No product has contributed more to Switzerland’s global influence than concrete.

Architects, builders, and lovers of Brutalist design admire the country for its innovation in structural engineering and meticulously constructed concrete buildings. To the Swiss, themselves, concrete has long been a centerpiece of national pride. Recent scholarship puts the material at the center of Swiss national identity and argues it is the real and figurative bedrock of the modern state and its successes. Even the new factory and museum for chocolate giant Lindt & Sprüngli on the shore of Lake Zurich emphasizes its “Swissness” with a pristine, curvy concrete interior, meant to evoke the flow of chocolate with the country’s other signature material.

Where there’s concrete, there’s cement, the binder that makes up roughly one-sixth of the mix of materials that harden into the final product. Switzerland is home to Holcim, the biggest (non-Chinese) cement company, with operations in nearly 90 countries. Home, too, to Sika, one of the largest construction chemicals companies. Also to some of the world’s most advanced, well-funded academic laboratories pushing innovation in concrete. That gives tiny Switzerland enormous sway over the future of the world’s most-widely used manufactured good. The world makes about 30 billion tons of concrete every year, three and three-quarters tons per capita worldwide. That’s a lot more than chocolate, and it lasts longer.

Which, of course, is part of the problem. The old ways of building and running buildings and infrastructure has been central to delivering the benefits of modern living, but it is also too carbon intensive for the planet’s health. Forty percent of global carbon emissions result from what we build and how we run the built environment and use it. The Swiss government, Swiss companies, and Swiss citizens, which historically have been the most avid users and promoters of concrete, are now striving to change that.

“The cement industry is very committed to decarbonizing,” says Bertrand Piccard, the psychoanalyst turned adventurer/environmentalist who heads the nonprofit Solar Impulse Foundation, headquartered in Lausanne, Switzerland. “They know that CO2 will eventually have a price [i.e., in the form of a carbon tax] and that buildings that have improved performance [i.e., are carbon neutral or negative] will have higher value in the market.”

Switzerland sits in a narrow climatic band. Global warming threatens its agriculturally productive lands. Water supplies reliant on glaciers and other mountain sources wither in a warmer world; modern public health, irrigation, hydropower—marvels that concrete helped engineer—and the country’s blessedly beautiful terrain, wither, too. It is not just the impact within Swiss borders causing the country to act aggressively. According to the benchmark KOF Index of Globalization, Switzerland is the world’s second most globalized economy. The country’s formidable banks, insurers, and money managers and some of the world’s biggest companies serving the construction sector need to navigate a changing climate, not just to preserve their assets but also to grow and prosper amid a world increasingly activated by climate change. According to the Bank of America, there will be a $2 trillion annual market related to climate adaptation. That works for Switzerland’s financial and industrial sectors. There are lots of visions of the future in which sustainability relies on slashing growth, consumption, and construction. The two billion more people likely to inhabit our planet by midcentury, mostly in growing cities, will demand the opposite. What’s afoot in Switzerland is a vision of construction technology that aims to endow the world with more of the built environment it needs without the cost to the climate.

There’s a new national project afoot to reinvent concrete and cement and the ways they are used. The Swiss mean to drive innovation that reins in concrete’s climate threat while preserving the benefits the material—or its alternatives—offer. The country’s voters and regulators are now demanding that new buildings be composed, in part, with the debris of old buildings. Strident environmental activists have taken to chaining themselves to the gates of cement plants and attacking trucks. There’s a cadre of lawyers and church-based groups litigating in Swiss courts. They want to hold the cement industry financially liable for its historic role in climate change.

Switzerland’s lavishly funded public research institutes and its architects are working on digitally driven designs that would deploy a fraction of the concrete and steel buildings currently use. But Switzerland’s giant global building materials and construction technology companies are also investing in innovation.

In December of 2022, I traveled to Lyon, France, to attend a showcase of startup companies at the Holcim Innovation Center. Global Cement Magazine reports that Holcim, based in Zug, produced 255.1 million metric tons of cement last year. Holcim’s next non-Chinese competitor, Germany’s Heidelberg Materials, produced 30 percent less. Holcim is also the biggest cement producer in the U.S. where its environmental record gets close scrutiny, including by the Securities Exchange Commission, which plays watchdog over companies that make environmental claims that are consequential to investors. The company recently described itself to the S.E.C. as “the number one building materials and solutions provider in the world…[that supplies] the aggregate, sand, stone, gravel, asphalt, insulation, roofing, cement, and concrete needed to build everything from the foundation of a building to the roof and everything in between.”

Cement may have long been king at Holcim, but internally, and to regulators and investors, attention is moving to other businesses. Holcim told investors in its 75-page 2022 Climate Report, for instance, that the portion of its revenues tied to cement production will be cut roughly in half by 2025. Betting big on becoming a more comprehensive solution provider to the construction industry, Holcim is working to grow its innovative chops and consulting expertise to serve the construction industry and has also been selling off dirtier divisions and acquiring companies in other construction niches. It has set a formal goal of being carbon neutral by 2050.

Edelio Bermejo is Holcim’s global head of research and coordinator of its support for smaller innovative firms focused on sustainable construction. For decades, says Bermejo, the cement industry vastly underinvested in research and innovation. As one of the executives charged with driving down Holcim’s carbon footprint, Bermejo is leading an effort to identify and groom startup companies whose innovations Holcim can use. “I strongly believe,” Bermejo says, “that 80 percent of innovation in the industry will come from the outside.”

Inside Holcim, though, eight in ten dollars spent on R&D now go toward green solutions, and most of its recent patents are also for sustainable tech. Over the past few years, the company has built links to nearly 500 firms worldwide, mostly startups, that are developing products and methods to drive carbon emissions out of construction. “Why should we care about [reaching net-zero] in 2050,” Bermejo asked at the December showcase of startup companies devoted to decarbonizing construction. “I hope I am still alive in 2050; maybe by then I will be too old to be in the company. Why should I care now about decarbonization? Because there is an urgency now. We need to prepare for 2030, now.”

One hope of Holcim’s leadership is that the push to decarbonize the firm stirs creativity in the big old-line firm. Change helps it recruit and keep talented workers who are increasingly aligned with sustainable values. The company may also be keen on being recast for its investors. CEO Jan Jenisch, who has been hammering home the message that Holcim’s future depends on transforming the company into a mission-driven organization, was recruited to Holcim from innovative Sika, the world’s giant provider of industrial chemicals for construction and the automotive industry. Sika, based in Baar, a short hop on the train from Holcim, has annual sales about one-fourth Holcim’s. Yet, Sika’s market cap (about $38.5 billion in January) exceeds Holcim’s (about $33.3 billion). Sika’s products and services earn higher margins and investors see a firm rich with cutting edge technology and oomph for growth. Sika also has a far smaller carbon footprint, which makes it easier for many portfolio managers with environmental screens on their holdings to hold its shares. These are all features Holcim’s retooling strives to match.

“Sustainability,” Matthieu Horgnies, Holcim’s technology scouting manager, told me, “can make possible better margins. It would be interesting to compare the change we’re going through to the car industry. We are in the same kind of period with a complex balancing of the mindset.”

The upside of change, for the planet and the company, however, can be huge. Holcim is one of a handful of global firms that have the scale to drive meaningful reductions in atmospheric carbon. Holcim recently switched to a lower carbon-emitting cement mix at two giant cement plants in Missouri and Michigan, a move that helps make the Midwest the one of the world’s region’s with the lowest emissions, per ton, of the material. Holcim runs three smaller plants in Europe with pilot programs that the company says are already producing cement with a zero-carbon footprint.

To date, Piccard’s Solar Impulse Foundation has certified more than 1,400 products, including several offered by Holcim. Piccard sees today’s concrete mixes getting replaced with ones that use 100 percent recycled waste products, including debris from demolished construction sites. He also envisions a near future in which concrete is made without clinker-based cement. Clinker is the material produced from super-heated limestone, a process that requires burning massive amounts of fossil fuels and solid waste. He notes that just a few years ago, the concrete lab at Zurich’s ETH, often cited as “the MIT of Switzerland,” didn’t exist, but today is a huge center for “absolutely fascinating research,” much of it supported by Holcim. Piccard is impressed with the speed of change. He also sees it in relation to the car industry. “They are making changes to their business quickly and on a huge scale in a way other big industries, such as the automobile companies, could not.”

The December showcase at Holcim’s Innovation Center capped a six-month-long competition in which 124 companies competed for the chance to test their technologies and business models with support from Holcim, Sika, and other companies. The showcase brought together the nine firms that won support and pitted them together in a kind Great British Bake Off for the climate. Winning the competition would mean more financial and practical support for the top company, though a collection of potential investors was also present to see all the startups.

Historically, the building of cities relied on the culling of materials from forest and rock and iron mines. But think of cities instead as mines for their own materials and they become centers of a circular economy for the construction industry. The sources of the materials are the buildings and infrastructure that are in constant flux. Construction and demolition generate about one third of the world’s waste. Its disposal demands swaths of landfill. In Switzerland, where landfill is no longer available, waste must either be incinerated or reused. The city of Zurich now demands that half of the material in new public buildings be made of recycled waste. The solutions so far spare the land more than the climate. That’s opened a promising class of startups that can accelerate the trend toward “urban mining.” If they succeed, they can lower the carbon footprint of recycling, reduce landfill sites, and create concrete with nearly no carbon emissions.

Promising innovations featured at the showcase included a version bioconcrete, which uses nature’s ability to mineralize elements into cement or concrete. Acardia, a Swiss startup, is working on using bacteria to fossilize waste from excavation, construction, and more into a concrete with an 80% lighter carbon footprint compared to conventional materials. Another company called Modulatio, a startup southeast of Paris, is inspired by the structures of materials that give strength to living things—bones, exoskeletons, plant stems, etc. Modulatio applies these principles of biomorphic design to fabricate concrete walls and floor slabs whose interiors are not solid, but rather trabecular, a kind of honeycomb-like structure akin to the interior of our bones (which are also made of a kind of cement). Reducing mass and maximizing strength with concrete has advantages that compound through a building. Higher strength means a builder can cut or eliminate the steel rebar that now is a necessary addition to most structural concrete—and a sizable contributor to a building’s carbon footprint. More steel is used in construction than for anything else, and most of that is for rebar.

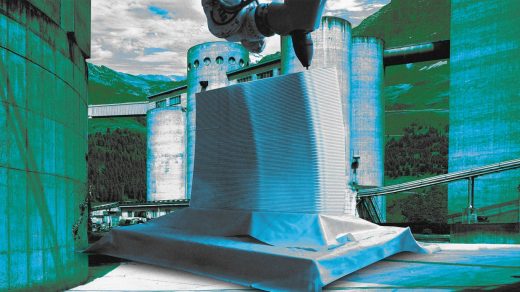

Advanced materials require advanced technology to fabricate them. Robotic construction will likely figure large in concrete’s future. One Swiss company, Seaki, creates robot modules—they fit on the heads of construction robots—that can dispense concrete with a high level of nonsteel carbon fiber reinforcement. That allows for more novel, material-saving designs. Saeki’s modules can also smooth the surface of printed concrete.

Outside of Holcim’s Innovation Center a new, curvy pedestrian bridge is taking shape. The Striatus is the second generation of a bridge that was first installed at the Venice Biennale in 2022. Composed of 3D -printed concrete pieces that fit together and stay structurally sound without the use of any mortar, the Striatus was designed by The Block Research Group at ETH, led by Philippe Block, who has long worked to develop computer-generated designs that optimize the strength of minimal amounts of concrete.

Block’s work draws on the work of premodern builders—including the Romans and the builders of cathedrals—who used geometry, especially the geometry of the arch, to eke out the highest possible strength from stone and brick. The ETH group has already demonstrated that computational geometry and modern design methods can create concrete floors—and bridges—requiring up to 90 % less material.

The new iteration of Striatus signifies most of the concrete industry’s big innovation trends. It was designed using advanced, digital computation that optimizes material. Its geometry eliminates the need for steel reinforcement. And it was mined from debris collected in an ancient city. If the industry manages to get decarbonization right, the sculptural bridge also looks something like the future.

A former trader and member of the Chicago Mercantile Exchange, Ted C. Fishman is the author of China, Inc. and Shock of Gray. His writing has appeared in The New York Times Magazine, Harper’s, Esquire, and many other publications. His forthcoming book on concrete will be published by W.W. Norton.

(21)