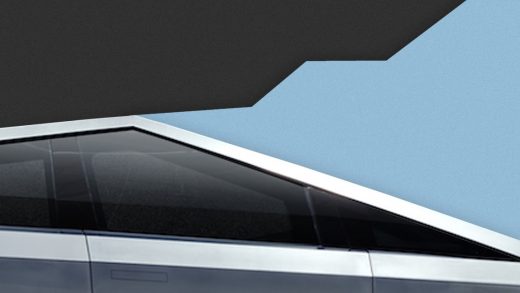

Tesla’s stock keeps going up—here’s why

Tesla’s stock “popped” today. The price per share went up 9.7% to close at $524.86.

That’s quite a leap from a low of $178.97 on June 3, 2019, but Elon Musk’s electric-car company has been rallying steadily since then.

Why did it happen, and why did the stock surpass $500 a share today? Here’s what the experts are saying.

For starters, a “pop” is just a way to indicate that the stock price climbed high in a short period of time. While it’s usually used to designate a quick rise in the share price of an IPO, it can also be used for any type of stock. On Friday, just before trading ended, Tesla’s price was hovering around $476, and today it jumped over $50 higher. That’s a significant and quick gain.

As for why it rose so quickly, there are several reasons.

An optimistic price target

Oppenheimer analyst Colin Rusch raised his target price on Tesla from $385 to $612. This is close to a 60% increase. To justify this, Rusch wrote a note to investors that stated Tesla’s “risk tolerance, ability to implement learnings from past errors, and larger ambition than peers are beginning to pose an existential threat to transportation companies that are unable or unwilling to innovate at a faster pace.”

Smart growth

Last January, Tesla announced it would build a $2 billion factory in Shanghai to produce its more affordable Model 3 and give the Chinese a chance to buy American cars without the high cost of tariffs on those manufactured Stateside. Musk made good on his pronouncement that the facility would be completed by summer, and the plan is to churn out 150,000 vehicles per year. The company delivered a total of 112,000 vehicles globally in 2019.

Profitability = confidence

Although it had posted losses to the tune of $1 billion earlier in 2019, Tesla posted a profitable third quarter, which delighted investors just before the holidays. The stock was up accordingly 20% on the heels of that report and has stayed up since the end of October.

Size matters

Several headlines declared that this surging stock price has pushed Tesla to a market cap of $93 billion, which makes it worth more than both Ford and GM. Both of those legacy companies are trying to compete with Tesla by making their own electric vehicles.

(24)