Tesla stock price surges after Q4 earnings. EV rivals Rivian and Nio see a bump, too

Ever since Elon Musk took over Twitter in October 2022, Tesla (TSLA) shares have had a bumpy ride. On October 28, 2022, Tesla’s stock was trading above $228, but by January 5, 2023, it had sunk nearly 50% to just above $110. Some in the industry blamed Musk’s Twitter antics for the drop—or at least his preoccupation with running Twitter.

But over the past 24 hours, things are looking up for Tesla stock. The company announced its Q4 2022 earnings (February 13, 2023), which has sent shares popping in pre-market trading today. Here’s what you need to know:

What’s happened? Tesla announced its Q4 2022 financial results (February 13, 2023). Its numbers were good. The company posted Q4 revenue of $24.3 billion and a Q4 adjusted EPS of $1.19, reports CNBC. Both those numbers beat street expectations. Tesla also reported a net income of $4.1 billion, which was up $1.3 billion from a year earlier.

So, why did Tesla beat estimates? For a number of factors, but a big one was likely the price cuts Tesla introduced near the end of 2022, notes CNBC. Those price cuts seem to have increased demand for Tesla vehicles. Demand is continuing into 2023, which saw Tesla cut prices even more. On the Tesla financial call, Musk said, “Thus far in January we’ve seen the strongest orders year-to-date than ever in our history. We’re currently seeing orders of almost twice the rate of production.”

How has the market reacted? Pretty well. As of the time of this writing, TSLA stock is up over 7% to just above $154.50 per share. It’s the first time in nearly six weeks that TSLA stock has traded that high.

But aren’t investors still worried about Musk’s attention to running Twitter? Yes. One investor asked Musk how Tesla’s brand could be safeguarded in light of all the negative press around Musk and Twitter.

How did Musk reply? By saying, “I’ve got 127 million followers. And it continues to grow rapidly. That suggests that I’m reasonably popular. I might not be popular with some people. But for the vast majority of people, like the follower count speaks for itself. [I have one of] the most interactive accounts, social media accounts, maybe in the world, certainly on Twitter, and that actually predated the acquisition. Twitter is actually an incredibly powerful tool for driving demand for Tesla.”

How have investors reacted to Tesla’s competitors after the company’s Q4 earnings beat? It seems like a rising tide lifts all boats—or EVs, at least. Tesla competitor Rivian Automotive’s stock (RIVN) is up over 3.5% in pre-market trading at the time of this writing. And rival Nio (NIO) is up over 5%.

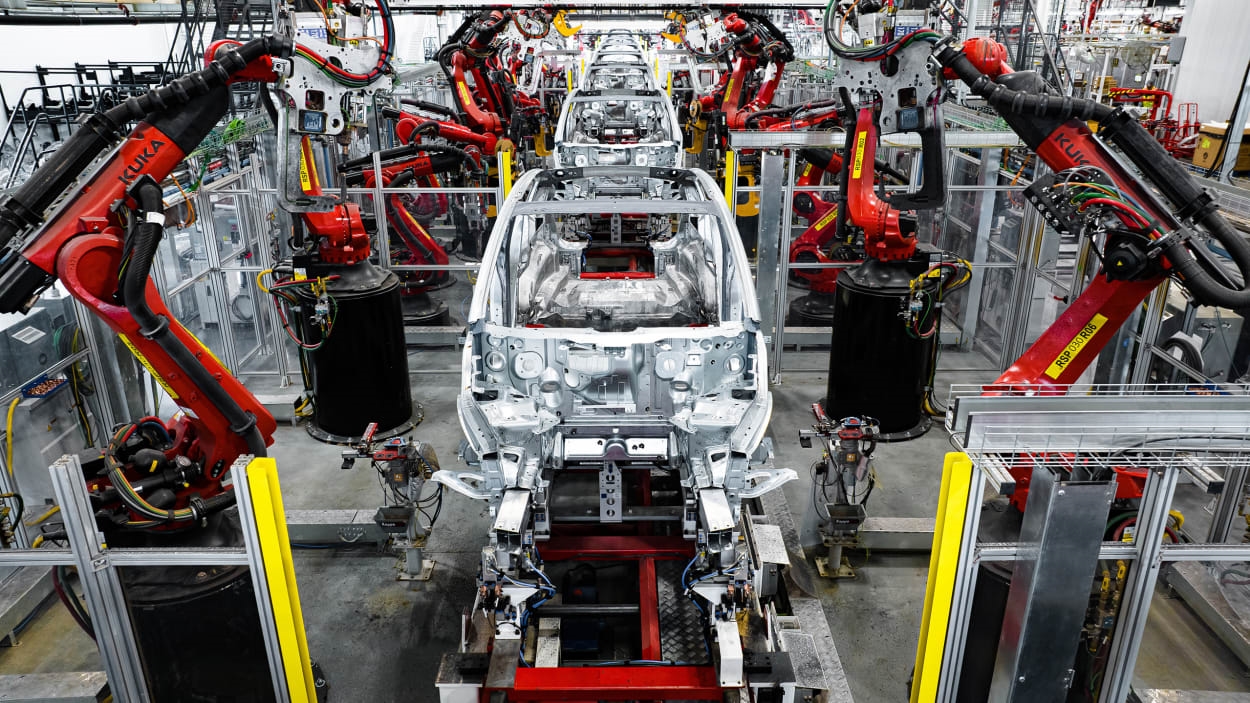

What comes next for Tesla? Guidance wasn’t issued for the quarters ahead, but the company stated in its earnings release, “We are planning to grow production as quickly as possible in alignment with the 50% compound annual growth rate target we began guiding to in early 2021.” It also revealed that its much-hyped Cybertruck would finally begin production this year.

(18)